Finance Chatbots for Personal and Business Success

Imagine having a personal assistant who handles your financial tasks effortlessly. That’s exactly what the best finance chatbot, Sobot, does. This AI-powered tool automates everything from tracking expenses to offering budgeting advice. Its importance keeps growing as 68% of financial institutions increase spending on AI. With potential savings of over $1 trillion by 2030, Sobot is transforming finance.

Benefits of Finance Chatbots

Cost Savings and Efficiency

Imagine cutting your operational costs while boosting productivity. That’s exactly what ai-powered chatbots bring to the table. They handle routine tasks like answering common questions or processing simple transactions, freeing up your team to focus on more complex issues. According to Gartner, chatbots can reduce customer service costs by up to 30%. McKinsey also highlights a 10-30% productivity boost from AI-driven automation.

Here’s a quick look at the financial impact of chatbots:

| Metric | Value |

|---|---|

| Expected savings by 2023 | $7.3 billion |

| Percentage of routine questions handled | 80% |

| Customer preference for chatbots | 65% |

By automating repetitive tasks, chatbots not only save money but also improve service quality. They’re a win-win for your business.

Enhanced Customer Support and Engagement

You know how frustrating long wait times can be. Chatbots eliminate that problem by providing instant responses. They’re available 24/7, ensuring your customers always get the help they need. Studies show that ai-powered chatbots can increase customer assistance by 20%, significantly enhancing satisfaction.

- They automate routine inquiries, reducing the need for large support teams.

- They offer instant responses, cutting down reliance on human agents.

- They’re often more effective than traditional methods for complex queries.

With these features, chatbots make your customer support faster and more engaging.

Personalized Financial Insights and Advice

Wouldn’t it be great to get tailored financial advice without lifting a finger? Chatbots analyze your spending habits and provide personalized insights. Whether you’re budgeting for a vacation or managing business expenses, they’ve got you covered. These features make financial planning easier and more efficient.

24/7 Availability and Automation of Routine Tasks

Life doesn’t stop at 5 PM, and neither do chatbots. They’re always online, ready to assist with tasks like tracking expenses or sending reminders. This constant availability ensures you never miss a beat. Plus, they automate routine tasks, allowing you to focus on what really matters.

💡 Tip: Businesses using chatbots report a 45% boost in productivity and a 9% decrease in complaint handling time, according to McKinsey.

With their round-the-clock support and automation capabilities, chatbots are transforming financial services for the better.

Top Use Cases for Finance Chatbots

Customer Support for Financial Services

Imagine needing help with your account balance or a loan inquiry at midnight. Chatbots make this possible by offering 24/7 customer support. They handle routine queries like transaction history, account details, and eligibility checks. This ensures you get instant assistance without waiting for a human agent. Financial institutions use chatbots to automate customer interactions, reducing response times and improving satisfaction.

These tools also enhance customer service by managing high volumes of inquiries. They’re efficient, reliable, and always available. With smarter responses, chatbots improve your experience while saving businesses time and money.

Fraud Detection and Prevention

Preventing fraud is a top priority for financial institutions, and chatbots play a key role here. They monitor financial transactions in real time, identifying unusual patterns that could indicate fraud. For example, if a transaction seems out of place, the chatbot sends you an alert immediately. This proactive approach helps protect your finances and builds trust.

AI-powered chatbots also improve risk management by analyzing data for potential threats. They’re like digital watchdogs, ensuring your financial safety while enhancing the overall security of financial services.

Budgeting and Expense Tracking for Individuals

Managing personal finance can feel overwhelming, but chatbots simplify it. They categorize your expenses, flag overspending, and even suggest adjustments to keep you on track. By connecting to your bank accounts, they provide real-time updates and reminders for due dates.

These tools use machine learning to analyze your spending habits and offer personalized recommendations. Whether you’re saving for a vacation or managing monthly bills, chatbots make personal finance management easier and more efficient.

Streamlining Business Financial Operations

For businesses, chatbots are invaluable in streamlining financial operations. They automate customer interactions, handle invoices, and assist with payroll management. This reduces the workload on your team and minimizes errors.

Chatbots also integrate seamlessly with existing systems, providing a unified platform for financial tasks. They improve productivity and allow businesses to focus on growth rather than administrative tasks. With their efficiency, chatbots are transforming how companies manage their finances.

