10 Best AI Chatbots for Financial Services in 2025

AI-powered chatbots are reshaping the financial services industry, making customer interactions faster and more efficient. Imagine getting your bank balance instantly or opening an account without waiting in line. Chatbots handle these tasks effortlessly, saving time for both you and the bank. They also improve employee productivity by letting staff focus on complex issues while ensuring customers receive personalized service. With advancements in ai-powered conversations and chatbot platforms, 2025 is set to be a game-changer. The growing need for a reliable chatbot solution for financial services organizations, like Sobot, shows just how essential these tools have become.

What is a Financial Services Chatbot?

Definition and purpose of finance AI chatbots.

A financial services chatbot is an AI-powered tool designed to assist customers with various financial tasks. These chatbots are tailored specifically for the finance industry, helping users manage their accounts, answer questions, and even detect fraud. Unlike general-purpose chatbots, finance AI chatbots focus on improving customer experience while ensuring compliance with strict financial regulations. They streamline interactions, making banking and other financial services more accessible and efficient.

Experts agree that finance AI chatbots play a vital role in enhancing customer service. They handle routine inquiries, allowing human employees to focus on complex tasks. This not only saves time but also reduces operational costs. By offering personalized assistance, these chatbots align with the financial sector's goal of delivering exceptional service.

How finance chatbots differ from general-purpose chatbots.

Finance chatbots are built for specialized tasks. They excel in areas like fraud detection, loan processing, and market predictions. General-purpose chatbots, on the other hand, aim to mimic human intelligence across a wide range of topics. While general chatbots are versatile, they lack the precision and compliance required in financial services.

Think of finance chatbots as experts in their field. They use Narrow AI to focus on specific applications, ensuring accuracy and reliability. General-purpose chatbots, however, are more like generalists. They can handle casual conversations but struggle with the complexities of financial regulations and data security.

Common applications in financial services.

Finance AI chatbots are transforming the way financial institutions operate. Here are some of their most common applications:

- Customer support: Chatbots provide 24/7 assistance, answering questions about account balances, transactions, and more. They improve customer experience by automating routine tasks.

- Fraud detection: These chatbots monitor financial activities in real-time, alerting users to suspicious behavior. This proactive approach enhances security.

- Loan processing: Chatbots guide customers through loan applications, check credit scores, and provide updates. This speeds up the process and reduces errors.

According to Gartner, chatbots are expected to save organizations $80 billion in customer service costs by 2025. Their ability to automate tasks and provide personalized support makes them indispensable in the financial sector.

Key Features to Look for in Financial Chatbots

Advanced natural language processing (NLP) for seamless communication.

When you interact with a financial chatbot, you expect it to understand your questions and respond accurately. That’s where advanced natural language processing (NLP) comes in. NLP enables chatbots to interpret user intent, even when questions are phrased differently. This makes conversations feel natural and human-like.

For example, Morgan Stanley uses AI-powered chatbots to provide personalized financial advice. These chatbots analyze user input in real time, offering tailored recommendations based on your financial goals. Metrics like customer satisfaction scores (CSAT) and engagement rates show how NLP improves communication.

| Metric Type | Description |

|---|---|

| Customer Satisfaction Indicators | Metrics like CSAT scores and sentiment analysis measure how well chatbots meet user needs. |

| Real-time Analytics | Immediate insights into user interactions and response times ensure seamless communication. |

| Engagement Metrics | Track active users, conversation duration, and interaction frequency to gauge chatbot success. |

With NLP, chatbots can handle complex queries, making your experience smoother and more efficient.

Integration with financial systems and APIs for operational efficiency.

A great financial chatbot doesn’t just chat—it connects seamlessly with financial systems. Integration with APIs allows chatbots to access real-time data, process transactions, and even assist with investment decisions. This improves efficiency across the board.

Take the case of a leading securities firm in Hong Kong. They integrated chatbots with their Robo-advisory platform, enabling real-time stock market updates and secure payment options. The result? Enhanced user engagement and streamlined customer relationship management.

- Key Features of Integration:

- Access to live market data.

- CRM integration for better customer support.

- Secure payment processing.

When chatbots integrate with your financial systems, they become powerful tools for both you and your institution.

Security and compliance with financial regulations.

