AI Chatbot for Finance: 2025 Service Trends

AI chatbots are transforming how you experience customer service in the financial sector. They operate round the clock, providing immediate responses and tailored solutions. Financial institutions increasingly rely on these tools, such as the Sobot AI chatbot for finance, to overcome challenges like extended wait times and high costs. By 2025, AI adoption in finance is expected to grow from 45% to 85%, with 60% of companies already implementing AI in various functions. Notably, Bank of America's virtual assistant, Erica, has resolved over 50 million client queries, achieving a 98% success rate. Tools like Sobot continue to refine these services, ensuring efficient and seamless interactions.

The Role of AI Chatbots in Finance

Defining AI Chatbots for Finance

AI chatbots designed for finance are intelligent tools that automate customer interactions. They handle tasks like answering queries, providing account details, and assisting with transactions. These chatbots are tailored to meet the unique needs of financial institutions. For example, they achieve an 85% resolution rate without human intervention and respond to inquiries within 1–2 seconds. They also engage customers effectively, with a 40% monthly return rate among users.

Did you know? AI-powered assistants can manage up to 70% of calls, chats, and emails, cutting customer service expenses by 30%. This efficiency makes them a valuable asset for financial services.

How AI Chatbots Improve Customer Service

AI chatbots transform customer service by offering instant responses and personalized support. They eliminate long wait times, ensuring you receive help when you need it most. For instance, chatbots provide real-time access to account balances and transaction histories. They also automate routine tasks, allowing human agents to focus on complex issues.

| Impact Area | Description |

|---|---|

| Instant Responses | AI chatbots provide immediate interaction, significantly decreasing wait times. |

| Scalability During Peak Times | Chatbots manage high volumes of inquiries, ensuring timely assistance even during busy periods. |

| Improved Customer Satisfaction | Reduced wait times lead to higher customer satisfaction levels. |

By improving efficiency and reducing human error, these chatbots enhance the overall quality of financial services.

Current Applications of Banking Chatbots

Banking chatbots are already making a significant impact. They assist with basic banking services like account inquiries and transactions, available 24/7. In 2022, 37% of the U.S. population interacted with these chatbots, showcasing their growing popularity. Financial institutions like JP Morgan use chatbots for securities transactions and account management. Similarly, Citi Singapore offers a chatbot on Facebook Messenger for balance inquiries and payment due dates.

These tools also drive measurable results. For example, BFSI companies are projected to save $23 million over three years by using chatbots. Additionally, platforms like Taxbuddy have seen a 13x increase in form fill-ups after implementing chatbots.

AI chatbots are not just tools; they are transforming how financial institutions deliver services, making banking more accessible and efficient for you.

