How AI Finance Chatbots Drive Customer Satisfaction and Loyalty

AI finance chatbots are revolutionizing the way you interact with financial institutions. These intelligent tools provide instant support, personalized advice, and seamless experiences. For example, HSBC's chatbot reduces wait times while offering tailored financial guidance, improving customer satisfaction. Similarly, Pentagon Federal Credit Union (PenFed) saw a 30% increase in satisfaction with loan applications after introducing AI-powered chat interfaces. Globally, the value of banking transactions via conversational AI is expected to surge to $524 billion by 2027, highlighting its growing importance. Sobot’s innovative chatbot solution empowers businesses to deliver 24/7 multilingual support, helping you save time and enjoy a smoother financial journey.

Understanding AI Finance Chatbots and Their Importance

What Are AI Finance Chatbots?

AI finance chatbots are intelligent tools designed to simplify your interactions with financial institutions. These chatbots use artificial intelligence to understand and respond to your queries in real time. They act as embedded technologies within financial applications, offering personalized assistance and resolving routine issues. For example, generative AI enables these chatbots to handle complex questions, such as guiding you through loan applications or explaining investment options.

You benefit from their ability to manage finances, transfer funds, and provide instant answers. AI finance chatbots have already handled 1.5 billion interactions and engaged 37 million users globally, showcasing their growing importance in modern financial services. Their efficiency reduces customer service costs by up to 30%, making them valuable for both banks and customers.

Why Financial Institutions Rely on AI Chatbots

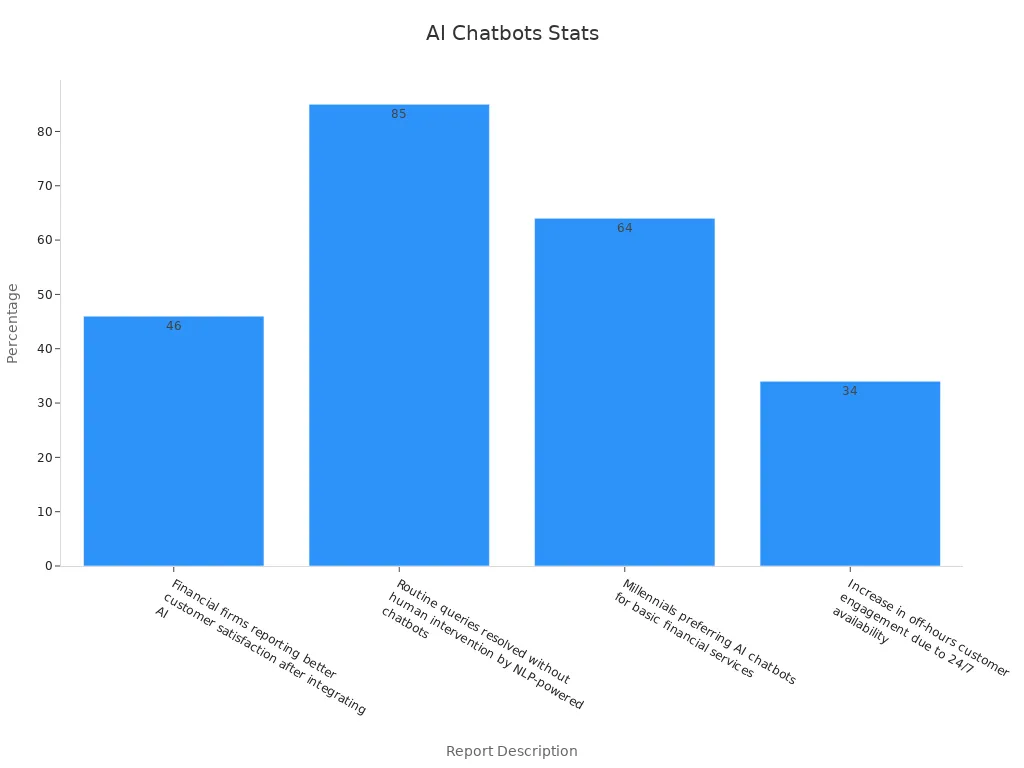

Financial institutions rely on AI chatbots because they enhance customer satisfaction and streamline operations. These chatbots resolve 85% of routine queries without human intervention, ensuring faster service. Millennials, who make up a significant portion of the customer base, prefer AI chatbots for basic financial services, with 64% favoring them over traditional methods.

