How AI Chatbots Are Redefining Banking and Finance

Artificial intelligence has revolutionized the way banks and financial institutions interact with customers. Chatbots in banking and finance have become indispensable tools, offering seamless, efficient, and round-the-clock service. Nearly 54% of customers prefer using finance bots for routine transactions, while FinTech companies have saved $7.3 billion in operational costs by adopting these solutions. You might find it fascinating that by 2026, over 110 million people in the U.S. will rely on chatbots for banking needs.

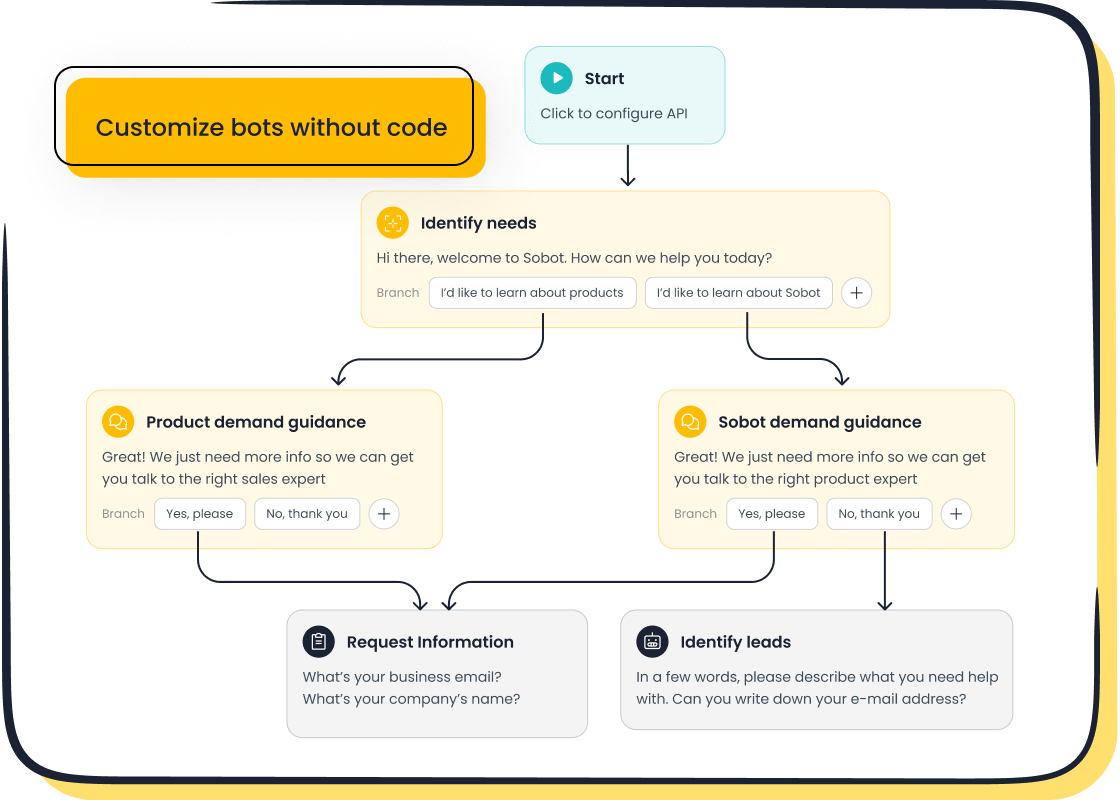

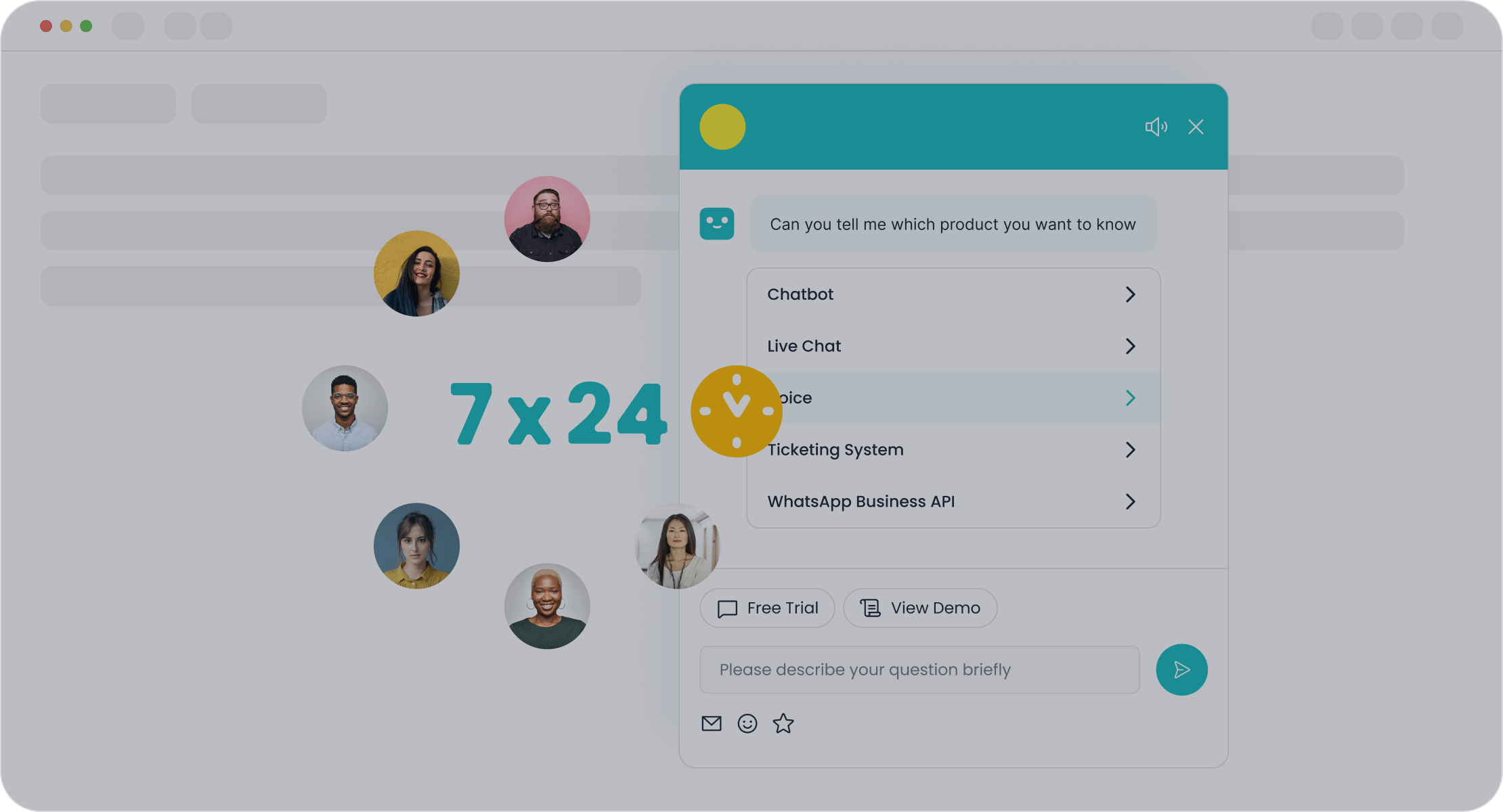

Sobot’s AI-powered chatbot exemplifies this innovation. It autonomously resolves queries, operates 24/7, and personalizes customer experiences. With its multilingual support and no-coding-required setup, Sobot ensures you meet evolving customer expectations while optimizing costs and efficiency.

The Evolution of Chatbots in Banking and Finance

From Rule-Based Systems to AI-Powered Chatbots

Chatbots have come a long way since their inception. Early systems relied on rule-based programming, where responses were pre-defined and limited. These bots could only handle simple, structured queries. However, the rise of AI-powered chatbots has transformed this landscape. Modern chatbots now use advanced technologies like natural language processing (NLP) and machine learning to understand and respond to complex customer needs.