Key Benefits of AI Chatbots in Finance

24/7 Availability for Financial Customer Support

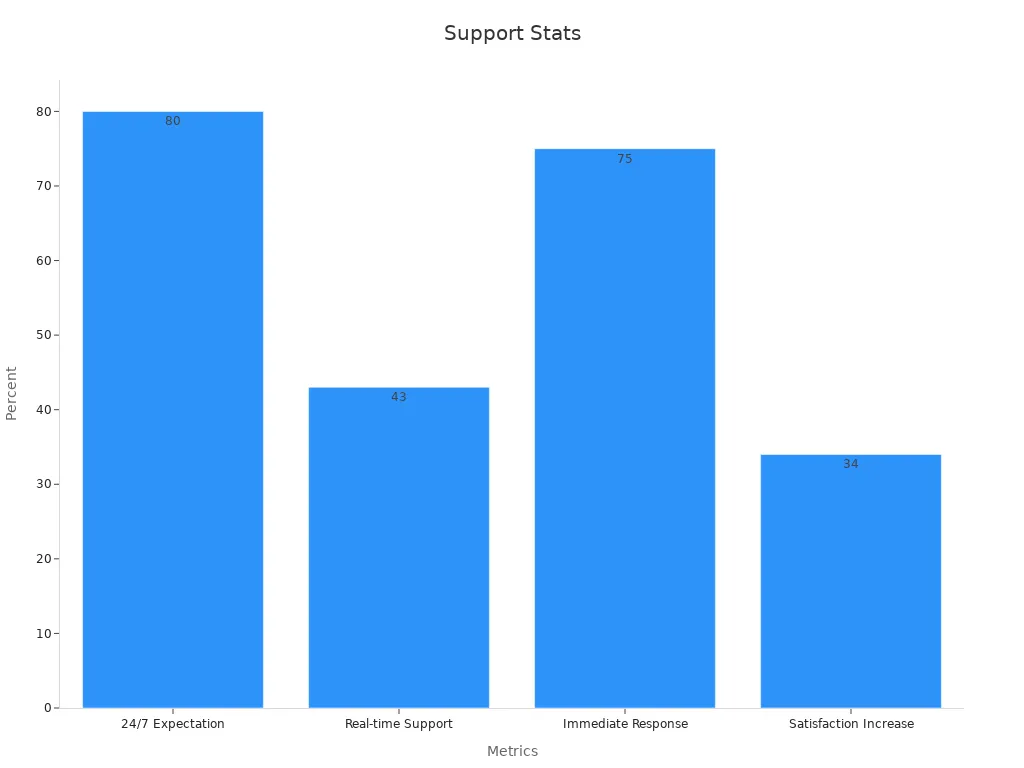

AI chatbots ensure you receive assistance whenever you need it. Unlike human agents, they operate round the clock, providing instant responses to your queries. This availability is crucial in the financial sector, where timely support can make a significant difference. For example, 80% of customers expect 24/7 support, but only 43% of companies currently offer real-time assistance. Chatbots bridge this gap by responding to inquiries in under five seconds, compared to the average wait time of over two minutes for live agents.

| Statistic | Value |

|---|---|

| Percentage of customers expecting 24/7 availability | 80% |

| Percentage of companies offering real-time support | 43% |

| Average wait time for live chat with a human agent | 2 minutes and 40 seconds |

| Average response time for chatbots | Under 5 seconds |

| Percentage of customers who believe immediate response is important | 75% |

| Increase in customer satisfaction scores after implementing chatbots | 34% |

This efficiency not only enhances customer satisfaction but also strengthens your trust in financial institutions.

Personalized Interactions with Data-Driven Insights

AI chatbots elevate your experience by offering a personalized customer experience. They analyze your financial history, credit scores, and spending patterns to provide tailored solutions. For instance, Bank of America's Erica chatbot delivers personalized financial advice on budgeting, bill payments, and investments. This helps you make informed decisions while saving time.

These chatbots also act as virtual financial advisors, offering:

- Customized savings plans based on your goals.

- Automated investment strategies aligned with market trends.

- Real-time insights to improve your financial health.

By integrating advanced language models, chatbots understand natural conversations, making interactions seamless and engaging. This level of personalization fosters stronger relationships between you and your financial service providers.

Cost Efficiency and Operational Scalability

AI chatbots reduce operational costs for financial institutions while improving scalability. They handle unlimited interactions simultaneously, unlike human agents who can manage only a few at a time. This capability allows banks and other financial services to save on labor costs and allocate resources more effectively.

| Evidence Description | Impact |

|---|---|

| Chatbots can handle unlimited interactions simultaneously, unlike human representatives who can only manage three at a time. | Significant labor cost savings for organizations. |

| The adoption of chatbots in various sectors is projected to save businesses $11 billion annually by 2023. | Reduction in operational costs across industries. |

| Chatbots provide 24/7 support, improving customer service availability. | Enhanced scalability and customer satisfaction. |

By automating routine tasks, chatbots free up human agents to focus on complex issues, ensuring you receive high-quality service. This combination of cost savings and improved efficiency makes chatbots an indispensable tool for modern financial institutions.

Fraud Detection and Risk Mitigation

AI chatbots play a crucial role in protecting your financial transactions from fraud. These intelligent tools monitor activities in real time, identifying unusual patterns that could indicate fraudulent behavior. For example, they analyze transaction histories and flag suspicious activities, such as multiple failed login attempts or transactions from unfamiliar locations. This proactive approach helps financial institutions safeguard your accounts.

The integration of AI chatbots into fraud detection systems has led to remarkable improvements. These tools enhance fraud detection rates by 20% on average. They also improve the identification of fraudulent transactions by up to 300%. This means your bank can detect and prevent more fraudulent activities than ever before.

| Improvement Type | Percentage Increase |

|---|---|

| Average increase in fraud detection rates | 20% |

| Improvement in identifying fraudulent transactions | Up to 300% |

| Reduction in false positives | N/A |

Banking chatbots also reduce false positives, ensuring legitimate transactions are not mistakenly flagged. This accuracy minimizes disruptions to your financial activities. By leveraging advanced algorithms, these chatbots provide a seamless and secure banking experience.

