Choosing the Right AI Chatbot for Finance Made Easy

Choosing the best AI chatbot for finance can transform how you manage customer interactions and operations. Did you know that banks could automate up to 90% of their interactions using AI? These tools also save financial companies over four minutes per inquiry, boosting efficiency. Sobot’s chatbot takes it further—streamlining your processes while enhancing customer service.

Define the Purpose of the Finance AI Chatbot

Identifying Financial Needs and Goals

Before choosing a finance AI chatbot, you need to understand your financial needs and goals. Are you looking to improve customer service, reduce costs, or streamline operations? Identifying these priorities helps you select a chatbot that aligns with your objectives. For example, chatbots can enhance customer satisfaction by being available 24/7, addressing immediate concerns, and providing quick responses. They also help financial institutions comply with regulatory standards, ensuring secure and reliable interactions. By focusing on your operational needs and growth plans, you can integrate a chatbot that truly supports your business.

Common Applications of Finance AI Chatbots

Finance AI chatbots are incredibly versatile. They handle tasks like answering customer inquiries, managing transactions, and even assisting with loan applications. Take a look at some real-world examples:

| Institution | Application | Key Outcomes |

|---|---|---|

| Crédit Mutuel | Online inquiries | 350,000 inquiries daily, 60% faster responses |

| Ally Bank | Spending analysis | Personalized banking experience |

| DBS Bank | Comprehensive services | Loan applications, transaction inquiries |

| Capital One | Spending alerts | Tracks activity, manages spending |

These examples show how chatbots improve efficiency and customer satisfaction. They also highlight the potential for cost savings, with Juniper Research estimating $7.3 billion in global savings by 2023.

Aligning Chatbot Capabilities with Customer Service Objectives

To get the best results, align the chatbot’s features with your customer service goals. AI-powered chatbots provide accurate, real-time information, ensuring customers get reliable answers. They also personalize interactions by analyzing historical data, making every conversation feel tailored. This not only boosts engagement but also reduces operational costs. By automating repetitive tasks, you free up resources to focus on growth while still delivering excellent service. A well-aligned chatbot becomes a powerful tool for achieving your financial objectives.

Key Features of the Best AI Chatbot for Finance

Real-Time Data Analysis and Insights

Imagine having access to the most accurate financial data whenever you need it. That’s what real-time data analysis offers. AI chatbots excel at connecting to live data sources, ensuring you always make decisions based on the latest information. They consolidate all your financial data into a single, reliable source, eliminating the hassle of juggling multiple systems.

| Feature | Description |

|---|---|

| Real-time data connectivity | Ensures decisions are based on the most accurate and up-to-date information. |

| Single source of truth | Integrates all finance data sources into one reliable source. |

| Secure data handling | Provides data from trusted and secured sources, ensuring safety and reliability. |

| Dashboards and visuals | Offers straightforward visuals for management reporting, eliminating the need for additional tools. |

With these capabilities, finance AI chatbots help you identify issues early, send automated alerts, and even provide predictive insights. This means you can make faster, smarter decisions while optimizing your operations. Whether it’s fraud detection or offering personalized financial advice, real-time assistance ensures you stay ahead.

Personalization and Multilingual Support

Your customers want to feel understood, no matter where they’re from or what language they speak. AI-powered chatbots make this possible by offering personalized interactions and multilingual support. They analyze customer data to tailor responses, making every conversation feel unique.

- Advanced language recognition allows chatbots to engage customers in their preferred language, building trust.

- Businesses using multilingual support often see a 30% revenue boost by connecting with diverse audiences.

- These features reduce misunderstandings and improve customer satisfaction, especially for non-English speakers.

Sobot’s chatbot takes this a step further. It supports multiple languages and uses AI to deliver personalized financial advice, helping you connect with customers on a deeper level. This not only enhances customer service but also opens up new opportunities in global markets.