For example, by 2025, organizations using AI-powered chatbots are expected to save $80 billion in customer service costs, according to Gartner. These bots can now achieve success rates of over 90% in handling banking queries, as reported by Bain & Company. This shift has made chatbots indispensable in banking technology, enabling financial institutions to provide seamless and efficient services.

| Feature | Rule-Based Systems | AI-Powered Chatbots |

|---|---|---|

| Response Capability | Limited to pre-defined | Dynamic and adaptive |

| Language Understanding | Basic keyword matching | Advanced NLP |

| Learning Ability | None | Continuous improvement |

The Role of AI in Banking: A Historical Perspective

AI in banking has evolved significantly over the decades. In 1966, the first chatbot, Eliza, was created as a simple psychotherapist. Fast forward to 2018, and AI-powered chatbots began dominating the financial services industry. This evolution reflects the growing reliance on AI in banking to meet customer expectations and improve operational efficiency.

- Interest in chatbots has increased ten-fold in the last five years.

- Modern AI systems enable banks to reduce downtime by 99%, ensuring uninterrupted services.

- Chatbots now play a crucial role in enhancing customer experience through natural conversations.

These advancements highlight how AI in banking has shifted from being a novelty to a necessity.

Why Chatbots Are Essential in Modern Digital Banking Trends

In today’s digital banking era, customers demand instant, personalized, and secure interactions. Chatbots fulfill these needs by offering 24/7 availability and multilingual support. They also reduce operational costs and improve efficiency, making them a cornerstone of financial services trends.