You benefit from these advancements as they protect your sensitive information and financial assets. With AI chatbots, financial institutions can respond to threats faster, reducing the risk of fraud. Their ability to operate 24/7 ensures constant vigilance, giving you peace of mind.

Challenges and Solutions in Implementing AI Chatbots

Addressing Data Security and Privacy Concerns

AI chatbots in financial institutions handle sensitive customer data, making security a top priority. Ensuring data privacy and compliance with regulations like GDPR is essential. However, these systems face risks such as spoofing, tampering, and unauthorized access. These vulnerabilities can lead to data breaches, compromising customer trust and financial stability.

To mitigate these risks, financial institutions implement robust encryption methods and access controls. Regular audits and monitoring systems also help identify and address potential threats. For example, integrating advanced security protocols ensures that customer support interactions remain secure and confidential.

| Challenge | Description | Proposed Solution |

|---|---|---|

| Data Security | Protecting sensitive customer data from breaches and unauthorized access. | Use strong encryption, access controls, and conduct regular security audits. |

| Bias in AI | Preventing unfair outcomes due to biased training data. | Regularly review AI algorithms and adjust them to eliminate biases. |

| Legacy Systems | Difficulty integrating AI with outdated systems. | Develop APIs and use cloud-based solutions for seamless integration. |

Overcoming Complex Query Limitations

AI chatbots excel at handling routine inquiries but often struggle with complex or nuanced customer concerns. For instance, they may fail to address emotional issues or provide detailed explanations for intricate financial services. This limitation stems from their reliance on training data and predefined algorithms.

To overcome this, financial institutions enhance chatbot capabilities by integrating advanced natural language processing (NLP) technologies. These tools enable chatbots to better understand context and provide more accurate responses. Additionally, hybrid models that combine AI with human agents ensure that complex queries receive the attention they require.

| Limitation | Description |

|---|---|

| Nuanced Concerns | Difficulty addressing emotional or highly specific customer issues. |

| Training Data | Dependence on high-quality data for accurate responses. |

| Integration | Challenges in connecting chatbots with legacy banking systems. |

Building Trust in AI-Driven Customer Service

Trust remains a significant barrier to the widespread adoption of AI in financial services. Customers often hesitate to rely on AI-driven systems, fearing inaccuracies or a lack of empathy. Studies show that trust in robo-advisers depends on the reputation of the financial institution and the perceived effectiveness of the technology.

"Trust can be defined as the readiness to be unguarded and to give up power to the trustor, influenced by the reputation of the financial institution and the perceived effectiveness of AI technologies."

To build trust, financial institutions focus on transparency and reliability. They provide clear explanations of how AI systems work and ensure consistent performance. AI chatbots also improve transaction times by 25% and increase client engagement by 20%, demonstrating their value in enhancing customer support.