In financial services, data security is non-negotiable. Chatbots must comply with strict regulations to protect sensitive information. This includes adhering to guidelines for data collection, processing, and storage.

However, studies reveal gaps in existing standards. For instance, 148 compliance issues were identified across various regulations, highlighting the need for robust security measures. Without clear guidelines, privacy risks increase.

| Security Concern | Description |

|---|---|

| Lack of Clear Guidelines | Ambiguities in data collection rules lead to privacy vulnerabilities. |

| Vague Control Measures | Weak technical measures result in uneven compliance across platforms. |

| Insufficient Standards | Existing frameworks fail to guarantee full security, exposing critical gaps. |

When choosing a chatbot, ensure it prioritizes data security and meets all regulatory requirements. This protects your customers and builds trust in your services.

Multilingual support for global customer bases.

If your financial institution serves customers worldwide, you know how important it is to communicate in their preferred language. Multilingual chatbots make this possible. They can interact with users in multiple languages, breaking down language barriers and creating a more inclusive experience. Whether your customers speak English, Spanish, Mandarin, or any other language, a multilingual chatbot ensures they feel understood and valued.

Imagine a customer in France asking about their account balance in French. A multilingual chatbot can respond instantly, providing accurate information in their native language. This not only improves customer satisfaction but also builds trust. Plus, it reduces the need for hiring agents fluent in multiple languages, saving your business time and money.

Multilingual chatbots also adapt to cultural nuances. They understand regional expressions and tailor responses accordingly. This makes conversations feel more natural and personalized. By offering support in various languages, you can expand your reach and connect with a broader audience.

Tip: When choosing a chatbot, look for one that supports multiple languages and offers easy customization. This ensures your global customers receive the same high-quality service as your local ones.

Scalability to handle high volumes of customer interactions.

As your business grows, so does the number of customer inquiries. A scalable chatbot ensures you can handle this increase without compromising service quality. It manages high volumes of interactions efficiently, providing quick responses even during peak times.

Scalability isn’t just about managing more conversations. It’s about maintaining performance as demand rises. For example, a well-designed chatbot can resolve thousands of queries simultaneously, ensuring no customer waits too long for help. This keeps your operations smooth and your customers happy.

Here’s how scalable chatbots perform:

| Metric | Description | Formula |

|---|---|---|

| Self-service rate | Percentage of inquiries resolved by the chatbot without human intervention. | (Conversations resolved by chatbot ÷ Total conversations) × 100 |

| Sales success rate | Measures how well the chatbot converts conversations into sales. | (Number of sales ÷ Total sales conversations) × 100 |

| Query Resolution Rate | Percentage of inquiries successfully resolved by the chatbot. | N/A |

| Cost per Interaction | Cost associated with each interaction handled by the chatbot. | N/A |

| Automation Rate | Percentage of tasks completed without human involvement. | N/A |

| Query Volume Handled | Total number of queries managed by the chatbot. | N/A |

Scalable chatbots also reduce operational costs. They automate repetitive tasks, freeing up your team to focus on complex issues. This leads to higher efficiency and better customer satisfaction. With the right chatbot, you can grow your business without worrying about overwhelming your support system.

Note: Look for chatbots that offer high automation rates and low costs per interaction. These features ensure your system remains efficient as your customer base expands.

10 Best AI Chatbots for Financial Services in 2025

Sobot Chatbot: AI-powered, multilingual, and customizable for financial institutions.

If you're looking for a chatbot solution for financial services organizations, Sobot Chatbot stands out as a top choice. This AI-powered chatbot is designed to handle the unique challenges of the financial sector while delivering exceptional customer service. It’s multilingual, customizable, and packed with features that make it a game-changer for financial institutions.

Sobot Chatbot doesn’t just answer questions—it transforms how you interact with your customers. It automates routine tasks like balance inquiries and payment setups, freeing up your team to focus on more complex issues. Plus, it integrates seamlessly with financial systems, CRMs, and compliance tools, ensuring smooth operations.