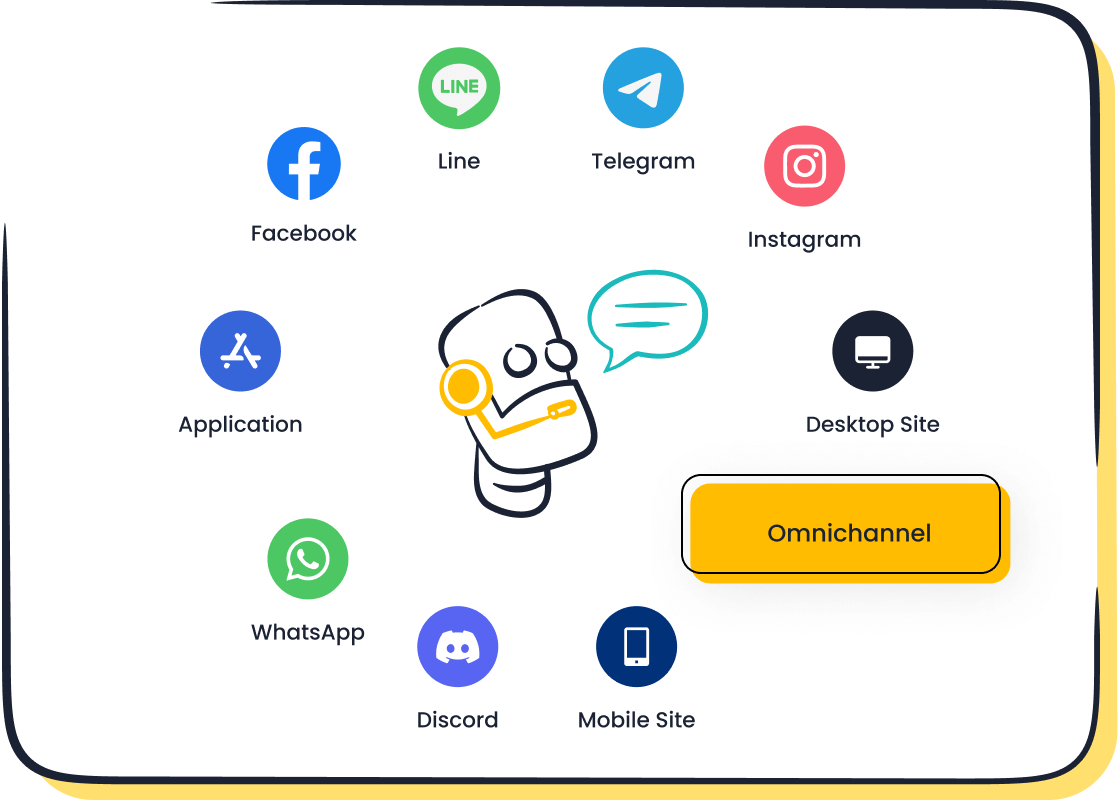

For instance, Sobot’s AI chatbot operates across multiple channels like WhatsApp and SMS, ensuring you can engage with customers wherever they are. Its ability to autonomously resolve queries boosts productivity by 70% and cuts costs by 50%. These features align perfectly with modern digital banking trends, where convenience and efficiency are paramount.

By integrating chatbots into your banking technology, you can stay ahead of the curve and deliver exceptional customer experiences.

Benefits of AI Chatbots in Banking Technology

Enhancing Customer Service with 24/7 Availability

AI chatbots have transformed customer service in banking by offering round-the-clock support. Unlike traditional methods, chatbots ensure that customers can access assistance anytime, even during holidays or outside business hours. This availability significantly improves customer satisfaction. For instance, post-interaction surveys show that banks using chatbots achieve higher service quality ratings. Additionally, first-contact resolution rates increase as chatbots instantly address common queries.

Sobot’s AI chatbot exemplifies this innovation. It operates 24/7 across multiple channels, including WhatsApp and SMS, ensuring seamless communication. Its multilingual capabilities allow you to serve diverse customer bases effectively. By integrating such solutions, banks can enhance digital banking experiences and meet the demands of modern financial services trends.

| Metric | Evidence |

|---|---|

| Customer Satisfaction Ratings | Post-interaction surveys via chatbot help banks assess service quality and address gaps. |

| First Contact Resolution Rates | AI chatbots instantly resolve common queries, increasing first-contact resolution rates. |

| Operational Cost Reductions | Implementing AI chatbots can reduce customer service expenses by up to 30%. |

Reducing Operational Costs and Improving Efficiency

AI in banking has proven to be a cost-effective solution. Chatbots reduce the need for additional customer service agents by handling repetitive tasks autonomously. This efficiency leads to significant cost savings. For example, banks saved $7.3 billion in operational costs in 2023 by adopting AI chatbots. Moreover, customer service costs can decrease by 30-40%, with some companies saving up to $150,000 annually.

Sobot’s chatbot enhances efficiency by solving regular queries and assisting agents, improving productivity by 70%. Its no-coding-required setup allows you to deploy it quickly, saving time and resources. By adopting such solutions, you can streamline operations and focus on delivering exceptional customer experiences.

- Key cost-saving statistics:

- 4% of companies saw cost savings of at least 20% after adopting AI.

- 28% of companies reduced costs by 10% or less.

| Sector | Cost Reduction (2019) | Cost Reduction (2023) |

|---|---|---|

| Banking | $209 million | $7.3 billion |

| Retail & Healthcare | N/A | $11 billion annually |

Personalizing Customer Experiences with AI

Personalization is a cornerstone of modern banking technology. AI chatbots analyze customer data to provide tailored recommendations and responses. This approach enhances customer experiences by addressing individual needs. For example, chatbots can suggest relevant financial products based on user behavior, increasing sales opportunities. They also remind customers of payments, improving cash flow and profitability.