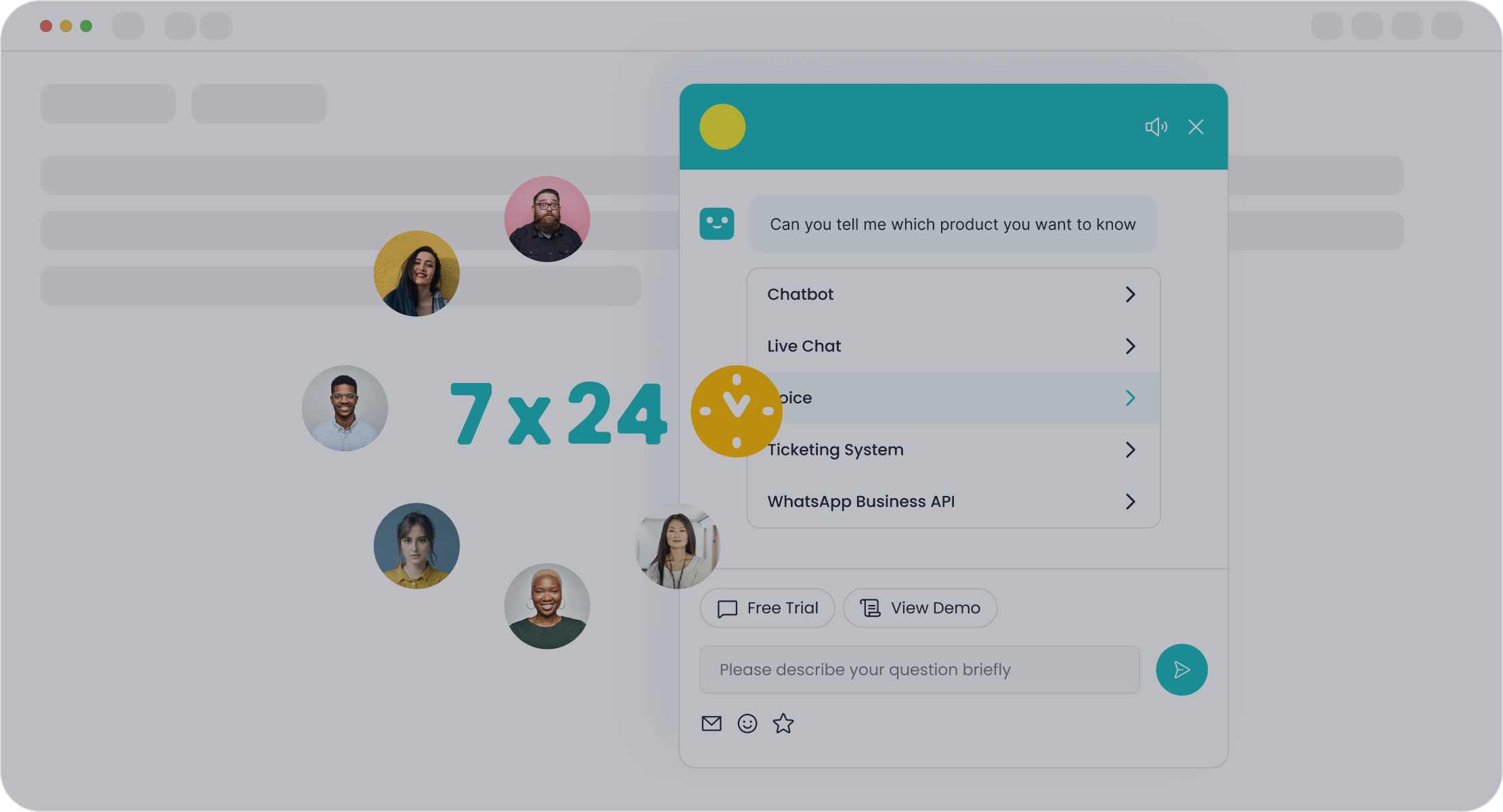

Solutions Offered by Sobot Chatbot

Sobot Chatbot transforms customer service in finance by automating interactions and delivering efficient solutions. It operates 24/7, ensuring you receive immediate assistance without delays. Its multilingual capabilities allow seamless communication in your preferred language, making it ideal for global financial institutions.

