Discover the Best Finance AI Chatbot Today

AI is revolutionizing financial analysis by tackling challenges that traditional methods cannot. Studies show that nearly 88% of spreadsheets contain errors, posing risks to accuracy. Meanwhile, the average 10-K report length has doubled, making manual analysis time-consuming. With AI, you can process vast financial data efficiently and reduce errors.

Sobot exemplifies how the best finance AI chatbot transforms decision-making. Its advanced chatbot integrates seamlessly with customer interaction tools, enabling real-time insights and smarter decisions. As digital transformation reshapes finance, tools like Sobot empower you to adapt quickly and align strategies effectively.

The shift towards AI in finance is no longer optional. It’s essential for modernizing processes and ensuring precision in financial data analysis. Whether you’re managing budgets or investments, AI tools like Sobot simplify complexities and help you make informed choices.

What Defines the Best Finance AI Chatbot?

Essential Features of AI Finance Tools

The best finance AI chatbot must excel in several key areas to meet industry benchmarks. These tools should prioritize user satisfaction, automation, and efficiency. A high Bot Automation Score (BAS) ensures the chatbot can handle tasks independently, reducing the need for human intervention. Additionally, a strong first-call resolution rate highlights the chatbot's ability to resolve issues during the initial interaction, saving time and improving user experience.

AI finance tools also deliver measurable benefits. For instance, they can improve first-call resolution rates by 20%, leading to higher customer satisfaction. Banks and financial institutions save between $0.50 and $0.70 per interaction, resulting in billions of dollars in global savings. These features make AI tools indispensable for modern financial operations.

| Metric | Description |

|---|---|

| User Satisfaction | Measures how well the chatbot meets user expectations and needs. |

| Bot Automation Score (BAS) | Indicates the effectiveness of the bot in completing tasks without escalation. |

| First-Call Resolution Rate | Percentage of issues resolved on the first interaction with the chatbot. |

Importance of User-Friendliness in Financial Analysis

User-friendliness is a critical factor in financial analysis tools. A complex interface can deter users, while an intuitive design encourages adoption. AI finance tools simplify intricate processes, making them accessible to professionals and non-experts alike. For example, 41% of finance professionals adopt AI to improve efficiency, while 18% focus on reducing costs and enhancing decision-making.

These tools also boost productivity. Financial services firms report a 20% productivity gain after implementing AI. This improvement stems from features like real-time insights and automated workflows, which streamline operations and reduce manual effort. By prioritizing user-friendly designs, the best finance AI chatbot ensures seamless integration into daily tasks.

How AI Enhances Financial Decision-Making

AI transforms financial decision-making by leveraging machine learning and big data analytics. These technologies process vast datasets quickly, providing actionable insights. For example, AI improves fraud detection and credit scoring, ensuring accuracy in technical functions. It also enhances strategic areas like customer experience and financial regulation.

AI tools contribute to revenue growth by enabling better customer targeting and personalized recommendations. They optimize pricing strategies and identify new revenue streams, enhancing profitability. Additionally, AI reduces operating costs through automation, allowing businesses to focus on high-value activities. By integrating predictive analytics, the best finance AI chatbot empowers you to make informed decisions with confidence.

| Application Area | Description |

|---|---|

| Decision-Making Processes | AI tools streamline decision-making by processing large datasets quickly and accurately. |

| Risk Assessment | AI enhances risk management strategies by analyzing historical trends and real-time data. |

| Fraud Detection | AI algorithms improve accuracy in detecting fraudulent transactions, reducing human error. |

| Credit Scoring | AI evaluates creditworthiness using both traditional metrics and alternative data sources. |

| Investment Strategies | AI optimizes portfolio management and personalizes investment strategies through robo-advisors. |

| Predictive Analytics | AI tools provide real-time insights into market dynamics, aiding in informed decision-making. |

Top Finance AI Chatbots of 2025

Sobot: The Best Finance AI Chatbot for Customer Interaction

Sobot stands out as a premier AI solution for customer interaction in the financial sector. Its advanced chatbot leverages cutting-edge AI to streamline communication and enhance financial statement analysis. With over 550,000 users globally, Sobot processes millions of interactions daily, ensuring reliability and efficiency. The platform integrates seamlessly with various tools, offering features like multilingual support, ChatGPT capabilities, and 24/7 availability.