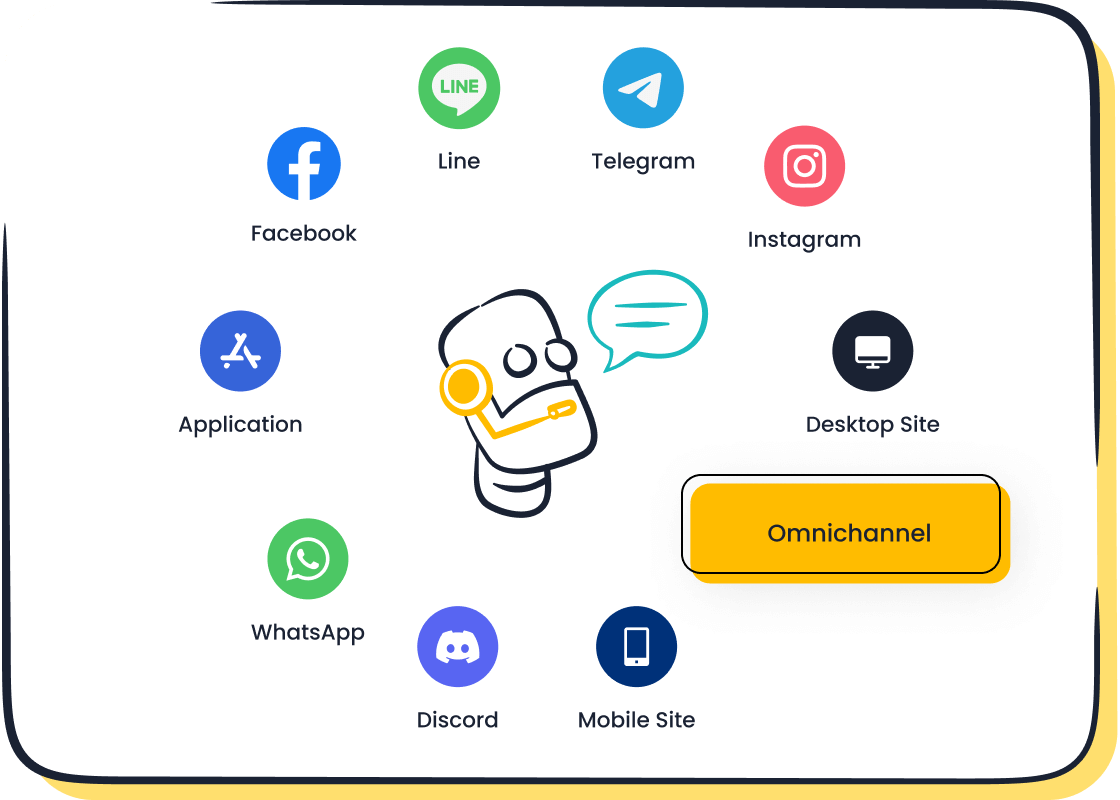

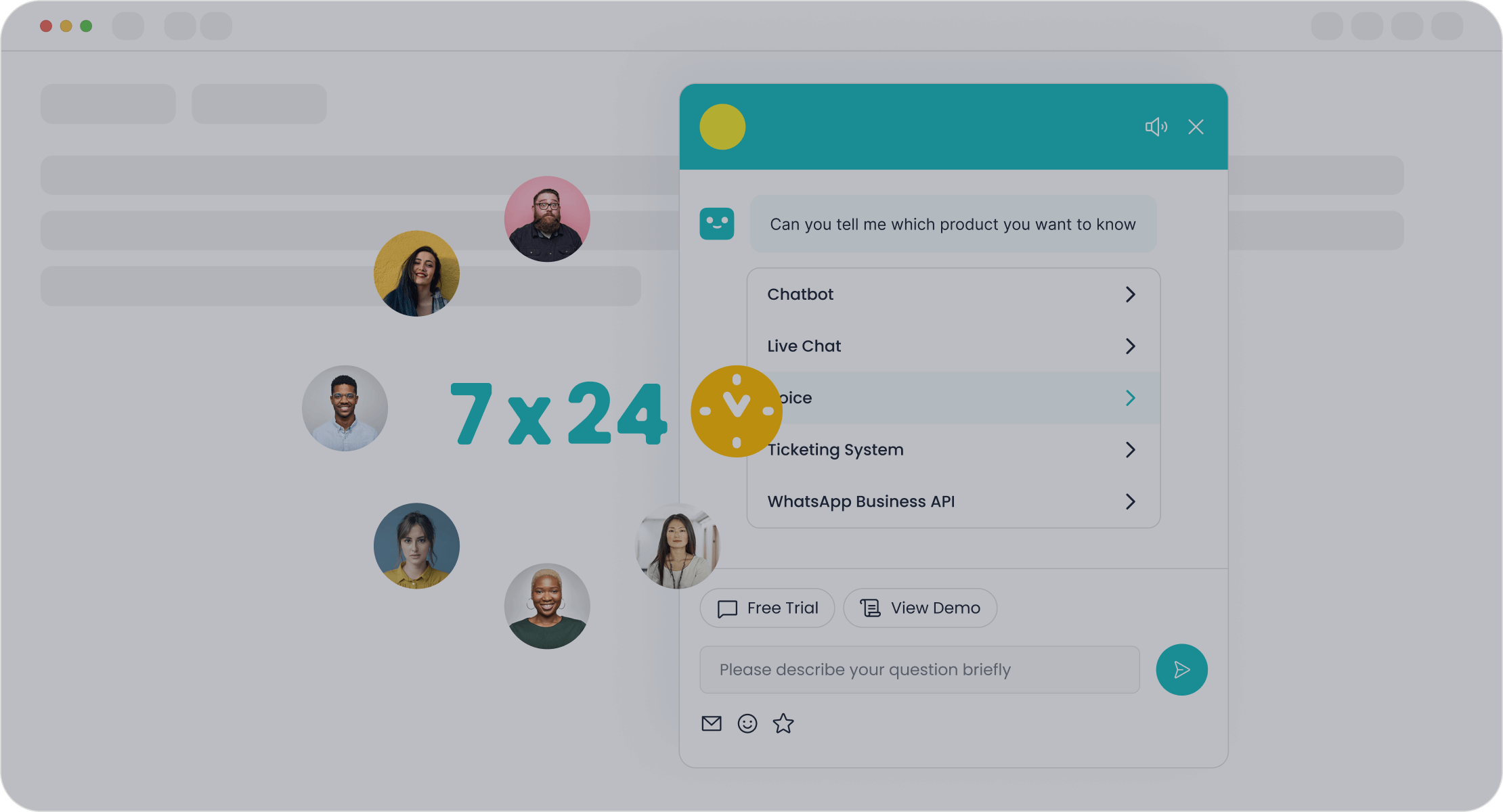

Omnichannel Accessibility for Seamless Customer Experience

Today’s customers expect instant support across all platforms. That’s why omnichannel accessibility is a must-have feature. Finance AI chatbots integrate with various channels—like WhatsApp, email, and SMS—offering a unified experience.

“Serving customers efficiently and seamlessly across channels is fundamental to providing a superior customer experience.”

With 75% of customers preferring self-service options, chatbots ensure they get real-time assistance wherever they are. They also anticipate customer needs, making interactions smoother and more efficient. For example, Sobot’s chatbot connects seamlessly with your existing systems, ensuring a consistent and enhanced customer experience across all touchpoints.

Security and Privacy in Finance AI Chatbots

Data Encryption and Protection Standards

When it comes to finance, keeping your customers’ data safe is non-negotiable. AI chatbots handle sensitive information like account details and transaction histories, making robust data security essential. Encryption plays a key role here. It protects data both in transit and at rest, ensuring that unauthorized parties can’t access it. Advanced protocols like AES-256 are commonly used to secure financial data.

Another critical aspect is authentication. Multi-factor authentication (MFA) adds an extra layer of security, requiring users to verify their identity through multiple methods. This reduces the risk of unauthorized access. Regular software updates also help keep your chatbot secure by patching vulnerabilities.

By implementing these measures, you not only protect your customers but also build trust. Transparency in how you handle data reassures users that their information is in safe hands.

Compliance with Financial Regulations

Finance AI chatbots must comply with strict regulations to ensure data privacy and security. Frameworks like GDPR and CCPA set the gold standard for data protection. For example, GDPR requires explicit consent before processing personal data and gives users the right to access or delete their information. Non-compliance can lead to hefty fines, sometimes reaching millions of dollars.

Here’s a quick look at some key regulations:

| Regulation | Description |

|---|---|

| GDPR | Protects user data and mandates explicit consent for processing. |

| CCPA | Grants California consumers rights over their personal data. |

| HIPAA | Secures sensitive health-related information. |

| SOX | Ensures accurate financial records to prevent fraud. |

| FCRA | Protects consumers’ credit information and ensures accuracy. |

By adhering to these standards, your chatbot not only avoids penalties but also gains credibility in the eyes of your customers.

Safeguarding Sensitive Customer Information

Your customers trust you with their most sensitive information. It’s your responsibility to safeguard it. Start by collecting only the data you truly need. This minimizes the risk of exposure. Continuous monitoring of chatbot interactions can also help detect suspicious activities early.