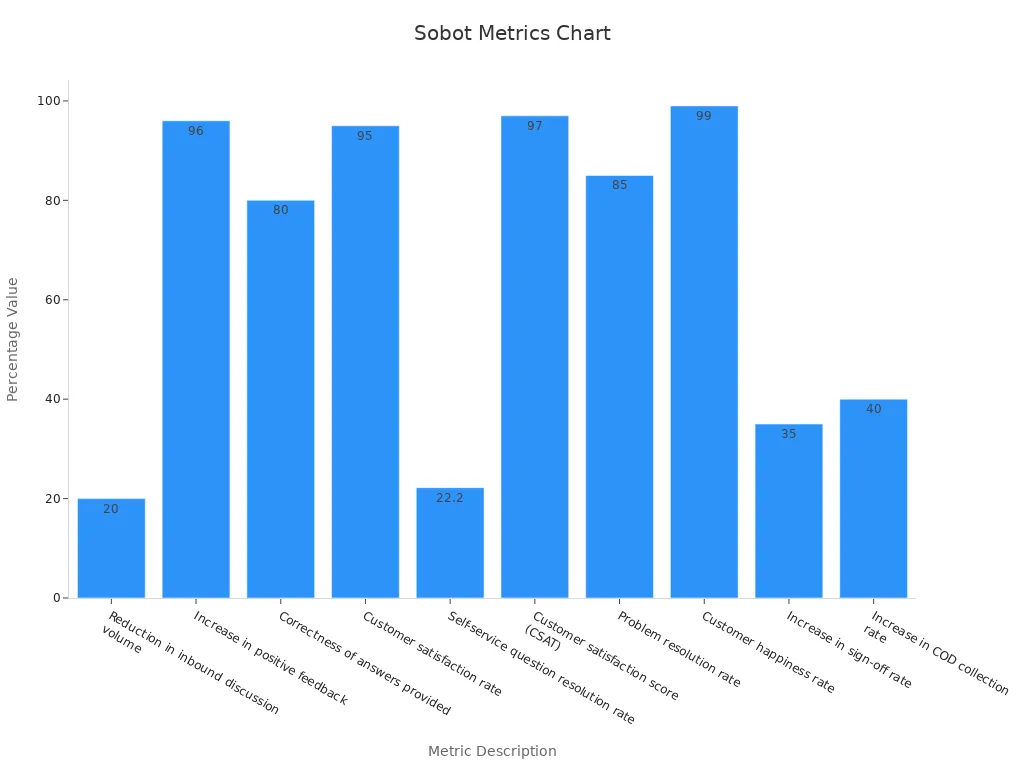

Here’s a quick look at its performance metrics:

| Metric Description | Value |

|---|---|

| Reduction in inbound discussion volume | 20% |

| Increase in positive feedback | 96% + |

| Correctness of answers provided | Over 80% |

| Customer satisfaction rate | Over 95% |

| Self-service question resolution rate | 22.2% |

| Customer satisfaction score (CSAT) | 97% |

| Problem resolution rate | 85% |

| Customer happiness rate | 99% |

| Increase in sign-off rate | About 35% |

| Increase in COD collection rate | About 40% |

Sobot Chatbot also excels in providing personalized interactions. It uses AI to understand customer intent and deliver tailored responses. Whether your customers need help with loan applications or fraud alerts, this chatbot has you covered. With a 97% customer satisfaction score, Sobot Chatbot proves that it’s not just efficient—it’s effective.

Tip: If you want to enhance customer satisfaction and reduce costs, Sobot Chatbot is a must-have for your financial institution. Learn more about its features here.

Eno by Capital One: Assists users in managing finances via mobile and web banking.

Eno by Capital One is another excellent finance chatbot that simplifies banking for users. It’s like having a virtual financial assistant in your pocket. Eno helps you manage your finances through mobile and web banking, offering features that make your life easier.

What makes Eno special? It’s adaptable and learns from your behavior over time. Whether you’re checking your account balance, reviewing spending patterns, or setting up recurring payments, Eno has you covered. It even understands emojis, making interactions fun and engaging.

Here’s a breakdown of Eno’s key features:

| Feature | Description |

|---|---|

| Virtual Financial Assistant | Eno helps users understand basic queries related to their finances. |

| Adaptability | The chatbot is trainable and adapts to the needs of each user over time. |

| Account Information | Users can access account balances, transaction history, and credit limits through Eno. |

| Emoji Understanding | Eno can understand emoji, which is a unique feature for a banking chatbot. |

| Transaction Alerts | Eno notifies users of illicit transactions, enhancing security and user trust. |

| Spending Patterns | The assistant helps customers check their spending patterns, contributing to better financial management. |

Eno also excels in security. It alerts you to suspicious transactions, helping you stay one step ahead of fraud. With its ability to provide personalized interactions, Eno ensures you feel supported every step of the way.