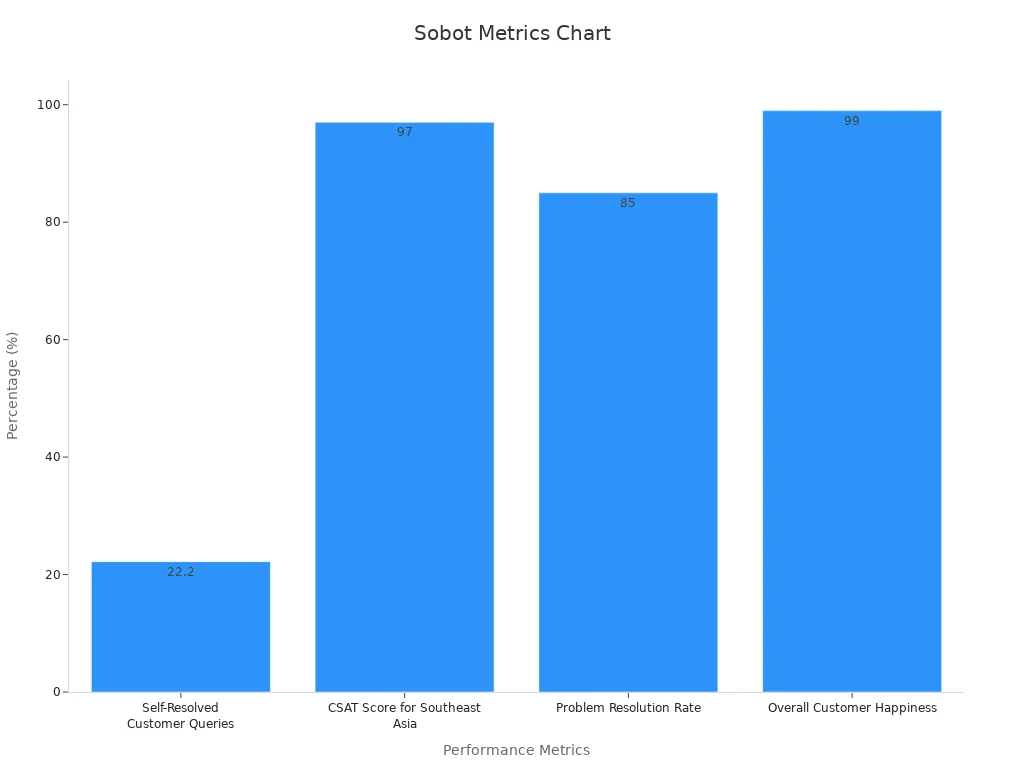

Sobot's performance metrics validate its excellence. For instance, it achieves a customer satisfaction rate exceeding 95% and resolves 22.2% of customer queries independently. In Southeast Asia, its CSAT score reaches an impressive 97%. These figures highlight Sobot's ability to deliver exceptional service while reducing operational costs.

| Metric | Value |

|---|---|

| Correct Answers | Over 80% |

| Customer Satisfaction (CSAT) | Over 95% |

| Self-Resolved Customer Queries | 22.2% |

| CSAT Score for Southeast Asia | 97% |

| Problem Resolution Rate | 85% |

| Overall Customer Happiness | 99% |

Sobot's success story with Opay further demonstrates its impact. By implementing Sobot's omnichannel solution, Opay increased customer satisfaction from 60% to 90% and reduced costs by 20%. This showcases how Sobot empowers businesses to optimize financial operations and improve customer experiences.