Additionally, your chatbot should allow users to access, correct, or delete their data. This aligns with regulations like GDPR and empowers customers to take control of their information. Regular audits and compliance checks ensure that your systems remain secure and up-to-date.

By prioritizing these practices, you create a secure environment where customers feel confident sharing their information. This not only enhances customer satisfaction but also strengthens your reputation in the finance industry.

Integration and Compatibility with Financial Tools

Seamless Integration with Existing Platforms

When choosing a finance AI chatbot, you want it to work effortlessly with your current systems. Whether it’s your CRM, loan management software, or core banking systems, integration should feel like a natural fit. A well-integrated chatbot reduces the time spent on repetitive tasks, like generating financial reports or handling regulatory filings. This frees up your team to focus on strategic decisions that require human insight.

| Feature | Description |

|---|---|

| Seamless Integration | Chatbots must integrate with existing systems like CRM platforms and payment gateways. |

| Operational Efficiency | Effective communication with current infrastructure enhances data flow and operational efficiency. |

| User Interaction Simplification | Chatbots should simplify user interactions while providing reliable customer support. |

For example, Sobot’s chatbot connects seamlessly with your existing platforms, ensuring smooth data flow and operational efficiency. This compatibility not only simplifies user interactions but also enhances the accuracy of financial outputs, minimizing errors.

API Support for Custom Financial Solutions

APIs are the backbone of customization. They allow you to tailor your chatbot to meet specific financial needs. With advanced AI capabilities, APIs enable your chatbot to analyze user data and provide personalized advice. Imagine a chatbot that helps customers save, invest, or even grow their wealth—all while operating 24/7.

| Capability | Description |

|---|---|

| Natural Language Processing | Engages in conversations and understands complex queries. |

| 24/7 Availability | Provides context-aware responses to consumers at any time. |

These tools empower you to offer innovative financial solutions. By integrating APIs, you can create a chatbot that not only answers questions but also helps users make informed decisions. This level of customization enhances the overall financial experience for your customers.

Compatibility with Omnichannel Contact Center Solutions

Your customers interact with you across multiple channels—email, WhatsApp, and even SMS. A finance AI chatbot should unify these touchpoints into a seamless experience. By integrating with omnichannel contact center technologies, chatbots automate workflows and retrieve customer data in real time. This reduces average handle times and improves service quality.

“AI-driven solutions scale effortlessly, managing high volumes of interactions while maintaining customer satisfaction.”

Sobot’s chatbot excels in this area. It connects with your omnichannel systems, ensuring consistent service across platforms. This compatibility boosts agent productivity and allows them to focus on complex issues, ultimately improving customer loyalty.

Cost and Scalability of Finance AI Chatbots

Understanding Pricing Models and Hidden Costs

When it comes to finance AI chatbots, understanding pricing models is key to making a smart investment. Most providers offer flexible options like subscription-based pricing, pay-as-you-go, or tiered plans. Subscription models give you predictable monthly costs, while pay-as-you-go works well if your usage varies. Tiered pricing lets you choose features that match your needs, so you’re not paying for extras you don’t use.

However, it’s important to look beyond the sticker price. Initial setup costs, integration with your existing systems, and staff training can add up. Maintenance expenses, like updates and performance improvements, also play a role. For example, implementing a chatbot with advanced AI capabilities might cost around $112,000, but the returns—like reduced operational costs and improved customer satisfaction—can far outweigh the investment.

| Key Metrics | Description |

|---|---|

| Cost Savings | Compare query handling costs before and after deployment. |

| Implementation Expenses | Include setup, integration, and training costs. |

| Maintenance Costs | Account for updates and ongoing improvements. |

| Lead Conversion Rates | Measure the impact on conversions compared to traditional methods. |

By carefully evaluating these factors, you can ensure your chatbot delivers maximum value without hidden surprises.

Evaluating Scalability for Future Growth

Scalability is a game-changer for finance AI chatbots. As your business grows, your chatbot should handle increasing customer interactions without breaking a sweat. AI-powered chatbots excel here, managing multiple conversations simultaneously and reducing operational costs. This scalability ensures you’re ready for future growth without needing to hire more agents.