Their 24/7 availability increases off-hours engagement by 34%, allowing you to access support whenever needed. Additionally, AI chatbots provide personalized interactions, eliminating wait times and improving your overall experience. Banks report a 46% improvement in customer satisfaction after integrating AI chatbots, highlighting their transformative impact.

| Statistic | Description |

|---|---|

| 85% | Routine queries resolved without human intervention. |

| 64% | Millennials' preference for AI chatbots. |

| 34% | Increase in off-hours customer engagement. |

The Role of Sobot Chatbot in Transforming Financial Interactions

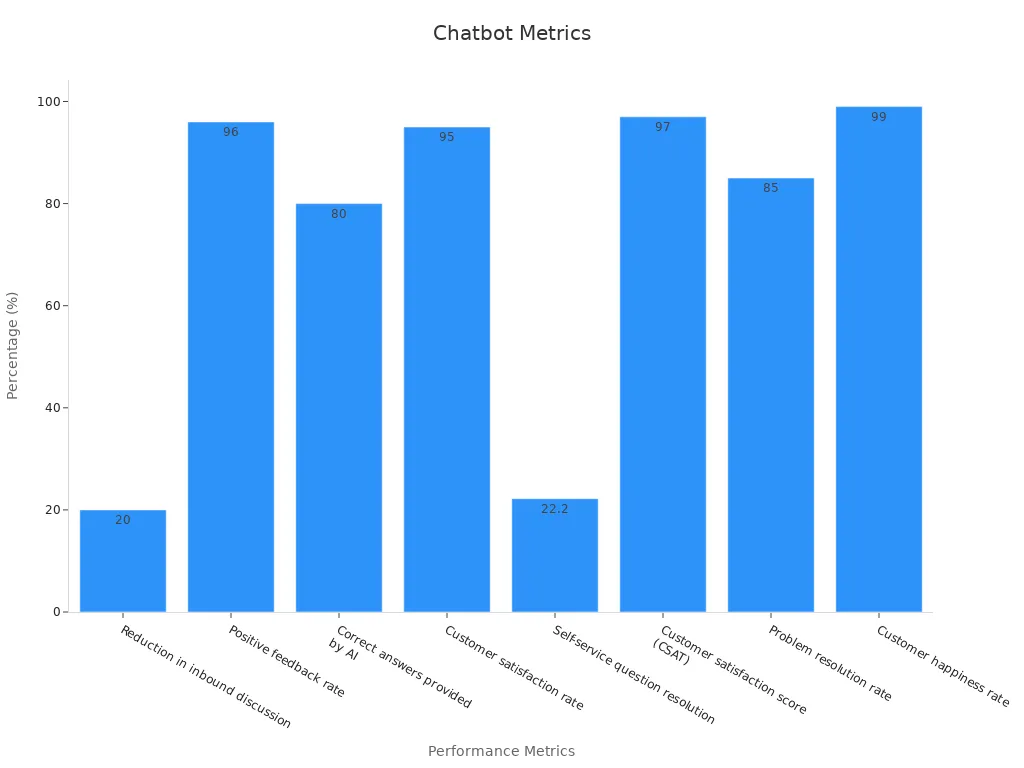

Sobot Chatbot plays a pivotal role in transforming financial services. It provides multilingual, 24/7 support, ensuring you receive assistance anytime, anywhere. Its AI-powered capabilities autonomously resolve regular queries, improving productivity by 70%. The chatbot also enhances customer satisfaction, achieving a positive feedback rate of over 96%.

Sobot’s chatbot reduces inbound discussions by 20%, allowing agents to focus on complex issues. It delivers correct answers 80% of the time, ensuring accuracy in financial interactions. With a customer satisfaction score of 97%, Sobot Chatbot sets a benchmark for excellence in AI-driven financial tools.

| Metric | Value |

|---|---|

| Reduction in inbound discussion | 20% |

| Positive feedback rate | 96%+ |

| Correct answers provided by AI | 80% |

| Customer satisfaction score | 97% |

Key Benefits of AI Finance Chatbots in Financial Services

Personalized Customer Service with AI Chatbots

AI chatbots elevate your customer experience by offering personalized customer service tailored to your needs. These intelligent tools analyze your preferences and past interactions to provide relevant solutions. For instance, they can recommend financial products based on your spending habits or guide you through complex processes like mortgage applications.

| Indicator | Description |

|---|---|

| Customer Satisfaction Score | Measures user satisfaction with the chatbot, typically rated on a scale of 1 to 5. |

| Resolution Rate | Percentage of inquiries resolved by the chatbot without human intervention. |

| Average Handling Time | Average time taken by the chatbot to handle a user inquiry. |

| User Engagement Metrics | Metrics such as interactions per user and conversation length that gauge chatbot effectiveness. |

| Conversion Rate | Percentage of interactions leading to desired actions, indicating sales effectiveness. |

Sobot’s AI-powered chatbot excels in delivering personalized service. It uses advanced analytics to predict your needs and provide accurate responses. This approach not only improves satisfaction but also builds trust, ensuring a seamless customer experience.