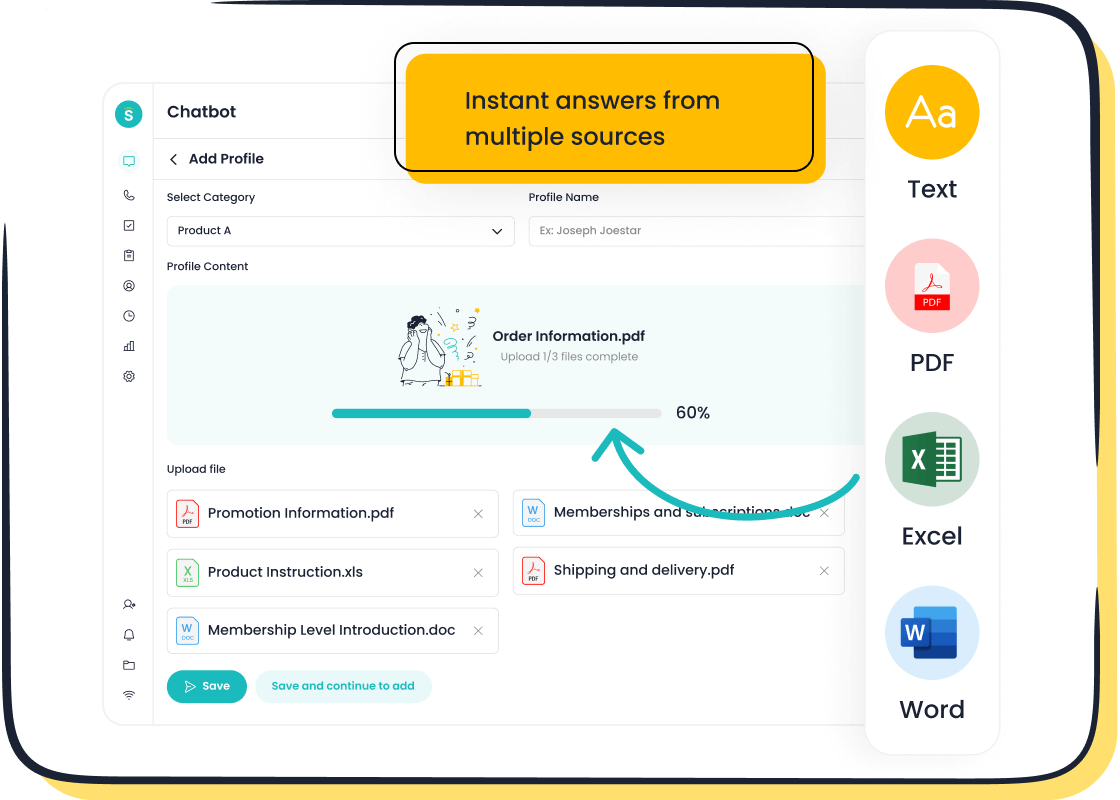

Sobot’s chatbot excels in delivering personalized experiences. It uses a knowledge base built from various sources to provide accurate and context-aware replies. Its proactive messaging feature boosts conversions by 20%, while its customizable design helps businesses gain 30% more leads. By leveraging such tools, you can create meaningful interactions that foster trust and loyalty.

| Benefit | Description |

|---|---|

| Personalize customer interactions | Enhances customer experience by providing tailored responses and 24/7 availability, meeting diverse customer needs. |

| Built-in upsell and cross-sell | Suggests relevant financial products based on customer behavior, enhancing sales opportunities. |

| Cash flow support | Reminds customers of payments and reduces operational costs, improving overall profitability. |

Boosting Conversions Through Smart Self-Service

Smart self-service has become a game-changer in the banking and finance industry. By empowering customers to resolve their queries independently, you can enhance user satisfaction and drive higher conversion rates. Chatbots play a pivotal role in this transformation. They provide instant responses, guide users through processes, and offer personalized recommendations—all without requiring human intervention.

Studies show that 74% of customers prefer using chatbots over human agents for simple queries. This preference highlights the growing trust in AI-driven solutions. For instance, Kia’s Kian chatbot increased website conversions by 14%, proving the effectiveness of smart self-service tools. Additionally, businesses that implement these solutions often see improved customer loyalty and retention rates.

| Statistic | Description |

|---|---|

| 74% | Customers preferring chatbots over human agents for simple queries. |

| 14% | Increase in website conversion attributed to Kia’s Kian chatbot. |

| N/A | Improved customer loyalty and retention rates through effective self-service tools. |

Sobot’s AI chatbot exemplifies the power of smart self-service. It operates 24/7, autonomously resolving routine queries and assisting customers in real time. Its proactive messaging feature engages users at critical moments, boosting conversions by 20%. The chatbot’s multilingual support ensures you can cater to diverse audiences, while its no-coding-required setup allows for quick deployment. These features make Sobot an ideal choice for businesses aiming to enhance customer experiences and drive growth.

By integrating chatbots into your operations, you can streamline customer interactions, reduce response times, and increase sales opportunities. Smart self-service not only improves efficiency but also builds trust, ensuring your customers return for future services.