Did you know? Eno’s transaction alerts have saved countless users from potential fraud, making it a trusted companion for secure banking.

Erica by Bank of America: Enhances customer service and streamlines banking tasks.

Erica by Bank of America is a finance chatbot that’s redefining customer service. With over 15 million users, Erica has proven its ability to streamline banking tasks and improve customer satisfaction. It’s like having a personal banker available 24/7.

Erica uses advanced AI to assist you with everything from bill payments to credit score monitoring. It also provides insights into your spending habits, helping you make smarter financial decisions. By integrating with customer analytics, Erica delivers personalized interactions that make banking feel effortless.

Here’s how Erica impacts the financial services industry:

| Evidence Description | Impact |

|---|---|

| Erica serves over 15 million users as of 2021 | Demonstrates widespread adoption and utility of the virtual assistant |

| Banks using customer analytics see a 15-25% increase in customer satisfaction metrics | Illustrates the positive effect of data-driven services on customer experience |

| Up to a 30% reduction in churn rates for banks utilizing analytics | Indicates improved customer retention due to enhanced service offerings |

Erica doesn’t just answer questions—it anticipates your needs. For example, if you’re about to miss a payment, Erica will remind you and even help you schedule it. This proactive approach sets Erica apart from other chatbots.

Fun Fact: Erica’s ability to analyze customer data has helped Bank of America reduce churn rates by up to 30%, proving its value as a customer retention tool.

Ceba by Commonwealth Bank: Provides personalized banking assistance.

Ceba, the virtual assistant by Commonwealth Bank, is a great example of how chatbots can simplify banking. Imagine needing to check your account balance or transfer funds but not wanting to visit a branch or navigate a complicated app. Ceba makes these tasks effortless. It can handle over 200 banking tasks, giving you the freedom to manage your finances anytime, anywhere.

What makes Ceba stand out is its conversational approach. Instead of clicking through menus, you can simply type or speak your request. This natural interaction removes the frustration of traditional banking systems. Whether you're asking about recent transactions or setting up a payment, Ceba responds quickly and accurately. It’s like having a personal banker available 24/7.

By making banking more accessible, Ceba enhances customer engagement. You feel more connected to your bank because the process feels easy and human. This is the future of finance chatbots—making your life simpler while keeping your finances secure.

Emitrr: Comprehensive chatbot solution tailored for financial services.

If you’re looking for a finance chatbot that does it all, Emitrr is worth exploring. This chatbot is designed specifically for financial services, offering a wide range of features to meet your needs. From answering customer inquiries to automating routine tasks, Emitrr ensures your financial institution runs smoothly.

One of Emitrr’s strengths is its ability to integrate with your existing systems. Whether it’s your CRM, payment gateway, or compliance tools, Emitrr connects seamlessly. This integration means you can provide faster, more efficient service to your customers. For example, if a customer wants to check their loan status, Emitrr can pull the information instantly without requiring human intervention.

Emitrr also excels in personalization. It uses AI to understand customer preferences and tailor its responses. This makes interactions feel more meaningful and builds trust. Plus, it’s scalable, so as your business grows, Emitrr can handle the increased volume of customer interactions without missing a beat.

With Emitrr, you’re not just getting a chatbot—you’re getting a comprehensive solution that transforms how you interact with your customers. It’s a game-changer for financial institutions looking to improve efficiency and customer satisfaction.

Kasisto: Conversational AI designed to enhance customer interactions.

Kasisto is another standout in the world of finance chatbots. Its conversational AI platform, KAI, is designed to help you make smarter financial decisions. Whether you’re managing your budget or planning investments, Kasisto provides the insights you need.

What sets Kasisto apart is its ability to connect with secure financial ecosystems. It pulls data from multiple sources to give you a complete picture of your finances. This integrated approach ensures you get accurate, personalized advice every time.

Here’s how Kasisto has made an impact in the finance sector:

| Bank | Implementation Details | Outcomes |

|---|---|---|

| DBS Bank | Integrated KAI for customer support and financial advisory | Reduced call center volume, enhanced satisfaction |

| Westpac | Implemented AI-driven financial planning solution | Provided tailored advice and insights to users |

Kasisto doesn’t just answer questions—it helps you take control of your financial future. For example, if you’re unsure about your spending habits, KAI can analyze your transactions and suggest ways to save. It’s like having a financial advisor in your pocket.