24/7 Availability for Seamless Financial Interactions

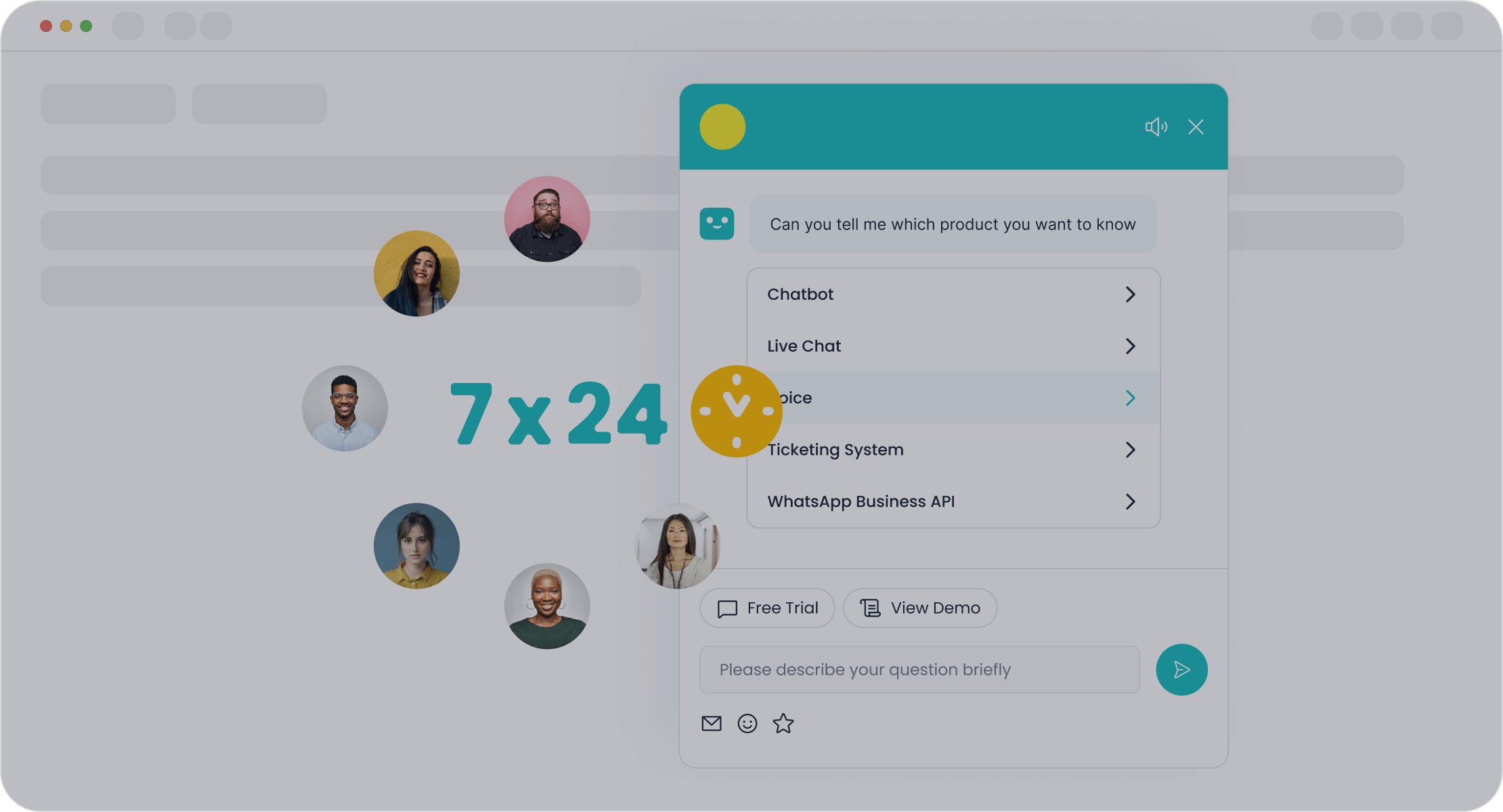

Financial chatbots operate around the clock, ensuring you receive assistance whenever needed. This continuous availability caters to a global audience, making it easier for you to manage finances across different time zones. Whether you need help with account inquiries or transaction support, AI chatbots are always ready to assist.

- AI chatbots provide 24/7 availability, ensuring clients receive assistance whenever needed.