Investment Advice and Portfolio Management

Chatbots are becoming powerful investment tools. They analyze market trends and provide tailored investment recommendations based on your goals. Whether you’re a seasoned investor or just starting, these tools guide you through the process.

By automating investment strategies, chatbots reduce costs and increase efficiency. They’re like having a financial advisor in your pocket, offering insights and helping you make informed decisions. With their support, managing your portfolio becomes simpler and more effective.

Top 10 Finance Chatbots for 2025

ProProfs Chat: Best for AI and Performance Reporting

ProProfs Chat stands out for its robust AI capabilities and detailed performance reporting. It helps businesses track customer interactions and improve service quality. With its intuitive interface, you can monitor metrics like response time and customer satisfaction. This chatbot solution is ideal for businesses looking to optimize their financial services.

Ultimate.ai: Excellence in Chat Automation

Ultimate.ai excels in automating customer interactions. It uses natural language processing (NLP) to understand and respond to queries in a human-like manner. This makes it a great choice for financial institutions aiming to reduce operational costs and improve efficiency. Its ability to handle multiple languages ensures accessibility for a global audience.

AlphaChat: Seamless Integration with Financial Systems

AlphaChat is designed for seamless integration with financial systems. It connects effortlessly with platforms like Salesforce and Shopify, making it easier to manage customer data. This chatbot solution simplifies tasks like transaction tracking and account management, helping you save time and resources.

Kasisto: Large Language Model (LLM) Support

Kasisto leverages large language models to provide advanced conversational AI. It offers personalized financial insights and advice, making it one of the best finance chatbot options for 2025. Its proactive approach helps detect unusual spending patterns and engage users before issues arise.

Haptik: Smart Budgeting and Financial Management

Haptik specializes in smart budgeting and financial management. It categorizes expenses, tracks spending, and even suggests ways to save money. Virtual finance assistants like Haptik can help users reduce their spending by approximately 14%, making it a valuable tool for personal finance.

Zoho SalesIQ: Credit Card Masking and Real-Time Translation

Zoho SalesIQ offers unique features like credit card masking and real-time translation. These capabilities enhance security and accessibility, making it a reliable choice for financial services. Its AI-driven chatbots provide instant responses, ensuring a seamless customer experience.

TARS: Simple and Effective for Small Financial Institutions

TARS is perfect for small financial institutions. Its simplicity and effectiveness make it easy to deploy and use. It automates routine tasks like answering FAQs, freeing up your team to focus on more complex issues. This chatbot solution is both cost-effective and efficient.