Kavout: AI for Investment Management

Kavout excels in AI-driven investment management, making it a top choice for financial professionals. Its platform uses machine learning to analyze financial statement analysis and identify undervalued stocks before they gain market traction. Kavout also optimizes asset allocation, reducing portfolio risk and enhancing returns.

| Benefit | Description |

|---|---|

| Identified undervalued stocks | Used AI to find stocks before they gained market traction. |

| Reduced portfolio risk | Achieved through AI-optimized asset allocation. |

| Improved investment returns | Followed AI-powered trading signals for better returns. |

| Incorporated AI-driven ETF selection | Diversified asset exposure using AI insights. |

| Utilized factor-based investing | Enhanced long-term returns through strategic investment factors. |

Kavout's ability to incorporate AI into financial decision-making ensures smarter investment strategies. By leveraging predictive analytics, it helps you stay ahead in a competitive market.

Tipalti: Automating Accounts Payable

Tipalti simplifies accounts payable processes through automation, offering significant cost savings and efficiency improvements. Businesses using Tipalti report an 81% reduction in processing costs and a 73% improvement in processing times. These tools also minimize human errors by up to 40%, ensuring accuracy in financial statement analysis.

Tipalti's automation capabilities make it an invaluable asset for finance teams. By streamlining workflows, it allows you to focus on strategic tasks rather than manual processes. This not only saves time but also enhances overall financial operations.

Quantivate: Financial Risk Management

Quantivate offers a comprehensive approach to financial risk management, making it an essential tool for businesses aiming to mitigate risks effectively. This AI-powered platform uses advanced methodologies to identify, assess, and manage risks, ensuring your organization remains resilient in the face of uncertainties. By leveraging Quantivate, you can streamline financial statement analysis and enhance decision-making processes.

Quantivate employs several statistical methods to deliver precise risk assessments. These include Value at Risk (VaR), Monte Carlo simulations, and stress testing. Each method provides unique insights into potential risks, helping you make informed decisions. For example, VaR estimates the maximum loss you might face over a specific period, while Monte Carlo simulations model various outcomes based on random variables. Stress testing evaluates how your organization would perform under extreme conditions, ensuring preparedness for unexpected scenarios.

| Statistical Method | Description |

|---|---|

| Value at Risk (VaR) | Estimates the maximum loss expected over a specific time frame with a certain degree of confidence. |

| Monte Carlo Simulations | Models the likelihood of different outcomes in unpredictable processes due to random variables. |

| Stress Testing | Evaluates the impact of stress conditions on an organization to understand risk exposure. |

| Optimization | Uses techniques to estimate efficient resource allocation to minimize risk. |

| Cost-Benefit Analysis | Systematically calculates strengths and weaknesses of alternatives to achieve benefits. |

| Decision Trees | Represents choices and possible outcomes and risks associated with each option. |

Quantivate also integrates seamlessly with other financial tools, enabling you to manage risks across various domains. Its AI-driven capabilities ensure accuracy in financial statement analysis, reducing the likelihood of errors. By adopting Quantivate, you can optimize resource allocation, minimize risks, and improve overall financial performance.

Botkeeper: AI-Powered Bookkeeping

Botkeeper revolutionizes bookkeeping by combining AI with human expertise, offering unmatched accuracy and efficiency. This platform automates repetitive tasks, allowing you to focus on strategic financial activities. Whether you're managing financial statement analysis or daily bookkeeping, Botkeeper ensures precision and saves time.

The platform boasts impressive metrics that highlight its effectiveness. Firms using Botkeeper experience a significant reduction in human errors and achieve cost savings of up to 50%. Additionally, the platform enables real-time data entry, ensuring you always have access to the latest financial information.

| Metric | Value |

|---|---|

| Accuracy Level | Incredibly high |

| Reduction in Human Error | Massive reduction |

| Cost Reduction | 30-50% |

| Time Savings for Firms | 50% or more |

- Key benefits of Botkeeper include:

- Onboarding and deploying new clients in minutes.