- Enhanced client engagement is achieved through round-the-clock service, improving client satisfaction and building trust.

- Continuous availability of AI chatbots enhances customer satisfaction.

Sobot’s chatbot offers multilingual, 24/7 support, making it a reliable partner for your financial needs. Its ability to handle queries at any time ensures you never face delays, enhancing your overall experience.

Enhancing Operational Efficiency in Financial Institutions

AI chatbots streamline operations by automating repetitive tasks and reducing response times. They act as the first layer of service, efficiently handling simple queries and transferring complex issues to human agents. This approach significantly improves productivity and reduces costs.

- From 2019 to 2021, there was a 2,350% increase in interactions through WhatsApp.

- New customer adoption rose by 1,590%.

- The problem-solving rate improved by 19%.

Sobot’s chatbot enhances efficiency by solving routine queries autonomously, improving productivity by 70%. It also reduces inbound discussions by 20%, allowing agents to focus on more critical tasks. This operational efficiency translates into better service for you and lower costs for financial institutions.

Fraud Detection and Prevention with Fintech Chatbots

Fraud detection is a critical challenge in the financial industry. You need tools that can identify suspicious activities quickly and accurately. Fintech chatbots are transforming how financial institutions tackle this issue. These intelligent systems analyze vast amounts of data in real time, spotting unusual patterns that might indicate fraud. For example, they can flag transactions that deviate from your usual spending habits or detect multiple failed login attempts on your account.

Fintech chatbots use advanced algorithms and machine learning to stay ahead of evolving fraud tactics. They monitor activities across multiple channels, ensuring no suspicious behavior goes unnoticed. If a chatbot detects potential fraud, it can immediately alert you and the financial institution. This rapid response minimizes risks and protects your assets.

Sobot’s AI-powered chatbot excels in fraud detection and prevention. It operates 24/7, monitoring transactions and identifying irregularities. Its multilingual capabilities ensure you receive alerts in your preferred language, enhancing accessibility. By integrating with various financial platforms, Sobot’s chatbot provides a seamless experience while safeguarding your accounts.

The benefits of fintech chatbots extend beyond fraud detection. They also educate you about secure financial practices. For instance, a chatbot might remind you to update your passwords regularly or avoid sharing sensitive information online. This proactive approach builds trust and strengthens your relationship with your financial institution.

According to a report by Juniper Research, banks using AI for fraud detection saved $217 billion in 2022 alone. This highlights the growing importance of fintech chatbots in the financial sector. By leveraging these tools, you can enjoy safer and more secure financial interactions.

Tip: Always review alerts from your fintech chatbot and report any suspicious activity immediately. Staying vigilant is key to protecting your finances.

Real-World Applications of AI Chatbots in Finance

Account Management and Transaction Support

AI chatbots simplify account management and make financial interactions more efficient. You can check balances, transfer funds, and update account details with minimal effort. These chatbots handle real-time queries, ensuring instant responses to your needs. For example, ICICI Bank's iPal chatbot assists customers with tasks like loan applications and account updates, managing multiple conversations simultaneously. This improves operational efficiency and enhances the digital customer experience.

Financial institutions benefit from chatbots by automating routine tasks. They reduce customer service costs by up to 30% and improve operational efficiency by 40%. Additionally, 76% of users prefer self-service options before contacting support, making chatbots an ideal solution. Sobot’s AI-powered chatbot excels in this area, offering 24/7 personalized support across multiple channels. It ensures you can manage your finances seamlessly, no matter the time or place.

Did you know? Chatbots can handle up to 80% of repetitive customer queries, freeing up human agents to focus on complex issues.

Providing Financial Advice and Budgeting Assistance

AI chatbots act as virtual financial advisors, helping you make informed decisions. They analyze your spending habits and provide personalized recommendations for budgeting, saving, and debt management. For instance, Bank of America's Erica chatbot offers advice on bill payments and investment opportunities, fostering better financial habits.

Sobot’s chatbot takes this a step further by integrating advanced analytics to deliver tailored financial advice. It helps you organize your finances, set goals, and track progress. This personalized support not only improves your financial behaviors but also enhances your overall satisfaction. According to recent data, firms using AI-driven insights report higher engagement in financial wellness programs, proving the value of these tools.

| Measurable Outcome | Benefit Description |

|---|---|

| Increased Engagement | Higher participation in financial wellness programs. |

| Improved Financial Habits | Personalized tips encourage better budgeting and saving practices. |

| Enhanced User Satisfaction | Significant improvements in customer satisfaction through tailored financial advice. |

Fraud Alerts and Security Notifications

Fraud prevention is a critical application of AI chatbots in finance. These tools monitor transactions in real time, identifying unusual patterns that may indicate fraud. For example, they can detect multiple failed login attempts or transactions that deviate from your usual spending habits. If suspicious activity occurs, the chatbot immediately alerts you and the financial institution.