Applications of Chatbots in Banking and Finance

Personalized Financial Advice and Budgeting Tools

Chatbots have become essential tools for offering personalized financial advice. They analyze your income, expenses, and savings patterns to provide tailored recommendations. This feature helps you make informed decisions about budgeting, investments, and savings. For example, about 65% of people prefer using chatbots for quick answers about their finances. These tools eliminate long wait times, making financial advice accessible to everyone.

Bank of America’s chatbot, Erica, is a great example. It offers customized financial insights and 24/7 assistance, enhancing customer satisfaction and productivity. Similarly, Sobot’s AI chatbot uses advanced analytics to deliver personalized experiences. It can remind you of upcoming payments or suggest financial products that match your needs. By integrating such tools, banks can improve customer experiences and foster trust.

| Statistic/Insight | Description |

|---|---|

| Customer Preference | 65% of people prefer chatbots for quick financial answers. |

| Cost Savings | Companies save up to $11 billion and 2.5 billion hours using chatbots. |

| Personalized Advice | Tailored guidance enhances user engagement and decision-making. |

Fraud Detection and Security Alerts

AI in banking plays a critical role in fraud detection. Chatbots monitor transactions in real time, identifying unusual activity and alerting you instantly. This proactive approach minimizes risks and ensures your financial security. For instance, some chatbots use machine learning to detect patterns that indicate fraud, such as multiple failed login attempts or large, unexpected withdrawals.

Sobot’s chatbot enhances security by integrating with banking technology to provide instant alerts. It operates across multiple channels like WhatsApp and SMS, ensuring you receive notifications wherever you are. This feature not only protects your finances but also builds confidence in digital banking services.

- Key benefits of fraud detection chatbots:

- Real-time monitoring of transactions.

- Instant alerts for suspicious activities.

- Enhanced trust in financial services.

Automating Routine Banking Tasks and Queries

Chatbots excel at automating repetitive tasks, freeing up human agents to focus on complex issues. They handle tasks like balance inquiries, fund transfers, and account updates with speed and accuracy. This automation reduces operational costs by 60% and increases productivity by 40%. For example, Crédit Mutuel’s chatbot processes 350,000 inquiries daily, allowing advisors to respond 60% faster.

Sobot’s AI chatbot streamlines routine tasks with its no-coding-required setup and multilingual support. It operates 24/7, ensuring you get instant assistance without delays. By automating these tasks, banks can improve efficiency and deliver better customer experiences.

| Bank Name | Implementation Details | Results |

|---|---|---|

| Crédit Mutuel | Chatbot handling 350,000 inquiries daily, freeing up human advisors. | Client advisors respond 60% faster, improving the customer service process. |

| DNB | Digital assistant deployed across eight departments, handling 80,000 conversations monthly. | 83% accuracy rate, streamlining banking and improving efficiency. |

Supporting Financial Literacy and Education

AI chatbots are transforming how you learn about managing money. They provide easy-to-understand guidance on topics like budgeting, saving, and investing. These tools make financial education accessible to everyone, regardless of age or background. For example, chatbots can explain complex terms like "compound interest" in simple language, helping you make smarter financial decisions.

Many banks now use chatbots to promote financial literacy. These bots answer questions about account types, interest rates, and loan options. They also offer interactive tools, such as quizzes and calculators, to help you understand your finances better. This approach empowers you to take control of your money and plan for the future.

Sobot’s AI chatbot takes this a step further. It uses advanced analytics to provide personalized advice based on your spending habits. It can remind you to save for upcoming expenses or suggest ways to reduce unnecessary costs. By integrating such tools, banks can not only educate their customers but also build trust and loyalty.

💡 Tip: Use chatbots to explore financial topics at your own pace. They’re available 24/7, so you can learn whenever it’s convenient for you.

Streamlining Loan and Credit Card Applications

Applying for loans or credit cards often feels overwhelming. AI chatbots simplify this process by guiding you through each step. They check your eligibility, collect necessary details, and submit your application instantly. This reduces paperwork and eliminates long waiting times.

AI models evaluate creditworthiness faster than traditional methods. For instance:

- They reduce processing times from days to minutes.

- JPMorgan Chase uses AI to analyze applicant data, speeding up loan approvals.

- Online lenders like Upstart approve loans in under five minutes.

Sobot’s chatbot enhances this experience by automating routine tasks. It operates across multiple channels, ensuring you can apply for loans or credit cards wherever you are. Its multilingual support makes the process accessible to diverse users. By adopting such solutions, banks can improve efficiency and provide a seamless customer experience.

📝 Note: Chatbots not only save time but also reduce errors in applications, ensuring a smoother process for you.

Challenges and Limitations of Chatbots in Banking

Addressing Data Privacy and Security Concerns

Data privacy remains a significant concern for customers using chatbots in banking. Studies show that 68% of consumers worry about their online privacy, and 57% believe AI poses risks to their personal information. Many customers find it challenging to understand how their data is collected and used. These concerns highlight the importance of robust security measures in AI-driven banking solutions.