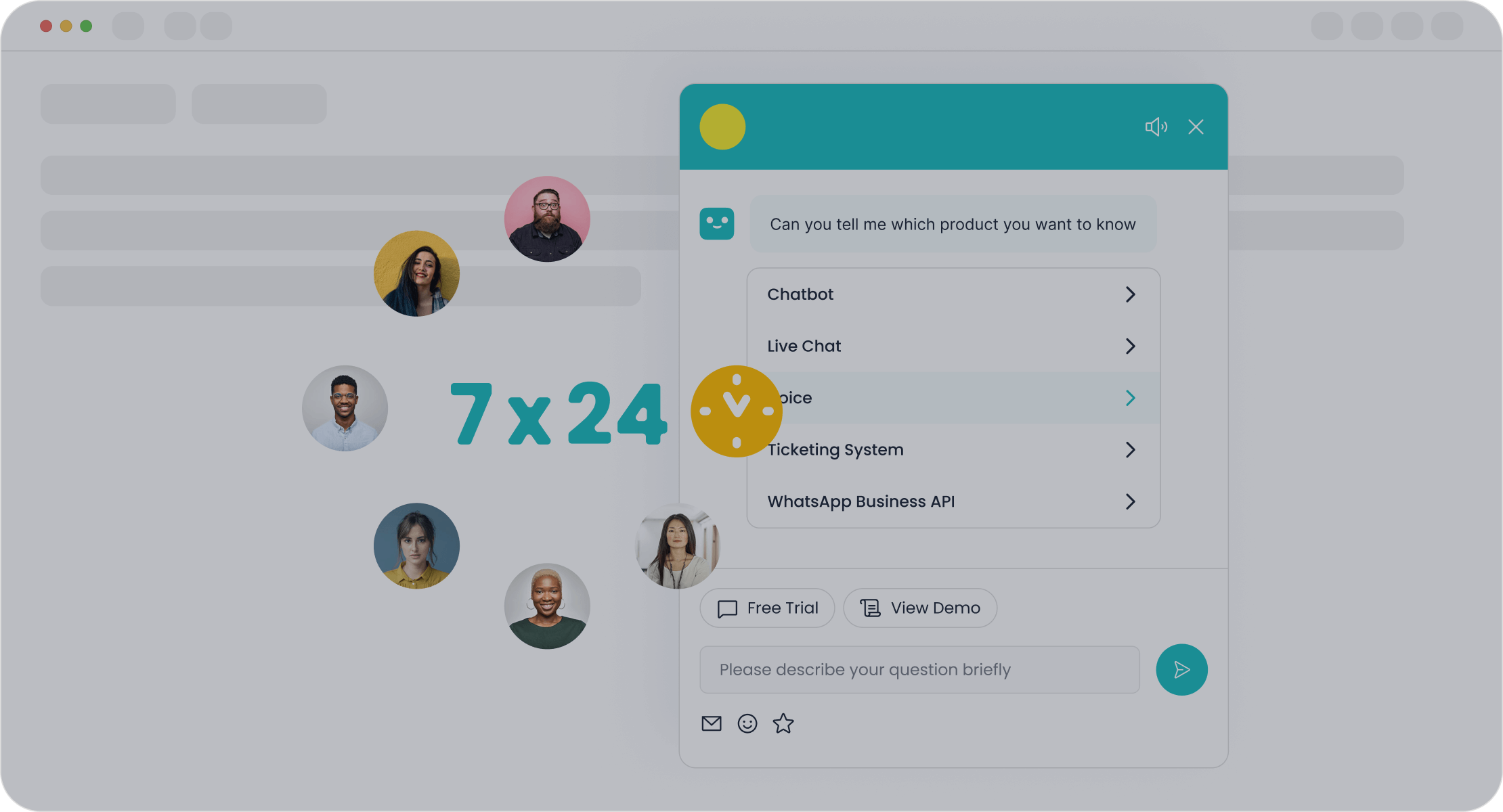

Sobot Chatbot: AI-Powered, Multilingual, and Customizable

Sobot Chatbot is a game-changer in the world of finance. It’s AI-powered, multilingual, and customizable, making it the best finance chatbot for businesses of all sizes. It operates 24/7, automating customer interactions and solving regular queries. With its no-coding-required setup, you can design workflows effortlessly. Sobot’s smart self-service and proactive messaging boost conversions by 20%, while its omnichannel support ensures seamless communication across platforms like WhatsApp and SMS. Learn more about Sobot Chatbot here.

Amelia: Advanced Conversational AI for Financial Services

Amelia is known for its advanced conversational AI. It provides real-time assistance and personalized financial advice. Its ability to learn from previous interactions enhances accuracy and efficiency, making it a top choice for financial institutions.

Kore.ai: Comprehensive Financial Assistance and Automation

Kore.ai offers comprehensive financial assistance and automation. It handles tasks like fraud detection, budgeting, and investment advice. Its AI-driven chatbots provide 24/7 availability, ensuring you always have access to financial support.

💡 Did you know? By 2022, 90% of interactions in banks were automated using chatbots. This trend continues to grow, making these tools indispensable for financial success.

Challenges and Considerations

Data Security and Privacy Concerns

When it comes to finance chatbots, data security and privacy are top concerns. You’re trusting these tools with sensitive financial information, so any breach could have serious consequences. A recent survey found that 29% of financial professionals worry about data privacy, while 11% highlight security risks like phishing scams.

Here’s a quick look at the risks:

| Evidence Type | Description |

|---|---|

| Report | Discusses risks like privacy breaches and security vulnerabilities. |

| Consumer Complaints | Highlights concerns about protecting consumer data security. |

| Security Risks | Identifies impersonation and phishing scams as significant threats. |

To stay safe, always choose chatbots with robust encryption and compliance with regulations like GDPR.

Integration with Existing Financial Systems

Integrating chatbots with your current financial systems can be tricky. Legacy systems often lack the flexibility needed for seamless operation. For example, Wells Fargo faced challenges when trying to integrate chatbots with older systems. Capital One also had to implement strict compliance measures to protect user privacy.

You might encounter issues like understanding complex financial jargon or ensuring personalized experiences. These hurdles require careful planning and collaboration with tech experts to ensure smooth implementation.