Sobot’s chatbot excels in fraud detection by analyzing vast amounts of data across multiple channels. Its multilingual capabilities ensure you receive alerts in your preferred language, enhancing accessibility. By providing instant responses to potential threats, it protects your assets and builds trust. According to Juniper Research, banks using AI for fraud detection saved $217 billion in 2022, highlighting the importance of this technology.

Tip: Always review fraud alerts promptly and report any suspicious activity to your bank. Staying vigilant helps secure your finances.

Sobot Chatbot Use Case: Enhancing Customer Engagement

Sobot Chatbot transforms how you interact with financial institutions by enhancing customer engagement. Its AI-powered features provide personalized, proactive support that keeps you connected and satisfied. By analyzing your preferences and past interactions, the chatbot delivers tailored solutions that meet your unique needs.

Many businesses have already seen remarkable results with AI chatbots. For example, Maruti Suzuki’s chatbot engaged over 400,000 users, handling millions of queries and facilitating thousands of bookings. Similarly, Delta Airlines’ "Ask Delta" chatbot significantly reduced wait times, improving the overall customer experience. These examples show how AI-powered systems can handle complex queries while offering personalized solutions.

Sobot Chatbot takes customer engagement to the next level. It operates 24/7, ensuring you receive support whenever needed. Its multilingual capabilities allow you to interact in your preferred language, making communication seamless. The chatbot also integrates with various platforms, such as WhatsApp and SMS, so you can connect through your favorite channels.

The chatbot’s proactive features set it apart. It sends reminders, updates, and alerts to keep you informed about your financial activities. For instance, it can notify you about upcoming bill payments or provide insights into your spending habits. This level of engagement builds trust and strengthens your relationship with your financial institution.

Sobot Chatbot doesn’t just improve your experience—it also benefits businesses. By automating routine tasks, it reduces operational costs and allows agents to focus on more complex issues. This efficiency leads to faster resolutions and higher satisfaction rates. With Sobot, you enjoy a smoother, more engaging financial journey.

Did you know? Banking AI chatbots like Sobot can boost customer satisfaction by up to 46%, making them an essential tool for modern financial services.

How AI Chatbots Foster Customer Satisfaction and Loyalty

Creating Tailored Customer Experiences

AI chatbots excel at creating personalized experiences that make you feel valued. By analyzing your financial data and behavior trends, these conversational interfaces anticipate your needs and offer tailored solutions. For instance, a chatbot might suggest increasing your monthly savings to help you reach a down payment goal faster. This level of personalization not only simplifies your financial decisions but also strengthens your loyalty to the service.

| Metric | Description | Importance |

|---|---|---|

| Customer Satisfaction (CSAT) | Measures customer satisfaction through post-interaction surveys. | Helps understand the chatbot's success in creating a positive attitude towards the service. |

| Net Promoter Score (NPS) | Evaluates customer loyalty based on likelihood to refer the service. | A high NPS indicates customer happiness with chatbot engagements. |

| User Retention Rate | Measures long-term client satisfaction and willingness to continue using. | Indicates long-term customer satisfaction and loyalty. |

Sobot’s chatbot takes personalization to the next level. It uses advanced analytics to recommend financial products based on your spending habits. This proactive approach ensures you receive relevant advice, enhancing your engagement with the platform.

Building Trust Through Consistent and Accurate Support

Trust is essential in financial services, and AI chatbots play a crucial role in building it. These conversational interfaces provide consistent and accurate support, ensuring you always receive reliable information. For example, they can explain complex financial terms or guide you through investment options with clarity.

AI chatbots also use transparent models to help you understand how decisions are made. This transparency fosters trust, as you feel more confident in the service. Sobot’s chatbot enhances this trust by offering multilingual support and maintaining a 97% customer satisfaction score. Its ability to provide accurate answers 80% of the time ensures you always get the help you need.

Note: Consistency in support builds trust, making you more likely to rely on the service for your financial needs.