Banks are addressing these issues by implementing strict data privacy regulations like GDPR. They anonymize sensitive information and secure explicit customer consent before using AI. For example, Sobot’s AI chatbot ensures compliance with global data protection standards. It operates securely across multiple channels, such as WhatsApp and SMS, safeguarding customer interactions. By prioritizing privacy, you can build trust and confidence in digital banking services.

Overcoming Limitations in Understanding Complex Queries

Chatbots excel at handling routine tasks but often struggle with complex financial queries. Poorly designed systems may fail to recognize disputes or provide accurate responses, leading to customer dissatisfaction. For instance, chatbots can misinterpret nuanced questions about loan eligibility or investment options.

However, advancements in AI in banking are bridging this gap. Modern chatbots analyze customer data to offer tailored recommendations and manage intricate tasks like compliance checks. They also enhance efficiency by handling high inquiry volumes, allowing human agents to focus on complex issues. Sobot’s chatbot leverages a powerful knowledge base to deliver accurate, context-aware replies. Its multilingual support ensures you receive precise assistance, regardless of language preferences.

| Challenge/Limitations | Description |

|---|---|

| Limited ability to solve complex problems | Chatbots handle basic inquiries well but may struggle with complex issues. |

| Risk of noncompliance | Financial institutions risk violating laws without proper chatbot design. |

| Inadequate support | Poorly designed systems fail to resolve disputes, frustrating customers. |

Balancing Automation with Human Interaction

While chatbots automate many banking processes, human interaction remains essential for building trust. Customers often prefer speaking with a person for sensitive matters like mortgage applications or fraud disputes. Striking the right balance between automation and human support ensures a seamless experience.

Several banks have successfully integrated AI with human assistance. For example, NatWest Group uses AI to guide employees during customer interactions, improving loyalty and reducing call durations. Similarly, Sobot’s chatbot complements human agents by triaging queries and escalating complex issues. This approach allows you to enjoy the efficiency of automation without losing the personal touch of human service.

Tip: Use chatbots for routine tasks and rely on human agents for more personalized support. This strategy ensures a balanced and effective customer experience.

Ethical Considerations in AI Decision-Making

AI chatbots have transformed banking and finance, but their decision-making processes raise important ethical questions. As you rely more on AI for tasks like loan approvals or fraud detection, ensuring fairness, transparency, and accountability becomes critical.

- Fairness and Inclusivity: AI systems must avoid bias. If training data contains imbalances, the chatbot may unintentionally discriminate against certain groups. For example, a biased algorithm might deny loans to small businesses in underserved areas. By addressing these imbalances, banks can ensure fairer outcomes for all customers.

- Transparency in Decision-Making: You deserve to understand how decisions are made. Transparent AI systems explain their processes clearly, allowing you to evaluate or challenge decisions. This builds trust and ensures accountability.

- Accountability for Outcomes: Banks must take responsibility for AI-driven decisions. Monitoring and evaluating chatbot performance helps identify errors and improve outcomes. For instance, if a chatbot incorrectly flags a transaction as fraudulent, the bank should have a process to resolve the issue quickly.

AI also improves decision-making in banking by analyzing data from multiple sources. Traditional methods often struggle with incomplete information, especially when assessing small businesses' creditworthiness. AI chatbots, like Sobot’s, overcome this challenge by processing data efficiently and without bias. This ensures informed, ethical decisions that benefit both banks and customers.

Sobot’s AI chatbot operates with these ethical principles in mind. It uses advanced analytics to provide accurate, unbiased responses while maintaining transparency. Its multilingual support ensures inclusivity, serving diverse customer bases effectively. By adopting such solutions, you can enhance customer trust and meet ethical standards in digital banking.

💡 Tip: Always choose AI solutions that prioritize fairness, transparency, and accountability. These principles ensure ethical decision-making and build long-term trust in financial services.

Future Trends in Chatbots and Banking Technology

Advancements in Conversational AI and NLP

Conversational AI and natural language processing (NLP) are transforming how you interact with financial institutions. These technologies enable chatbots to understand and respond to complex queries with human-like accuracy. For example, ChatGPT has been applied in financial institutions to simulate real-world scenarios like customer service inquiries and financial planning advice. This allows chatbots to provide tailored solutions, improving your overall experience.

Chatbots powered by conversational AI also enhance market efficiency. They analyze vast amounts of unstructured financial data, offering real-time insights that help you make faster decisions. Additionally, large language models (LLMs) like BloombergGPT specialize in financial tasks, such as classifying documents and recognizing entities. These advancements make chatbots indispensable in modern banking technology, ensuring you receive accurate and timely assistance.

💡 Tip: Look for chatbots that use advanced NLP to get precise answers to your financial questions.

The Rise of Voice-Activated Banking Assistants

Voice-activated banking assistants are gaining popularity as they make banking more convenient. These tools allow you to perform tasks like checking balances or transferring funds using simple voice commands. For instance, Bank of America’s Erica has over 10 million users and has processed more than 100 million transactions. This shows how voice technology is reshaping digital banking trends.