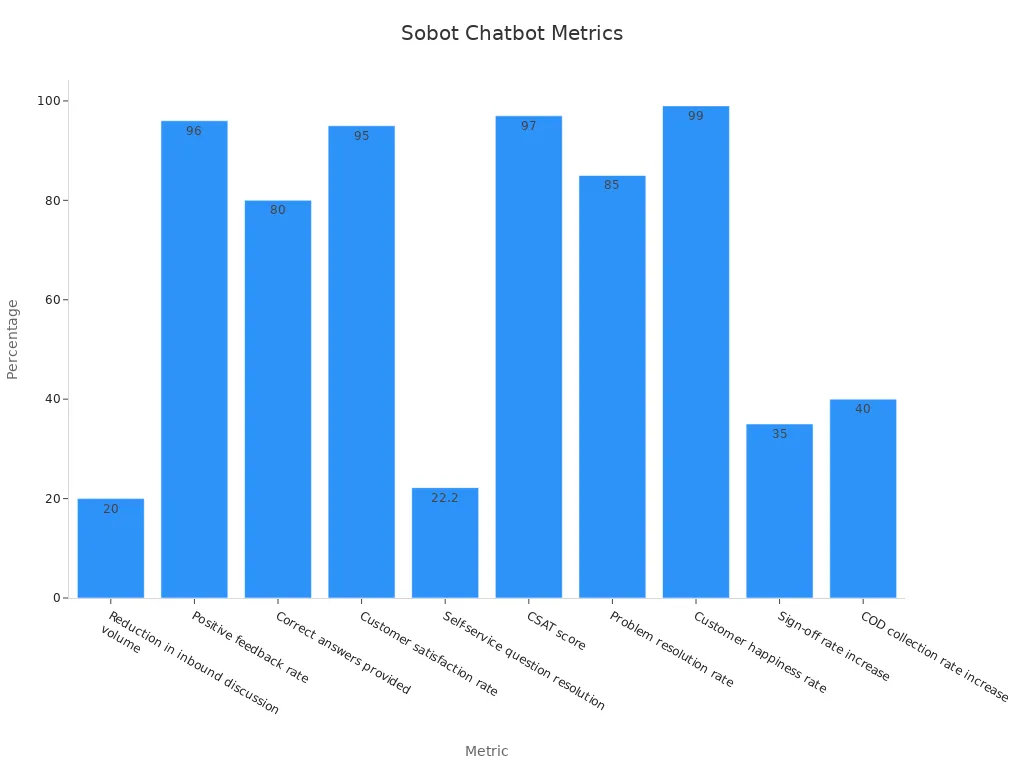

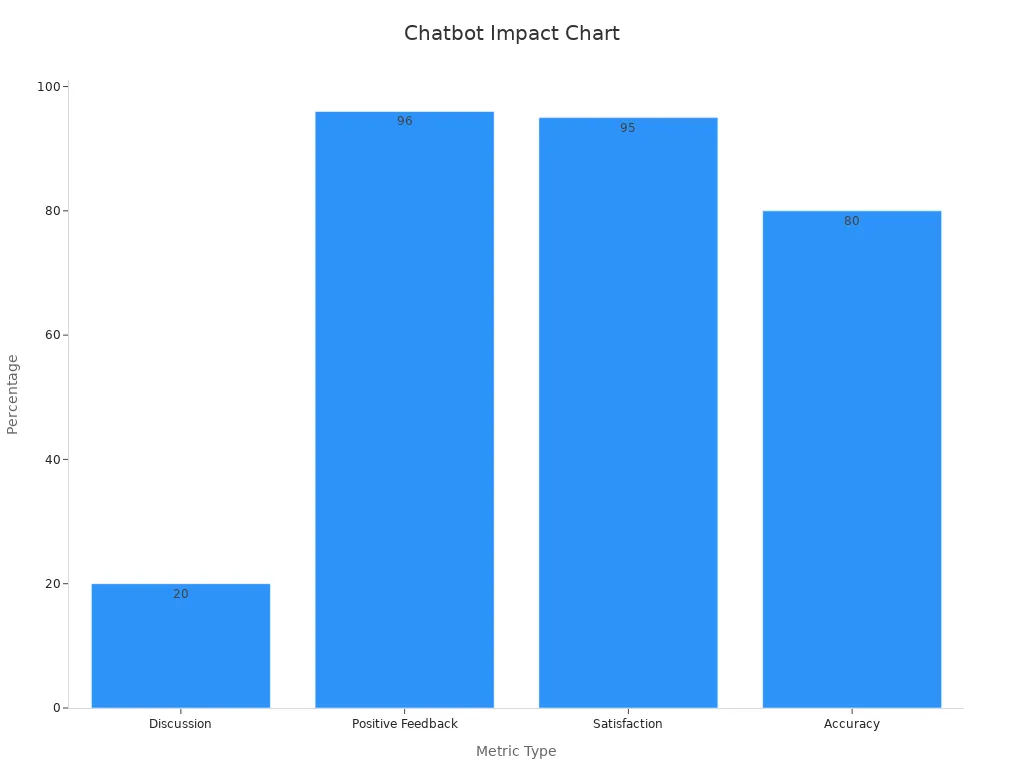

The chatbot excels in handling routine queries, reducing inbound discussion volume by 20%. It provides correct answers over 80% of the time, ensuring accuracy in responses. With a customer satisfaction rate of 95%+, Sobot Chatbot enhances your experience by resolving issues quickly and effectively. Its self-service feature resolves 22.2% of questions independently, empowering you to find solutions without waiting for human intervention.