With Kasisto, you get more than just a chatbot. You get a partner that understands your financial goals and helps you achieve them. It’s no wonder banks like DBS and Westpac trust Kasisto to enhance their customer interactions.

Pro Tip: If you want a chatbot that combines advanced AI with a human touch, Kasisto is a fantastic choice.

Kore.ai: Automates customer interactions for financial services organizations.

Kore.ai is a leader in automating customer interactions for financial services. Its intelligent virtual assistants (IVAs) are designed to handle a wide range of tasks, from answering basic inquiries to managing complex financial processes. With Kore.ai, you can streamline operations and improve customer satisfaction without adding extra workload to your team.

One of Kore.ai's standout features is its ability to automate up to 80% of customer interactions. This means fewer repetitive tasks for your agents and faster responses for your customers. Imagine a customer asking about their account balance or needing help with a loan application. Kore.ai's IVAs can handle these queries instantly, saving time for everyone involved.

Here’s a quick look at how Kore.ai delivers value:

| Feature/Benefit | Description |

|---|---|

| Automation of Customer Interactions | Kore.ai's solutions can automate up to 80% of customer interactions, significantly reducing operational costs. |

| Enhanced Customer Experience | By implementing intelligent virtual assistants, businesses can improve customer satisfaction and engagement. |

| Operational Efficiency | Gartner predicts a 25% increase in operational efficiency for organizations using AI in customer engagement platforms by 2025. |

Kore.ai doesn’t just stop at automation. It also enhances the overall customer experience. Its IVAs use advanced AI to understand customer intent, ensuring accurate and personalized responses. Whether your customers need help with fraud alerts or investment advice, Kore.ai makes the process seamless.

Pro Tip: If you want to reduce costs and improve efficiency, Kore.ai is a great choice for automating customer interactions in your financial institution.

Haptik: Smart Skills technology for the finance industry.

Haptik is another game-changer in the world of chatbots for financial services. Its Smart Skills technology is specifically designed to address the unique needs of the finance industry. With Haptik, you can offer your customers a wide range of services, all through a single, easy-to-use platform.

Here’s what Haptik’s Smart Skills can do for your customers:

- Quickly check account balances.

- Provide a mini statement of the last five transactions.

- Assist users in checking their credit scores.

- Allow customers to track the status of their applications.

- Offer help with loan-related queries and calculate loan payments.

- Facilitate virtual document uploads for various processes.

- Guide users through the account opening process.

- Handle multiple financial queries at the same time.

Haptik also integrates seamlessly with ERP, CRM, and ticketing systems. This ensures smooth information flow between its intelligent virtual assistants and your existing applications. Plus, it uses a Python-based multifunctional code editor and flexible webhooks for easy customization. These features make Haptik a versatile solution for financial institutions looking to enhance their customer interactions.

Imagine a customer needing help with a loan application. Instead of waiting on hold, they can use Haptik’s chatbot to get instant assistance. This not only saves time but also improves the overall customer experience. With Haptik, you can handle multiple queries simultaneously, ensuring no customer feels left behind.

Did you know? Haptik’s Smart Skills technology can even guide customers through complex processes like account opening, making it a valuable tool for financial institutions.

Voiceflow: No-code chatbot solution for financial institutions.

Voiceflow takes chatbot creation to the next level with its no-code platform. If you’ve ever wanted to design a chatbot without needing technical expertise, Voiceflow is the solution for you. It empowers financial institutions to create custom chatbots that meet their specific needs, all without writing a single line of code.

With Voiceflow, you can build chatbots that handle everything from basic inquiries to advanced financial tasks. Its drag-and-drop interface makes the process simple and intuitive. You can design workflows, set up automated responses, and even integrate your chatbot with existing systems like CRMs and payment gateways.

Here’s why Voiceflow stands out:

- Ease of Use: The no-code platform allows anyone to create a chatbot, regardless of technical skill.

- Customization: You can tailor your chatbot to meet the unique needs of your financial institution.

- Integration: Voiceflow supports seamless integration with third-party systems, ensuring smooth operations.