Voice assistants also enhance security by using biometric voice recognition to confirm your identity. HSBC was among the first to adopt this technology, setting a benchmark for secure and accessible banking. As demand for efficient customer service grows, voice-activated assistants will play a crucial role in meeting your expectations.

| Evidence Type | Details |

|---|---|

| Growth of Voice-Based Technology | 72% of banking experts believe voice is crucial for future performance. |

| Adoption Rate | Bank of America’s Erica has 10 million users and processed over 100 million transactions. |

| Industry Shift | HSBC pioneered speech recognition for client services in 2019. |

Domain-Specific AI Models for Financial Services

Domain-specific AI models are revolutionizing financial services by addressing industry-specific challenges. These models excel in tasks like fraud detection, risk management, and algorithmic trading. For example, AI can analyze your transaction patterns to detect anomalies, preventing credit card fraud. It also processes large datasets quickly, helping banks manage risks more effectively.

Finance-focused LLMs like BloombergGPT enhance analytical capabilities. They classify financial documents and automate tasks, improving efficiency. Sobot’s AI chatbot integrates similar technologies to deliver precise, context-aware responses. By adopting these tools, banks can offer you smarter, faster, and more secure services.

📝 Note: Domain-specific AI models ensure that financial services are tailored to your unique needs, making banking more reliable and efficient.

Hyper-Personalization Through Predictive Analytics

Predictive analytics is reshaping how banks interact with you. By analyzing your transaction history and spending patterns, banks can anticipate your needs and offer tailored solutions. This approach, known as hyper-personalization, strengthens customer relationships and drives business growth. For example, AI-powered systems can recommend financial products based on your past behavior, ensuring you receive services that match your preferences.

Hyper-personalization relies on real-time data analysis to deliver personalized experiences. AI and machine learning create micro-segments, allowing banks to send targeted marketing messages that resonate with you. These tools also help banks identify trends, such as your likelihood to invest or save, enabling proactive engagement.

- Benefits of hyper-personalization in banking:

- Builds stronger customer relationships.

- Provides tailored service recommendations based on historical data.

- Enhances marketing effectiveness through micro-segmentation.

Sobot’s AI chatbot exemplifies hyper-personalization. It uses predictive analytics to analyze customer data and deliver context-aware replies. Its proactive messaging feature boosts conversions by 20%, while its multilingual support ensures inclusivity. By integrating such tools, banks can enhance your experience and foster loyalty.

💡 Tip: Look for banks that use predictive analytics to offer personalized services. These tools make banking more convenient and efficient.

Integration with Blockchain and Fintech Ecosystems

Blockchain technology and Fintech ecosystems are revolutionizing financial services. Blockchain ensures secure and transparent transactions, reducing fraud risks. Fintech platforms integrate innovative solutions, such as AI chatbots, to streamline operations and improve customer experiences. Together, these technologies create a seamless and efficient banking environment.

Blockchain enhances security by encrypting your financial data. It also enables faster cross-border payments, eliminating delays caused by traditional systems. For example, Ripple uses blockchain to process international transactions in seconds. Fintech ecosystems leverage AI to automate processes like loan approvals, saving you time and effort.

Sobot’s omnichannel solution integrates seamlessly with Fintech platforms, offering unified customer service across channels like WhatsApp and SMS. Its AI chatbot operates 24/7, ensuring you receive instant assistance. By adopting these technologies, banks can provide secure, efficient, and personalized services.

| Feature | Blockchain Benefits | Fintech Ecosystem Benefits |

|---|---|---|

| Security | Reduces fraud risks | Automates routine tasks |

| Speed | Enables instant payments | Improves customer service |

| Innovation | Supports smart contracts | Enhances personalization |

📝 Note: Blockchain and Fintech ecosystems are transforming banking. Choose institutions that embrace these technologies for better service quality.

Sobot's Role in Redefining Digital Banking Trends

How Sobot's Chatbot Enhances Customer Interactions

Sobot's AI chatbot is transforming how banks and financial institutions interact with their customers. By leveraging advanced technologies like natural language processing and machine learning, it delivers personalized experiences that cater to individual needs. The chatbot operates 24/7, ensuring customers receive instant assistance at any time. Its multilingual support allows banks to serve diverse audiences effectively, breaking down language barriers in customer service.

One of the standout features of Sobot's chatbot is its ability to integrate seamlessly across multiple channels, including WhatsApp and SMS. This omnichannel capability ensures consistent and efficient communication, enhancing the overall customer experience. Additionally, the chatbot's proactive messaging feature engages users at critical moments, boosting conversions by 20%. These innovations align perfectly with modern digital banking trends, where convenience and efficiency are paramount.

💡 Did you know? Sobot's chatbot improves productivity by 70% and reduces operational costs by up to 50%, making it a cost-effective solution for financial services.

Real-World Success Stories: Opay and Sobot's Omnichannel Solution

Sobot's omnichannel solution has delivered remarkable results for various companies in the finance sector. For instance, Opay, a leading financial service platform, achieved a 90% customer satisfaction rate after implementing Sobot's solution. The platform streamlined customer interactions across social media, email, and voice channels, significantly improving service delivery.