| Metric/Result | Value |

|---|---|

| Reduction in inbound discussion volume | 20% |

| Positive feedback rate | 96%+ |

| Correct answers provided | 80%+ |

| Customer satisfaction rate | 95%+ |

| Self-service question resolution | 22.2% |

| CSAT score | 97% |

| Problem resolution rate | 85% |

| Customer happiness rate | 99% |

| Sign-off rate increase | 35% |

| COD collection rate increase | 40% |

Sobot Chatbot also boosts operational efficiency. It improves sign-off rates by 35% and increases cash-on-delivery collection rates by 40%, demonstrating its impact on financial transactions. By integrating advanced AI, the chatbot ensures secure and accurate interactions, protecting your sensitive financial data.

The chatbot’s no-coding-required setup makes it easy for financial institutions to deploy. Its omnichannel support connects with platforms like WhatsApp and SMS, ensuring you can access services through your preferred channels. With Sobot Chatbot, financial institutions can deliver faster, smarter, and more personalized customer service, enhancing your overall experience.

2025 Trends in AI Chatbots for Finance

Advanced Natural Language Processing (NLP) Capabilities

AI chatbots for finance are becoming smarter with advancements in natural language processing (NLP). This technology enables chatbots to understand and respond to human conversations more effectively. By 2025, NLP will process large volumes of unstructured data, such as customer queries and financial documents, to extract actionable insights. For example, fraud detection systems use NLP to identify unusual behavior, enhancing security in financial transactions.

NLP also speeds up tasks like analyzing financial statements and regulatory reports. This allows financial institutions to make timely decisions, such as executing trades or deals. Generative AI complements NLP by automating report generation and personalizing client communications. These advancements ensure that AI-powered assistants provide accurate and meaningful interactions, improving your overall banking experience.

Integration with Financial Tools and Platforms

AI chatbots are seamlessly integrating with existing financial tools and platforms, making them indispensable for financial institutions. For instance, Erica, Bank of America's chatbot, assists customers with tasks like checking balances and transferring money. Similarly, FP&A Genius, a ChatGPT-style chatbot, provides quick, data-driven answers during management meetings.

| Chatbot Name | Functionality | Example Use Case |

|---|---|---|

| Erica | Voice- and chat-activated AI | Assists with banking tasks like checking balances. |

| FP&A Genius | ChatGPT-style chatbot for finance | Provides data-driven answers during management meetings. |

This integration allows chatbots to deliver personalized services while working alongside financial tools. As a result, you can enjoy faster, more efficient banking services tailored to your needs.

Predictive Analytics for Proactive Customer Support

Predictive analytics is transforming how financial institutions anticipate your needs. AI chatbots analyze spending patterns to offer tailored financial advice, such as budgeting tips or investment opportunities. They also detect unusual account activities and notify you instantly, acting as a proactive measure against fraud.

By 2025, predictive analytics will help financial institutions foresee market trends and customer behaviors. This capability enables them to make informed decisions, improving their overall performance. For you, this means receiving proactive support that enhances your financial well-being and security.

Multilingual and Voice-Enabled Banking Chatbots

Multilingual and voice-enabled chatbots are transforming how you interact with financial services. These advanced tools ensure that language and accessibility barriers no longer limit your ability to manage finances. By 2025, these features will become essential for financial institutions aiming to provide inclusive and efficient customer support.

Voice-enabled chatbots allow you to interact naturally, using spoken commands instead of typing. This technology makes banking faster and more convenient. For example, you can check your account balance or transfer funds simply by speaking. Voice assistants also improve accessibility for individuals with disabilities or those who struggle with traditional interfaces.

- 74% of people prefer using voice for search queries.

- Nearly half of users find speech-based assistants faster and more accessible than human interaction.

- Voice technology ensures equal access to financial services, breaking down barriers for underserved communities.

Multilingual capabilities further enhance your experience by allowing communication in your preferred language. These chatbots can switch between languages seamlessly, ensuring you receive accurate and personalized support. For instance, if you speak Spanish, the chatbot can provide financial advice or resolve issues in your native language. This feature is especially valuable for global financial institutions serving diverse customer bases.