The financial industry is already embracing this trend. AI spending in finance is expected to grow from $35 billion in 2023 to $97 billion by 2027, with a compound annual growth rate (CAGR) of 29%. This reflects the rising demand for scalable, efficient solutions. Whether you’re a small business or a large financial institution, a scalable chatbot ensures you stay competitive as customer expectations evolve.

Cost-Effectiveness of Sobot's Chatbot for Financial Services

Sobot’s chatbot stands out as a cost-effective solution for financial services. It operates 24/7, reducing the need for additional agents and saving up to 50% on operational costs. Its smart self-service features boost lead conversions by 20%, while proactive messaging enhances customer engagement. Plus, the no-coding-required setup minimizes implementation expenses, making it accessible for businesses of all sizes.

With Sobot, you’re not just saving money—you’re investing in a tool that grows with you. Its scalability ensures it can handle increasing volumes of customer interactions as your business expands. By choosing Sobot, you’re setting yourself up for long-term success in the competitive world of finance.

User Reviews and Support for Finance AI Chatbots

Importance of Customer Feedback and Ratings

Customer feedback plays a vital role in shaping the effectiveness of finance AI chatbots. Reviews and ratings help you understand what works and what doesn’t. Did you know that 72% of customers won’t take action until they’ve read reviews? This highlights how critical feedback is when choosing a chatbot for your financial services. Metrics like Customer Satisfaction Score (CSAT) and Net Promoter Score (NPS) are often used to gauge how well a chatbot meets customer expectations.

Analyzing reviews also helps you identify areas for improvement. For instance, if users frequently mention slow response times, it’s a sign to optimize your chatbot’s performance. By paying attention to feedback, you can ensure your chatbot delivers instant support and aligns with your customer service goals.

Evaluating Customer Support and Reliability

When it comes to customer support, reliability is everything. You need a chatbot that consistently delivers fast and accurate responses. Take Klarna, a financial services company, as an example. They implemented AI chatbots to handle growing customer inquiries. The results were impressive: response times dropped from hours to seconds, operational costs fell by 45%, and customer satisfaction stayed above 85%.

These outcomes show how AI-powered chatbots can transform customer support. By integrating smart automation and refining processes with data, you can achieve similar results. A reliable chatbot not only improves efficiency but also builds trust with your customers by providing instant support whenever they need it.

Sobot's Commitment to Customer Success

Sobot goes above and beyond to ensure your success with its finance AI chatbots. Designed to handle complex customer support needs, Sobot’s chatbot operates 24/7, providing instant support across multiple channels like WhatsApp, email, and SMS. Its multilingual capabilities and no-coding-required setup make it accessible and user-friendly.

Sobot also prioritizes customer satisfaction. With a proven track record of helping companies like Opay achieve a 90% satisfaction rate, Sobot demonstrates its commitment to delivering reliable and scalable solutions. By choosing Sobot, you’re not just getting a chatbot—you’re gaining a partner dedicated to your growth and success.

Choosing the best AI chatbot for finance doesn’t have to be complicated. Focus on factors like purpose, features, security, integration, cost, and user reviews. Sobot’s chatbot checks all these boxes. It’s secure, scalable, and efficient, meeting top compliance standards like ISO27001 and GDPR.

| Compliance Standard | Description |

|---|---|

| ISO27001 | Ensures information security management systems are in place to protect customer data. |

| ISO9001 | Focuses on quality management systems to enhance customer satisfaction. |

| ISO14001 | Addresses environmental management, ensuring sustainable practices. |

| GDPR Compliance | Protects personal data and privacy of individuals within the EU. |

Ready to see how Sobot’s AI-powered chatbot can transform your financial services? Try a demo today and experience the difference firsthand!

FAQ

What is the main advantage of using AI chatbots in finance?

AI chatbots save time by automating repetitive tasks like answering FAQs. They also improve customer satisfaction by offering 24/7 support and personalized financial advice.

Can AI chatbots handle sensitive financial data securely?

Yes, AI chatbots use encryption and comply with regulations like GDPR to protect sensitive information. Sobot’s chatbot ensures secure interactions with advanced data protection standards.

How do AI chatbots improve customer experience in finance?

AI chatbots provide instant responses, multilingual support, and seamless omnichannel accessibility. For example, Sobot’s chatbot connects with WhatsApp and email to deliver a unified experience.

See Also

Tips for Selecting Top Chatbot Software for Your Needs

Simple Steps to Effectively Use Chatbot Examples on Websites

Effortless Ways to Build a Chatbot for Your Site