- Built-in collaboration tools that reduce communication overhead.

- 24/7 availability for real-time data entry.

Botkeeper's AI capabilities simplify financial statement analysis, making it an indispensable tool for finance professionals. By automating bookkeeping tasks, it reduces operational costs and enhances productivity. This allows you to allocate resources more effectively and focus on growing your business.

Features and Benefits of the Best Finance AI Chatbots

Real-Time Financial Insights and Analysis

AI-powered tools provide real-time insights that transform financial operations. These tools analyze vast datasets instantly, enabling you to make real-time decisions with confidence. For example, CFOs can now respond to financial challenges with precise, evidence-based strategies. Real-time data analysis also uncovers trends and hidden patterns, which are essential for strategic planning and operational efficiency.

Sobot’s AI chatbot excels in delivering real-time financial insights. By integrating advanced analytics, it helps you monitor financial statement analysis and identify anomalies as they occur. This capability ensures that you stay ahead of potential risks and seize opportunities promptly. Additionally, predictive analytics within these tools enhances resource allocation and risk management, turning financial reporting into a forward-looking process.

Tip: Real-time insights not only improve decision-making but also enhance customer satisfaction by providing accurate and timely responses.

Predictive Analytics for Smarter Forecasting

Predictive analytics is a game-changer in financial planning and analysis. It uses advanced models like neural networks and ensemble methods to forecast future trends accurately. These models are particularly effective in areas such as budgeting and forecasting, credit risk assessment, and investment strategies.

For instance, in finance, predictive analytics helps assess creditworthiness and predict loan defaults. In budgeting, it optimizes resource allocation by forecasting revenue and expenses. Sobot’s AI chatbot leverages predictive analytics to provide smarter forecasting, enabling you to make informed decisions about financial planning. This feature not only reduces errors but also enhances the accuracy of financial statement analysis.

| Model Type | Description | Applications in Industries |

|---|---|---|

| Neural Networks | Inspired by the human brain, effective for complex tasks. | Time series forecasting, natural language processing. |

| Ensemble Methods | Combines multiple models to improve accuracy. | Enhances predictive performance in finance and other sectors. |

| Support Vector Machines | Supervised learning methods for classification and regression. | Useful in finance for risk assessment and credit scoring. |

Seamless Integration with Financial Platforms

The best finance AI chatbots integrate effortlessly with existing financial platforms, streamlining operations and improving efficiency. This seamless integration supports automated data management, reducing manual effort and ensuring accuracy. For example, Sobot’s chatbot connects with tools like accounting software and CRM systems, creating a unified workspace for financial statement analysis.

Integration also enhances scalability. AI chatbots handle high volumes of inquiries without compromising service quality, making them ideal for businesses experiencing rapid growth. Additionally, these tools offer personalized financial guidance by analyzing customer data, strengthening client relationships. With features like 24/7 availability and multilingual support, Sobot ensures that your financial operations run smoothly across all channels.

| Benefit | Description |

|---|---|

| Cost Reduction | Financial institutions save up to 40% on customer service expenses through automation. |

| Improved Operational Efficiency | Digital transformation leads to a 30% increase in operational efficiency in banking. |

| 24/7 Customer Support | AI chatbots provide round-the-clock service, improving customer retention and satisfaction. |

| Scalability During High-Volume | Chatbots handle spikes in inquiries without additional staffing costs, maintaining service levels. |

| Personalized Financial Guidance | Chatbots analyze customer data to offer tailored financial advice, enhancing customer relationships. |

By integrating seamlessly with your financial tools, AI chatbots like Sobot simplify complex processes, allowing you to focus on strategic goals.