Reducing Wait Times and Improving Accessibility

AI chatbots significantly reduce wait times, allowing you to access support instantly. They handle inquiries quickly, ensuring you never have to wait for assistance. According to recent data, 65% of people prefer using chatbots for quick answers about their finances.

| Statistic | Percentage |

|---|---|

| Companies aiming to reduce wait times | 33% |

| Companies reporting decreased wait times | 55% |

| Financial institutions reporting improved customer experience | 46% |

| Organizations seeing revenue increase | 34% |

| Organizations reporting improved customer satisfaction | 27% |

Sobot’s chatbot operates 24/7, ensuring you can access support at any time. Its multilingual capabilities make it accessible to a global audience, while its ability to handle routine tasks autonomously reduces the workload on human agents. This efficiency improves your overall experience, making financial interactions smoother and more convenient.

Sobot's Role in Encouraging Long-Term Customer Engagement

Sobot plays a vital role in helping financial institutions build lasting relationships with their customers. Its AI-powered chatbot creates meaningful interactions by offering personalized financial services tailored to individual needs. For example, the chatbot analyzes your transaction history to recommend savings plans or investment opportunities that align with your goals. This level of customization makes you feel valued and understood, strengthening your connection with the service.

Sobot’s chatbot also excels in proactive engagement. It sends timely reminders about bill payments, account updates, or upcoming financial deadlines. These notifications keep you informed and reduce the chances of missed payments or penalties. Additionally, the chatbot provides real-time insights into your spending habits, helping you make smarter financial decisions. This proactive approach not only enhances your experience but also builds trust in the platform.

The chatbot’s multilingual capabilities ensure accessibility for users worldwide. Whether you prefer English, Spanish, or another language, Sobot’s chatbot communicates in your preferred language. This feature makes financial services more inclusive and user-friendly. Furthermore, its 24/7 availability ensures you can access support whenever needed, eliminating delays and improving satisfaction.

Businesses benefit from Sobot’s ability to automate routine tasks. By handling common queries, the chatbot reduces the workload on human agents, allowing them to focus on complex issues. This efficiency leads to faster resolutions and higher customer satisfaction rates. According to recent data, companies using AI chatbots report a 20% increase in customer retention, proving their effectiveness in fostering loyalty.

Sobot’s commitment to innovation ensures that its chatbot evolves with your needs. By integrating advanced analytics and machine learning, it continues to deliver exceptional service, encouraging long-term engagement and trust.

The Future of AI Chatbots in Financial Interactions

Advancements in AI and Natural Language Processing

AI and natural language processing (NLP) are transforming how you interact with financial services. NLP allows chatbots to understand and process human language, enabling natural and meaningful conversations. For example, chatbots can interpret your requests, such as "What’s my account balance?" or "How much did I spend on dining last month?" This makes managing your finances easier and more intuitive.

Machine learning (ML) enhances personalization by analyzing your behavior and offering tailored financial advice. Algorithms like Named Entity Recognition (NER) identify key terms in your queries, ensuring accurate responses. Sentiment analysis helps chatbots gauge your emotions, allowing them to respond appropriately during urgent situations. These advancements create predictive banking experiences that anticipate your needs and simplify complex tasks.

Sobot’s AI-powered chatbot leverages these technologies to deliver seamless interactions. Its multilingual capabilities and secure API integrations ensure you receive accurate, real-time financial insights, no matter where you are.

Integration with Emerging Fintech Solutions

AI chatbots are becoming essential in the fintech landscape. They automate processes like KYC verifications, making compliance faster and more cost-effective. Chatbots also monitor transactions for unusual patterns, enhancing security and preventing fraud. By working alongside human agents, they ensure your satisfaction through smooth handovers during complex inquiries.

Sobot’s chatbot integrates seamlessly with fintech platforms, offering real-time updates and personalized financial advice. For example, it can analyze your spending habits and recommend savings plans that align with your goals. This integration not only improves your financial management but also builds trust in the services you use.

| Source | Projection | Details |

|---|---|---|

| Grand View Research | 2030 | The chatbot market will grow significantly in BFSI, aiding account management. |

| Meticulous Research | 2025 | Chatbots in BFSI will surpass USD 2 Billion, driven by automation needs. |

| Market.us | 2033 | The global AI chatbot market will reach USD 66.6 Billion, growing at 26.4% CAGR. |