Other success stories include Michael Kors, which enhanced customer engagement, and Samsung, which achieved a 97% customer satisfaction score. These examples highlight the versatility and effectiveness of Sobot's technology in improving digital banking experiences.

| Company | Success Metric | Link |

|---|---|---|

| Michael Kors | Enhanced customer engagement and satisfaction | Read More |

| Samsung | Achieved 97% customer satisfaction score | Read More |

| Agilent | Sixfold increase in customer service efficiency | Read More |

| Opay | 90% customer satisfaction rate | Read More |

| Tineco | Significant improvements in response times | Read More |

Leveraging Sobot's AI Chatbot for Operational Efficiency

Sobot's AI chatbot is not just about enhancing customer interactions; it also drives operational efficiency. By automating routine tasks, the chatbot allows human agents to focus on more complex issues. This automation leads to faster response times and improved service quality. For example, the chatbot achieves an 83% resolution rate, ensuring most queries are handled without human intervention.

The chatbot also integrates seamlessly with Sobot's omnichannel platform, further enhancing interaction efficiency. Businesses using this technology have reported a 57% increase in repurchase rates, demonstrating its impact on customer loyalty. These features make Sobot's chatbot an essential tool for staying competitive in the evolving landscape of financial services.

📝 Note: Automating repetitive tasks not only saves time but also reduces costs, allowing you to allocate resources more effectively.

The Future of Banking with Sobot's AI-Powered Solutions

The future of banking is rapidly evolving, and AI-powered solutions like Sobot’s chatbot are at the forefront of this transformation. As customer expectations grow, banks must adopt innovative tools to stay competitive. Sobot’s AI chatbot offers a glimpse into what lies ahead by combining advanced technology with practical applications.

AI chatbots in the financial sector are projected to save approximately $2.3 billion by 2023. This highlights their potential to reduce costs while improving efficiency. Sobot’s chatbot already achieves this by automating routine tasks, cutting expenses by up to 50%, and boosting productivity by 70%. These capabilities allow banks to allocate resources more effectively, focusing on personalized customer interactions.

Mobile payments are another area experiencing exponential growth. By the end of 2025, mobile payments are expected to exceed $12,407.5 billion, growing at a CAGR of 23.8%. Sobot’s omnichannel solution supports this trend by integrating seamlessly with platforms like WhatsApp and SMS. This ensures you can access banking services anytime, anywhere, enhancing convenience and accessibility.

Hyper-personalization will also define the future of banking. Sobot’s chatbot uses predictive analytics to anticipate your needs, offering tailored recommendations and proactive assistance. For example, it can remind you of upcoming payments or suggest financial products that align with your goals. This level of personalization fosters trust and strengthens customer relationships.

As AI continues to advance, Sobot’s solutions will play a pivotal role in shaping the future of digital banking. By adopting these tools, financial institutions can deliver secure, efficient, and customer-centric services, ensuring they remain relevant in an ever-changing landscape.

💡 Tip: Embrace AI-powered solutions like Sobot’s chatbot to stay ahead in the evolving world of banking.

AI chatbots have revolutionized banking and finance by automating customer interactions and enhancing service quality. By 2025, AI will assist in 95% of customer interactions, reflecting its growing importance. Nearly half of financial firms report improved customer satisfaction after adopting AI tools. Chatbots like Sobot’s deliver 24/7 support, reduce costs, and personalize experiences, making them indispensable in modern banking. Addressing challenges like data privacy ensures their full potential is unlocked. By embracing AI-powered solutions, you can stay ahead in the evolving financial landscape. Explore Sobot’s chatbot to redefine your banking experience.

FAQ

What are AI chatbots, and how do they work in banking?

AI chatbots are virtual assistants that use artificial intelligence to interact with customers. In banking, they handle tasks like balance inquiries, fund transfers, and fraud alerts. For example, Sobot's AI chatbot operates 24/7, providing instant assistance and improving customer satisfaction by automating routine queries.

How do AI chatbots improve customer service in finance?

AI chatbots enhance customer service by offering 24/7 support, resolving queries instantly, and personalizing interactions. Sobot's chatbot, for instance, boosts productivity by 70% and reduces costs by 50%, ensuring efficient and seamless communication across multiple channels like WhatsApp and SMS.

Are AI chatbots secure for banking transactions?

Yes, AI chatbots in banking prioritize security. They use encryption and comply with data protection regulations like GDPR. Sobot's chatbot ensures secure interactions across channels, safeguarding sensitive information while providing real-time fraud alerts to protect your finances.

Can AI chatbots handle complex financial queries?

Modern AI chatbots, like Sobot's, use advanced natural language processing (NLP) to understand and respond to complex queries. They analyze customer data to provide accurate, context-aware answers, ensuring you receive reliable assistance even for intricate financial matters.

How do AI chatbots save costs for banks and financial institutions?

AI chatbots reduce costs by automating repetitive tasks, minimizing the need for additional agents. For example, Sobot's chatbot saves up to 50% on operational expenses while improving efficiency. This allows banks to allocate resources to more critical areas, enhancing overall service quality.

See Also

Enhancing Customer Satisfaction Through E-commerce Chatbots

Simple Ways to Integrate Chatbots on Your Website

Key Advantages of Using Chatbots on Websites