By combining voice and multilingual functionalities, chatbots create a more inclusive and user-friendly banking experience. They not only save time but also make financial services accessible to everyone. As these technologies evolve, you can expect even greater convenience and personalization in your interactions with financial institutions.

Sobot’s Contribution to the Future of Customer Service in Finance

How Sobot Chatbot Enhances Financial Customer Interactions

Sobot Chatbot revolutionizes how you interact with financial institutions by delivering efficient, personalized, and secure services. It operates 24/7, ensuring you receive immediate assistance without delays. The chatbot’s multilingual capabilities allow seamless communication in your preferred language, making it ideal for global financial services.

Over two years, Sobot Chatbot reduced inbound discussion volume by 20% and achieved over 96% positive feedback. Its accuracy in responses exceeds 80%, ensuring reliable interactions. These features enhance customer engagement and satisfaction, making your banking experience smoother and more enjoyable.

| Evidence Type | Description |

|---|---|

| Customer Experience Improvement | Reduced inbound discussion volume by 20% and increased positive feedback to over 96%. |

| Satisfaction Rate | More than 95% of customers reported satisfaction with the chatbot’s service. |

| Accuracy of Responses | Achieved over 80% accuracy in responses, enhancing reliability. |

By integrating advanced AI and data analytics, Sobot Chatbot provides personalized financial advice tailored to your needs. It helps you make informed decisions, whether you’re managing accounts or planning investments.

Real-World Success Stories: Opay and Sobot

Opay, a leading financial platform, partnered with Sobot to transform its customer service. By implementing Sobot’s omnichannel solution, Opay streamlined interactions across social media, email, and voice channels. This integration improved customer satisfaction from 60% to 90% and reduced operational costs by 20%.

- Opay achieved a 90% customer satisfaction rate through Sobot’s solutions.

- The platform increased conversion rates by 17% and reduced costs significantly.

These results highlight how Sobot’s innovative tools empower financial institutions to deliver exceptional customer service.

The Role of Omnichannel Solutions in Financial Services

Sobot’s omnichannel solution ensures you can access financial services through your preferred platforms, such as WhatsApp, email, or SMS. This unified approach simplifies communication, allowing you to resolve issues quickly and efficiently.

The solution integrates AI-driven automation to handle repetitive tasks, freeing agents to focus on complex issues. It also consolidates customer data into a single workspace, enabling personalized interactions. For example, financial institutions using Sobot’s omnichannel solution have improved productivity by 30% and enhanced customer satisfaction.

By combining automation, data analytics, and seamless integration, Sobot’s omnichannel solution redefines how you experience financial services.

AI chatbots are revolutionizing how you experience financial services. Tools like Sobot Chatbot provide faster, more personalized customer support, ensuring you receive assistance when you need it most. Financial institutions are addressing challenges like data security through advanced AI technologies, making interactions safer and more efficient. By 2025, these chatbots will redefine financial services, offering proactive solutions and enhancing customer satisfaction. With their ability to streamline operations, financial institutions can focus on delivering innovative services tailored to your needs.

FAQ

1. How do AI chatbots ensure data security in financial services?

AI chatbots use encryption and access controls to protect sensitive information. They monitor interactions for suspicious activity and comply with regulations like GDPR. Regular audits and updates strengthen security, ensuring your financial data remains safe.

2. Can AI chatbots handle complex financial queries?

Yes, advanced chatbots use natural language processing (NLP) to understand context and provide accurate responses. For highly complex issues, hybrid models combine AI with human agents to ensure you receive the best support.

3. Are AI chatbots available in multiple languages?

Absolutely! Many AI chatbots, including Sobot Chatbot, offer multilingual support. You can interact in your preferred language, making financial services accessible to diverse customer bases worldwide.

4. How do AI chatbots improve customer satisfaction?

Chatbots provide instant responses, personalized advice, and 24/7 availability. They reduce wait times and automate routine tasks, allowing human agents to focus on complex issues. These features enhance your overall experience and satisfaction.

5. Do AI chatbots require coding knowledge for setup?

No coding is needed! Tools like Sobot Chatbot feature point-and-click interfaces. You can design workflows and deploy automations easily, even without technical expertise.

See Also

10 Innovative Websites Leveraging Chatbots This Year

10 Leading Chatbot Solutions for Websites in 2024

Essential Tips for Selecting Top Chatbot Software