Expanding Use Cases in Customer Support

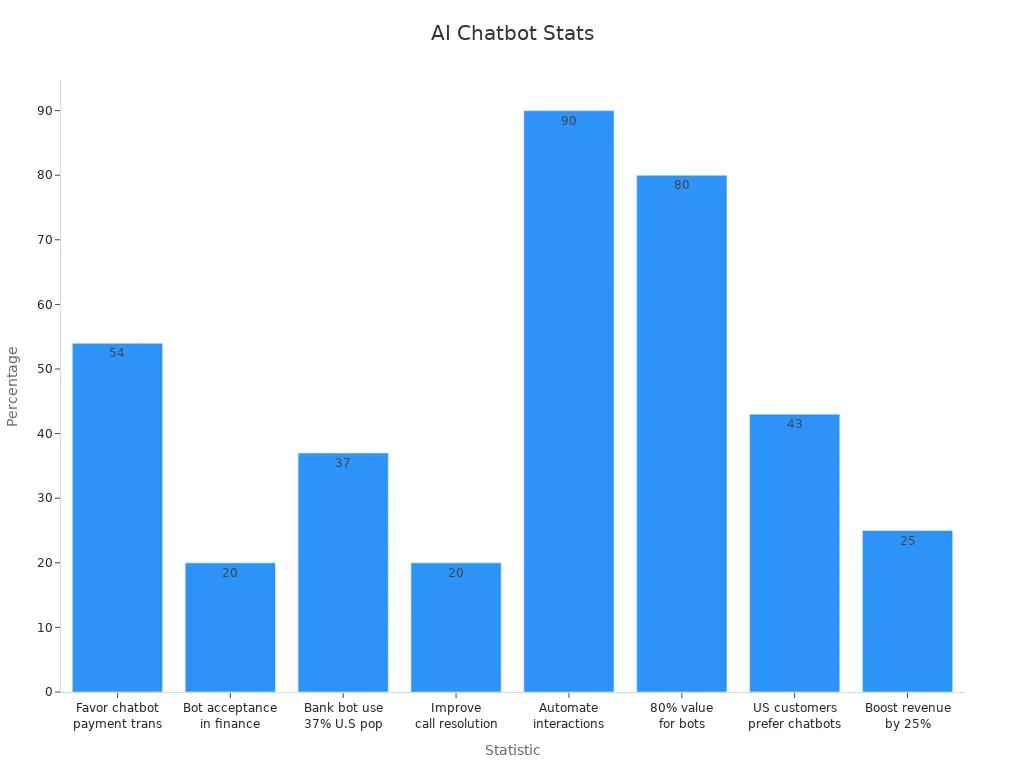

AI chatbots are reshaping customer support in finance. They handle up to 90% of interactions, reducing wait times and improving first-call resolution rates by 20%. Tasks like payment transactions, fraud alerts, and account updates are now faster and more efficient. Over 43% of U.S. customers prefer using chatbots for financial inquiries, highlighting their growing acceptance.

Sobot’s chatbot excels in customer support by automating routine tasks and providing 24/7 assistance. Its proactive features, such as reminders and alerts, keep you informed about your financial activities. This efficiency not only enhances your experience but also allows financial institutions to save time and resources.

Sobot's Vision for Fully Automated Financial Ecosystems

Sobot envisions a future where financial interactions become seamless, efficient, and fully automated. This vision focuses on creating ecosystems where AI-powered chatbots handle most customer interactions, leaving human agents to manage only the most complex tasks. By integrating advanced technologies like machine learning and natural language processing, Sobot aims to redefine how you experience banking and finance.

Fully automated financial ecosystems promise significant benefits. They reduce operational costs, improve service speed, and enhance accuracy. For example, companies like Overstock.com have already adopted chatbots to automate processes, showcasing the potential of this technology. Major banks, including Lloyds Banking Group and Royal Bank of Scotland, are replacing traditional call centers with automated assistants. These advancements align with Sobot's mission to lead the way in automation.

Sobot's chatbot plays a crucial role in this transformation. It operates 24/7, providing multilingual support and instant responses. Its ability to analyze data in real time ensures personalized financial advice tailored to your needs. Whether you need help managing accounts, detecting fraud, or receiving budgeting tips, Sobot's chatbot delivers reliable solutions. Studies by Juniper and Gartner predict that chatbots will save billions annually in customer service costs, further validating Sobot's approach.

The future of banking and finance lies in automation. Sobot's commitment to innovation ensures that its chatbot evolves with your needs. By integrating with emerging fintech platforms, Sobot aims to create a fully automated ecosystem that simplifies your financial journey. This vision not only enhances your experience but also sets a new standard for the industry.

Did you know? Chatbots can handle up to 90% of routine customer queries, making them an essential tool for the future of financial services.