Use Cases for Finance AI Chatbots

Personal Financial Management and Budgeting

AI chatbots have transformed personal financial management by offering tailored solutions for budgeting and expense tracking. These tools analyze your spending habits and provide actionable insights to help you save more effectively. For instance, they can categorize expenses, set savings goals, and send reminders for bill payments. Approximately 37% of the U.S. population interacted with a bank's chatbot in 2022, showcasing the growing reliance on AI for personal finance.

Sobot’s AI chatbot enhances personal financial management by delivering real-time insights into your financial activities. Its multilingual support ensures accessibility for users worldwide, while its predictive analytics feature helps you forecast expenses and plan budgets. By integrating seamlessly with banking apps, Sobot simplifies complex financial tasks, making it easier for you to achieve your financial goals.

Tip: Use AI-powered tools to monitor your spending patterns and identify areas where you can cut costs.

Corporate Financial Analysis and Reporting

AI chatbots streamline corporate financial analysis by automating repetitive tasks and improving reporting accuracy. These tools process large datasets quickly, providing real-time insights that are essential for strategic planning. For example, AI bots can generate detailed financial reports, identify anomalies, and ensure compliance with regulations. Early results indicate that AI reduces the time spent on routine tasks, allowing professionals to focus on strategic decisions.

Sobot’s chatbot excels in corporate financial reporting by integrating with accounting software and CRM systems. It automates workflows, organizes data, and delivers insights that enhance decision-making. Organizations using AI tools like Sobot report increased operational efficiency and reduced costs. A recent study highlights that financial firms utilizing AI manage large data volumes more effectively, simplifying reporting workflows and improving overall performance.

| Key Takeaways | Description |

|---|---|

| Accuracy and Efficiency | Enhances the accuracy and speed of financial reporting. |

| Real-time Insights | Provides immediate data for strategic decision-making. |

| Adoption for Growth | Supports organizations aiming for operational excellence and scalability. |

Investment Portfolio Optimization with AI

AI has revolutionized investment portfolio optimization by leveraging advanced techniques like machine learning and deep learning. These technologies enhance predictive accuracy, improve risk management, and optimize trading strategies. For example, AI tools analyze market trends and historical data to recommend the best investment opportunities. Currently, 18% of funds utilize AI for operational use cases, highlighting its growing importance in finance.

Sobot’s AI chatbot supports portfolio optimization by offering real-time insights and predictive analytics. It helps you identify high-performing assets and minimize risks, ensuring smarter investment decisions. By integrating natural language processing, Sobot simplifies data analysis, making it accessible even to non-experts. This capability empowers you to stay ahead in a competitive financial landscape.

| AI Technique | Impact on Portfolio Optimization |

|---|---|

| Machine Learning | Enhances predictive accuracy and risk management. |

| Natural Language Processing | Improves data analysis and decision-making processes. |

| Deep Learning | Optimizes trading strategies through advanced algorithms. |

Note: AI tools like Sobot enable you to make data-driven investment decisions, maximizing returns while minimizing risks.

Comparing the Best Finance AI Chatbots

Performance and Accuracy in Financial Analysis

When evaluating finance AI chatbots, performance and accuracy stand out as critical factors. The best tools process vast amounts of financial data with precision, ensuring reliable insights. For example, Sobot achieves an impressive 95% customer satisfaction rate and resolves 22.2% of queries independently. These metrics highlight its ability to deliver accurate results while reducing operational costs.

AI-powered chatbots also enhance financial accuracy by minimizing human errors. Tools like Quantivate use advanced methodologies such as Monte Carlo simulations and stress testing to assess risks effectively. This ensures that your financial decisions are based on robust data analysis. Additionally, seamless integration with platforms like Salesforce and Mailchimp boosts operational efficiency by up to 40%, allowing you to focus on strategic goals.

Note: Prioritizing accuracy in financial tools not only improves decision-making but also builds trust with stakeholders.