Limitations in Complex Financial Scenarios

Chatbots excel at handling routine tasks, but they can struggle with complex financial scenarios. For instance, they might not fully understand intricate investment strategies or unique tax situations. While AI is improving, you may still need human advisors for nuanced financial decisions.

User Adoption and Trust in AI Tools

Getting people to trust and use AI tools isn’t always easy. Some users worry about accuracy, while others feel uneasy sharing personal data with a machine. Building trust takes time. You can start by offering transparent policies and demonstrating the chatbot’s reliability through consistent performance.

💡 Tip: Educating users about how chatbots work can help ease concerns and boost adoption rates.

The Future of Finance Chatbots

Advancements in AI and Machine Learning

AI chatbots are evolving rapidly, and the future looks brighter than ever. With advancements in machine learning and natural language processing, these tools are becoming smarter and more intuitive. They’re learning to understand complex queries, detect emotions, and provide real-time financial advice that feels almost human.

- The chatbot industry is projected to grow to $3.62 billion by 2030, with a CAGR of 23.9%.

- AI chatbots are expected to drive the market from $8.98 billion in 2025 to $103.84 billion by 2034, growing at a CAGR of 31.24%.

- Innovations like sentiment analysis and conversational AI are making interactions more user-friendly and engaging.

These advancements mean you’ll experience faster, more accurate responses and a seamless customer experience.

Increased Personalization and Predictive Analytics

Imagine a chatbot that knows your financial habits better than you do. AI finance chatbots are heading in that direction, thanks to predictive analytics. They analyze real-time data to offer hyper-personalized solutions, whether it’s budgeting tips or investment advice.

| Key Factors Driving Hyper-Personalization | Impact of Data Analytics on Financial Solutions |

|---|---|

| Advanced Data Analytics | Real-Time Insights |

| AI and Machine Learning | Predictive Capabilities |

| Customer-Centric Approaches | Enhanced Engagement |

This level of personalization not only improves your financial decisions but also strengthens your trust in these tools.

Broader Adoption Across Industries

AI chatbots aren’t just for banks anymore. Industries like retail, gaming, and education are embracing conversational AI to enhance customer experience. For example, financial services use real-time data to detect fraud, while e-commerce platforms offer instant payment assistance.

As more sectors adopt these tools, you’ll see them everywhere—from helping you shop smarter to managing your student loans. Their user-friendly design ensures they fit seamlessly into your daily life.

Potential for Fully Automated Financial Management

The ultimate goal? Fully automated financial management. AI finance chatbots are already automating tasks like expense tracking and investment planning. In the future, they could handle everything from paying bills to managing your portfolio, all in real-time.

This shift will free up your time and reduce the stress of managing finances. With conversational AI leading the way, the dream of effortless financial management is closer than you think.

💡 Tip: Stay ahead by choosing AI chatbots that offer real-time data insights and user-friendly interfaces. They’ll make your financial journey smoother and more efficient.

Finance chatbots are revolutionizing how you manage money. They save costs, scale effortlessly, and offer 24/7 support. Tools like Sobot Chatbot simplify personalized financial planning, making your life easier. With AI advancing rapidly, you can expect smarter, more secure, and fully automated solutions to handle your personal and business finances seamlessly.

💡 Did you know? Chatbots can save financial institutions up to 40% on customer service costs while improving satisfaction.

Benefits and Challenges of Finance Chatbots:

| Benefit/Challenge | Description |

|---|---|

| Cost Efficiency | Save significantly on customer service costs. |

| Scalability | Handle thousands of interactions daily, even during peak times. |

| Increased Security | Monitor transactions and detect suspicious activities. |

| Data Security | A major challenge requiring robust encryption and compliance. |

| Integration with Legacy Systems | Many institutions face hurdles integrating AI tools with older systems. |

FAQ

What makes finance chatbots so effective?

Finance chatbots streamline tasks like budgeting and fraud detection. They offer a user-friendly interface, making financial services accessible and efficient for everyone.

Can chatbots replace human advisors in financial services?

Chatbots handle routine tasks well but lack the depth for complex finance decisions. They complement human advisors rather than replace them.

How secure are finance chatbots?

Most finance chatbots use encryption and comply with regulations. Always choose one with a user-friendly interface and strong security features to protect your financial data.

See Also

Steps to Build a Chatbot for Online Success

Enhancing Customer Satisfaction Through E-commerce Chatbots

Simple Ways to Integrate Chatbots on Your Website