- Scalability: As your business grows, your chatbot can scale to handle increased customer interactions.

Voiceflow also supports voice-based interactions, making it ideal for customers who prefer speaking over typing. Imagine a customer asking about their account balance through a voice command. Voiceflow’s chatbot can provide an instant response, creating a more engaging and accessible experience.

Tip: If you’re looking for a no-code solution to create powerful chatbots, Voiceflow is a fantastic option for your financial institution.

Botpress: Open-source platform for customizable financial chatbots.

If you’re looking for a chatbot platform that gives you complete control, Botpress is a fantastic choice. It’s an open-source conversational AI platform designed to help you create chatbots tailored to your financial institution’s needs. Whether you’re building a bot for customer support, fraud detection, or loan processing, Botpress makes the process simple and efficient.

What makes Botpress stand out is its flexibility. You can customize every aspect of your chatbot, from its responses to its integrations. It supports various Natural Language Understanding (NLU) libraries, which means your chatbot can understand and respond to user queries more accurately. Plus, Botpress includes a visual conversation builder. This tool lets you design chatbot workflows without needing advanced technical skills. Even if you’re new to chatbot development, you can create something powerful with minimal training data.

Botpress also helps you save money. Since it’s open-source, you don’t have to worry about expensive licensing fees. The platform lowers the entry barriers for creating financial chatbots, making it accessible to businesses of all sizes. You can focus on building a chatbot that meets your specific goals without breaking the bank.

Another great feature of Botpress is its ability to integrate with popular messaging services. Whether your customers prefer WhatsApp, Facebook Messenger, or another platform, your chatbot can connect with them seamlessly. This makes it easier for you to reach your audience wherever they are. For financial institutions, this kind of accessibility is a game-changer. You can provide instant support, answer questions, and even guide users through complex processes like account setup or loan applications.

Let’s say you want to create a chatbot that helps customers check their account balances or report suspicious transactions. With Botpress, you can design a bot that handles these tasks effortlessly. Its visual builder simplifies the process, so you don’t need a team of developers to get started. And because it supports multiple NLU libraries, your chatbot will understand user requests more effectively, leading to a smoother experience for your customers.

Botpress isn’t just about functionality—it’s also about scalability. As your financial institution grows, your chatbot can grow with it. The platform can handle increasing volumes of customer interactions without compromising performance. This ensures your customers always get the support they need, even during peak times.

Pro Tip: If you’re new to chatbot development, start with Botpress’s visual conversation builder. It’s user-friendly and perfect for creating workflows quickly.

In today’s fast-paced financial world, having a reliable chatbot is essential. Botpress gives you the tools to build one that’s not only customizable but also efficient and cost-effective. It’s a platform that empowers you to deliver better service while staying ahead of the competition.

Benefits of AI Chatbots in Financial Services

Enhanced customer experience through 24/7 support.

Imagine needing help with your account late at night. Instead of waiting until morning, you can get instant support from an ai-powered chatbot. These chatbots are available 24/7, ensuring you always have access to real-time assistance. Whether it’s checking your balance or resolving a payment issue, they’re there to help.

Long waiting times often frustrate customers and lead to complaints. They’re also a major reason why people switch to other financial services. With chatbots, you don’t have to wait. They provide quick answers, significantly reducing response times. In fact, ai-powered chatbots can address queries 70% faster than human agents. This speed enhances customer experience and keeps you engaged with your financial institution.

Here’s how 24/7 availability benefits you:

- You get instant support, no matter the time.

- Your questions are answered quickly, improving satisfaction.

- You feel valued, which increases your loyalty to the service.

Cost savings by automating repetitive tasks.

Financial institutions spend a lot on customer service. Automating repetitive tasks with chatbots can save up to 40% on these expenses. Tasks like answering FAQs, processing payments, or guiding you through loan applications no longer require human agents. This reduces costs while maintaining high-quality service.

For example, Gartner reports that companies using chatbots see a 30% reduction in operational costs. McKinsey adds that productivity can increase by 10-30% when repetitive tasks are automated. These savings allow financial services to invest in better tools and services for you.