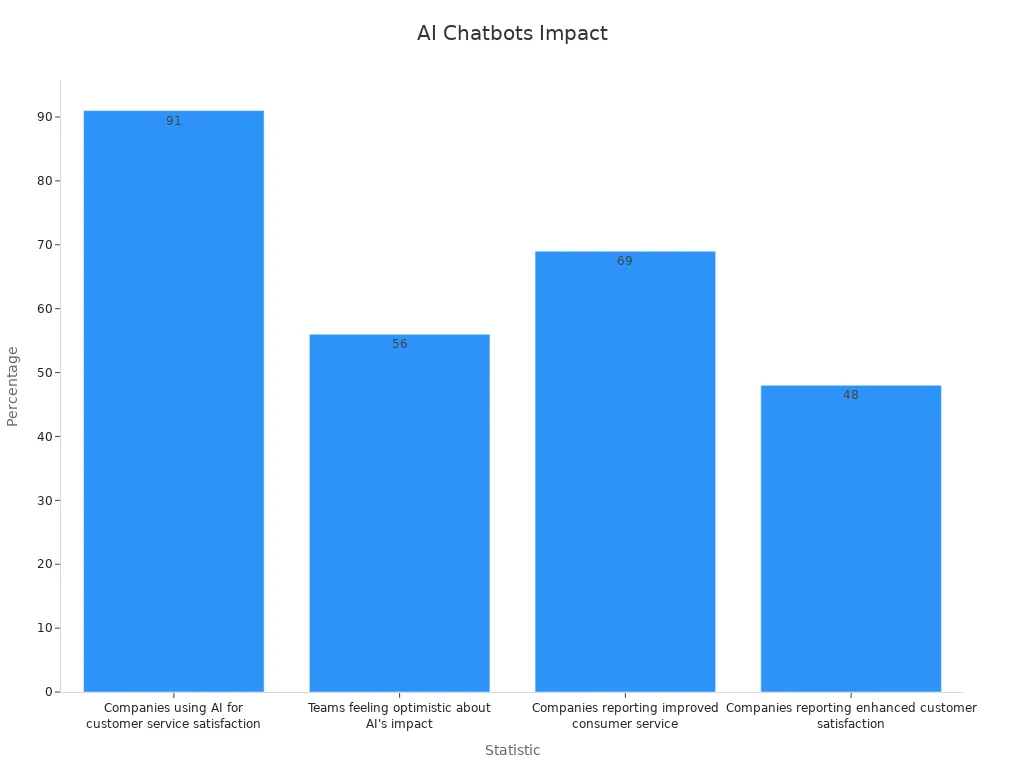

AI finance chatbots have reshaped how you interact with financial services, offering personalized recommendations and instant support. By analyzing customer data, these tools make interactions more relevant, boosting satisfaction and loyalty. Businesses leveraging AI for customer service, now at 56%, demonstrate the growing trend toward automation that enhances operational efficiency. With projected cost savings of $447 billion by 2024, AI chatbots are not just transforming customer experiences but also driving financial impact.

Sobot Chatbot exemplifies this innovation. Its multilingual, 24/7 support ensures seamless interactions, while its proactive features build trust and engagement. As mobile payment adoption grows from 22% to 34%, and institutions deploying generative AI rise, the future of financial services promises even greater advancements. Sobot’s commitment to evolving technology positions it as a leader in creating smarter, more efficient ecosystems for your financial needs.

FAQ

What makes AI finance chatbots different from traditional customer service?

AI finance chatbots provide instant, 24/7 support and personalized assistance. They use advanced technologies like machine learning to analyze your needs and deliver tailored solutions. Unlike traditional methods, they reduce wait times and improve the user experience by offering seamless, real-time interactions.

Can AI chatbots handle complex financial queries?

Yes, AI chatbots can guide you through complex tasks like loan applications or investment planning. For example, Sobot’s chatbot uses a knowledge base to provide accurate answers and real-time assistance, ensuring you receive the support you need for intricate financial matters.

How do AI chatbots improve security in financial services?

AI chatbots monitor transactions in real time to detect unusual patterns or potential fraud. They send instant alerts for suspicious activities. Sobot’s chatbot enhances security by integrating with financial platforms and providing multilingual alerts, ensuring your accounts remain protected.

Are AI chatbots accessible to non-English speakers?

Many AI chatbots, including Sobot’s, support multiple languages. This feature ensures users worldwide can access financial services in their preferred language, improving inclusivity and accessibility for diverse audiences.

How do AI chatbots enhance operational efficiency for financial institutions?

AI chatbots automate repetitive tasks, reducing the workload on human agents. Sobot’s chatbot improves productivity by 70% and cuts costs by up to 50%, allowing financial institutions to allocate resources more effectively while maintaining high service standards.

See Also

Enhancing Customer Satisfaction Through Chatbots in E-commerce

Increasing Efficiency With AI-Powered Customer Service Solutions

Driving Sales Growth With Live Chat Software for E-commerce