Ease of Use and Accessibility for Diverse Users

Ease of use plays a pivotal role in the adoption of finance AI tools. A user-friendly design ensures that you can navigate the platform effortlessly and accomplish tasks efficiently. Features like organized menus, meaningful icons, and keyboard shortcuts enhance the overall experience. For instance, Sobot’s intuitive interface allows users to find information quickly, making it accessible to both experts and beginners.

Accessibility features further improve user satisfaction. High color contrast, alt text for images, and effective onboarding processes cater to diverse user needs. Incorporating user feedback during the design phase helps identify and resolve usability issues. This approach ensures that the chatbot meets your expectations and adapts to your requirements seamlessly.

- Key benefits of user-friendly AI tools:

- Faster task completion.

- Improved productivity.

- Enhanced customer experience.

Pricing and Value for Money

Finance AI chatbots offer significant cost savings compared to traditional methods. For instance, employing a chatbot can reduce monthly expenses from $38,730 to $12,746, saving up to 67% of current costs. These tools also provide 24/7 availability, handling unlimited queries without additional staffing costs.

| Expense Category | Current Costs | Chatbot Costs |

|---|---|---|

| Monthly Expenses | $3,873 per agent | $500 – $5,000 |

| Available Hours | 40 hours/week | 24/7 |

| Query Capacity | Limited | Unlimited |

| Training Costs | Ongoing | One-time setup |

To evaluate value for money, calculate the return on investment (ROI). Estimate the savings from reduced labor costs and increased efficiency, then subtract the chatbot’s implementation and maintenance expenses. For example, a company that automates 80% of its queries can achieve substantial savings while improving service quality.

Tip: Investing in AI chatbots not only reduces costs but also enhances operational efficiency, making them a valuable asset for financial operations.

AI has revolutionized the financial sector by enhancing operations and enabling rapid decision-making. Studies show that AI-powered chatbots improve service quality and streamline processes, making them indispensable in modern finance. These tools also advance financial research by supporting data analysis and promoting innovative methodologies.

Sobot exemplifies the transformative potential of AI in financial analysis. Its advanced chatbot integrates seamlessly with financial platforms, offering real-time insights and predictive analytics. Businesses like Opay have achieved remarkable results, including a 90% customer satisfaction rate, by adopting Sobot's solutions. These outcomes highlight Sobot's ability to optimize financial operations and improve decision-making.

Exploring AI tools like Sobot empowers you to stay competitive in the evolving financial landscape. By adopting these technologies, you can simplify complex tasks, enhance accuracy, and make smarter financial decisions.

FAQ

What is financial due diligence, and how can AI help?

Financial due diligence involves analyzing a company’s financial health before making decisions like investments or acquisitions. AI simplifies this process by automating data analysis, identifying risks, and providing accurate insights. This ensures you make informed decisions quickly and efficiently.

How does AI for document processing improve financial workflows?

AI for document processing extracts and organizes data from financial documents like invoices and reports. It reduces manual effort, speeds up workflows, and minimizes errors. This technology ensures you can focus on strategic tasks rather than repetitive data entry.

Can AI-driven workflow automation enhance financial operations?

AI-driven workflow automation streamlines repetitive tasks like data entry and report generation. It improves efficiency, reduces costs, and ensures accuracy. By automating these processes, you can allocate resources to more critical financial activities.

How does AI for data extraction benefit financial analysis?

AI for data extraction identifies and retrieves relevant information from large datasets. It ensures accuracy and saves time by eliminating manual searches. This technology helps you analyze financial data more effectively, improving decision-making.

Why is due diligence important in financial decision-making?

Due diligence ensures you understand the risks and opportunities of a financial decision. It involves analyzing data, verifying information, and assessing potential outcomes. AI tools enhance this process by providing accurate insights and reducing the time required for analysis.

See Also

Essential Tips for Selecting Top Chatbot Solutions

2024's Leading Chatbots for Enhancing Your Website

2024's Best Websites Leveraging Chatbot Technology