Here’s a quick look at the numbers:

| Source | Cost Savings Estimate | Additional Insights |

|---|---|---|

| IBM | Up to 40% reduction in customer service costs | Automates repetitive inquiries |

| Juniper | Over $11 billion in global savings by 2025 | Notable savings in banking and retail sectors |

| Salesforce | Average savings of $300,000 annually | 64% of inquiries deflected by chatbots |

By automating tasks, chatbots not only save money but also ensure you get faster and more efficient service.

Improved accuracy and reduced human error.

Mistakes in financial services can be costly. Chatbots minimize these errors by providing accurate, consistent responses. They rely on pre-programmed data and AI algorithms, which means they don’t forget details or make careless mistakes. This ensures you get reliable information every time.

For instance, when you ask a chatbot about your account balance or loan status, it pulls the data directly from the system. There’s no room for miscommunication. This accuracy builds trust and enhances customer engagement. Plus, chatbots can handle multiple queries simultaneously without losing focus, something human agents might struggle with during busy periods.

By reducing errors, chatbots improve your overall experience. You can rely on them for precise answers and real-time assistance, making your interactions with financial services smoother and stress-free.

Faster response times for customer inquiries.

Nobody likes waiting, especially when it comes to financial matters. Whether you're checking your account balance or resolving a payment issue, you want answers fast. That’s where chatbots shine. They respond instantly, ensuring you get the help you need without delays. Unlike traditional customer service, which often involves long hold times, chatbots are available 24/7 and can handle multiple inquiries at once.

The efficiency of chatbots in financial services is backed by impressive benchmarks:

- A 50% improvement in response times was observed within six months of implementing AI chatbots.

- Customer satisfaction scores increased by 35%.

- The integration also led to a 45% reduction in customer service costs.

These numbers highlight how chatbots not only save time but also enhance the overall customer experience. Imagine needing help with a loan application late at night. Instead of waiting until the next business day, you can get instant assistance. This speed and availability make chatbots indispensable for modern financial institutions.

Faster response times also mean fewer frustrated customers. When you get quick answers, you feel valued and supported. This builds trust and strengthens your relationship with the financial institution. With chatbots, you’re not just saving time—you’re improving your entire customer experience.

Insights from data analytics and customer interactions.

Chatbots don’t just answer questions—they learn from every interaction. By analyzing your conversations, they gather valuable insights that help financial institutions serve you better. For example, chatbots can study your income, expenses, and savings patterns to offer tailored advice. They might suggest ways to save more or even recommend investment opportunities based on your financial goals.

Here’s how chatbots use data to improve your experience:

| Evidence Description | Insights Provided |

|---|---|

| Chatbots analyze income, expenses, and savings patterns to offer tailored advice. | They can suggest specific actions to help customers reach financial goals faster. |

| Chatbots analyze account data to identify savings opportunities and predict trends. | This helps customers make informed decisions based on their financial history. |

| Chatbots gather customer data from interactions to identify trends and needs. | This proactive approach allows banks to address potential issues before they escalate. |

These insights don’t just benefit you—they also help financial institutions improve their services. By understanding customer needs, banks can develop better products and address problems before they arise. For instance, if many customers struggle with a specific loan process, the bank can simplify it based on chatbot feedback.

The ability to analyze data in real time makes chatbots a powerful tool for enhancing the customer experience. They don’t just solve problems—they anticipate them, ensuring you always feel supported and understood.

How to Choose the Right Chatbot for Your Financial Institution

Assessing your institution's specific needs and goals.

Before diving into chatbot options, take a moment to evaluate what your financial institution truly needs. Are you looking to improve customer support, streamline loan applications, or offer real-time financial advice? Identifying your goals will help you choose a chatbot that aligns with your priorities.

Think about your customers. Do they prefer quick answers to FAQs, or are they looking for personalized financial planning? Understanding their expectations can guide you toward a chatbot that meets their needs. For example, if your customers often ask about account balances or transaction details, a chatbot with strong automation capabilities will be a game-changer.

Also, consider your team. Will the chatbot assist your agents or handle tasks independently? Answering these questions will clarify your requirements and set you on the right path.

Evaluating chatbot features and capabilities.

Not all chatbots are created equal. Some excel at handling basic inquiries, while others shine in complex areas like fraud detection or financial planning. Look for features that match your goals.

For instance, if you want to provide real-time financial advice, choose a chatbot with advanced AI and integration capabilities. A good chatbot should also support multiple languages, ensuring you can serve a diverse customer base. Security is another must-have. Make sure the chatbot complies with financial regulations to protect sensitive data.

Test the chatbot’s user experience. Is it easy to use? Does it understand natural language? A chatbot that feels intuitive will keep your customers engaged and satisfied.

Considering budget and ROI.

Budget plays a big role in your decision. While some chatbots come with hefty price tags, others offer affordable solutions without compromising quality. Calculate the potential return on investment (ROI). A chatbot that reduces customer service costs or boosts conversions can quickly pay for itself.

Think long-term. A scalable chatbot will grow with your business, saving you from future upgrades. Also, consider the time and resources needed for setup and maintenance. A no-code chatbot might save you money on development costs.

Ultimately, the right chatbot balances affordability with features that deliver value. By focusing on ROI, you can make a smart investment that benefits both your institution and your customers.

Ensuring compliance with industry regulations.

When it comes to financial services, following industry regulations isn’t optional—it’s a must. You deal with sensitive customer data every day, and keeping that information secure is critical. That’s why chatbots designed for financial institutions need to meet strict compliance standards. They don’t just help you serve customers better; they also protect your business from legal risks.

So, how do chatbots ensure compliance? First, they follow data protection laws like GDPR or CCPA. These laws require businesses to handle personal information responsibly. A good chatbot will encrypt data, limit access, and store information securely. This keeps your customers’ details safe from cyber threats.

Second, chatbots can help you stay on top of financial regulations. For example, they can guide customers through Know Your Customer (KYC) processes. They verify identities, collect necessary documents, and ensure everything meets legal requirements. This automation saves time and reduces errors.

Another way chatbots support compliance is by maintaining detailed records of every interaction. These logs can be useful during audits or investigations. If regulators ask for proof of compliance, you’ll have everything you need at your fingertips.

You might wonder, “What happens if regulations change?” Don’t worry. Many chatbots are built to adapt. Developers can update them to reflect new rules, so your business stays compliant without missing a beat.

By choosing a chatbot that prioritizes security and compliance, you’re not just protecting your customers—you’re also building trust. When people know their data is safe, they’re more likely to stick with your services. And in the competitive world of financial services, trust is everything.

Tip: Always check if a chatbot complies with the latest industry regulations before you integrate it into your system.

AI chatbots are changing the way financial services work. They make customer interactions faster, safer, and more efficient. You can get instant answers, manage your accounts, and even detect fraud—all without waiting in line or on hold. These tools don’t just save time; they also improve how financial institutions serve you.

If you want to stay ahead in 2025, adopting AI-powered chatbots like Sobot Chatbot is a smart move. It’s customizable, multilingual, and built to handle the unique challenges of the finance industry. With Sobot, you’ll enhance customer satisfaction, cut costs, and boost productivity.

AI isn’t slowing down. It’s evolving to solve bigger problems and create smarter solutions. Chatbots will continue to shape the future of finance, making services more accessible and personalized for everyone.

FAQ

What are chatbots, and how do they work in financial services?

Chatbots are AI tools that interact with you through text or voice. In financial services, they answer questions, process transactions, and provide advice. They use algorithms to understand your needs and respond instantly, making banking faster and easier.

Can chatbots handle sensitive financial data securely?

Yes, chatbots designed for financial services follow strict security protocols. They encrypt data, comply with regulations, and ensure your information stays safe. You can trust them to protect your privacy while providing efficient service.

How do chatbots improve customer satisfaction?

Chatbots offer 24/7 support, quick responses, and personalized interactions. They save you time by automating routine tasks and providing instant answers. This convenience boosts satisfaction and makes your experience with financial institutions more enjoyable.

Are chatbots expensive to implement for financial institutions?

Not necessarily. Many chatbots offer scalable solutions that fit different budgets. They reduce costs by automating tasks and improving efficiency. Over time, the savings often outweigh the initial investment, making them a smart choice for financial services.

Can chatbots assist with multilingual customer support?

Absolutely! Many chatbots can communicate in multiple languages. They help you feel understood, no matter where you’re from. This feature is especially useful for global financial institutions serving diverse customer bases.

See Also

2024's Top 10 Chatbots for Enhancing Your Website

2024's Leading Websites Implementing Chatbots Effectively

Best 10 AI Solutions for Enterprise Contact Centers