How Chatbots Improve Financial Services in 2025

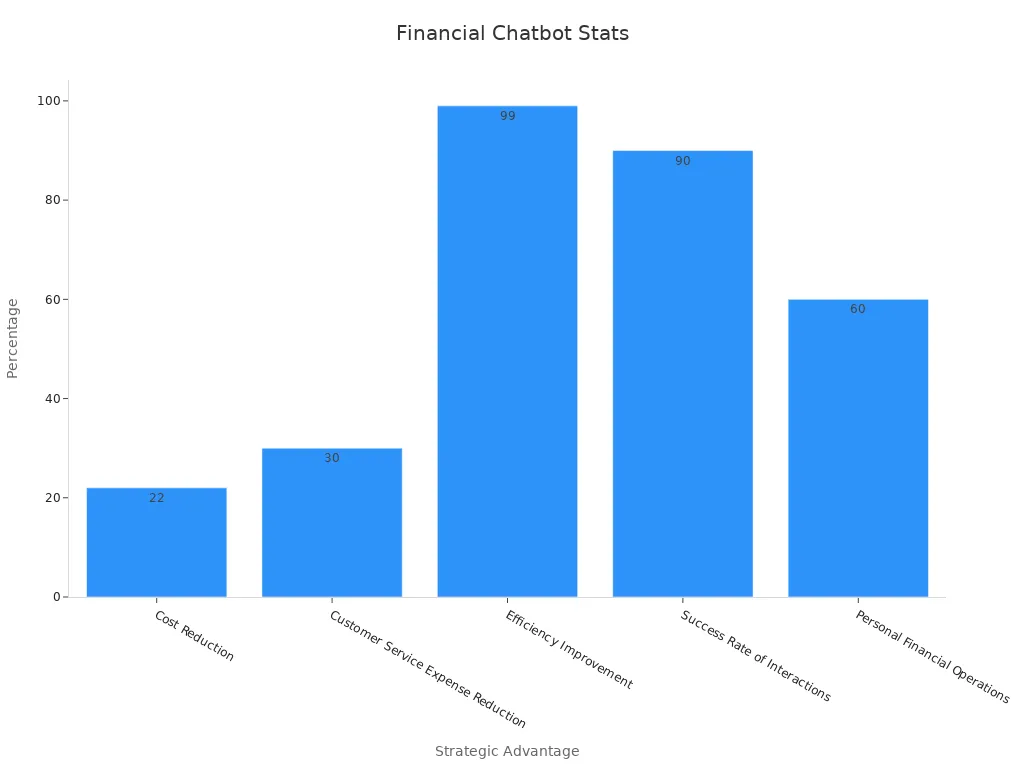

Imagine resolving a banking issue in seconds, no waiting, no frustration—just instant help. That’s the magic of chatbots in financial services today. In 2025, this technology has become a game-changer. Chatbots save customers about 4 minutes per inquiry and reduce service costs by 30%. With 43% of banking customers preferring chatbots for issue resolution, these tools are reshaping how financial institutions operate.

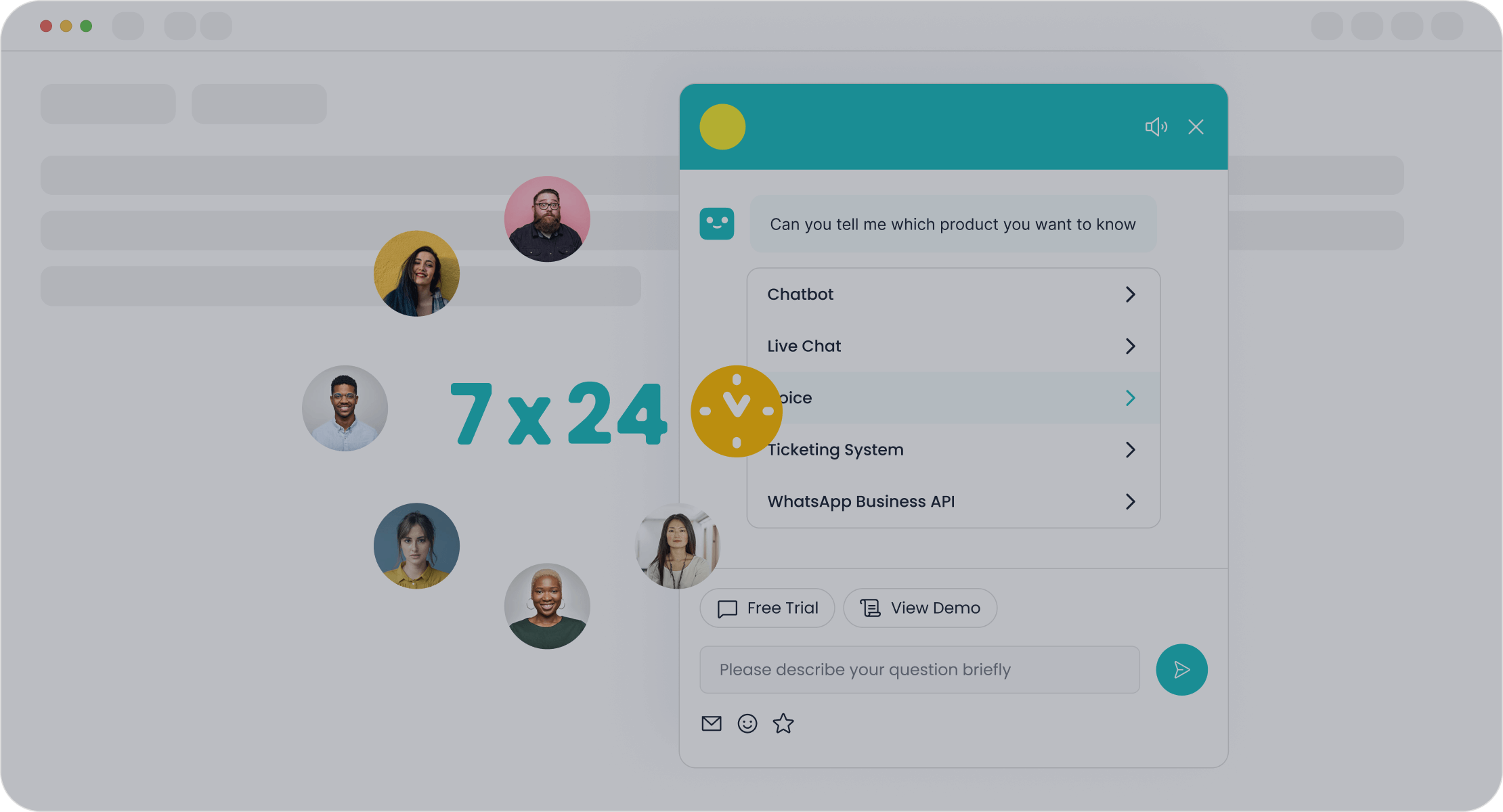

Sobot, a leader in AI innovation, offers a chatbot for finance that automates tasks, enhances efficiency, and personalizes experiences. Its 24/7 availability ensures you get help whenever you need it, making your financial journey smoother and stress-free.

The Role of AI Chatbots in Financial Services

Defining Chatbot for Finance

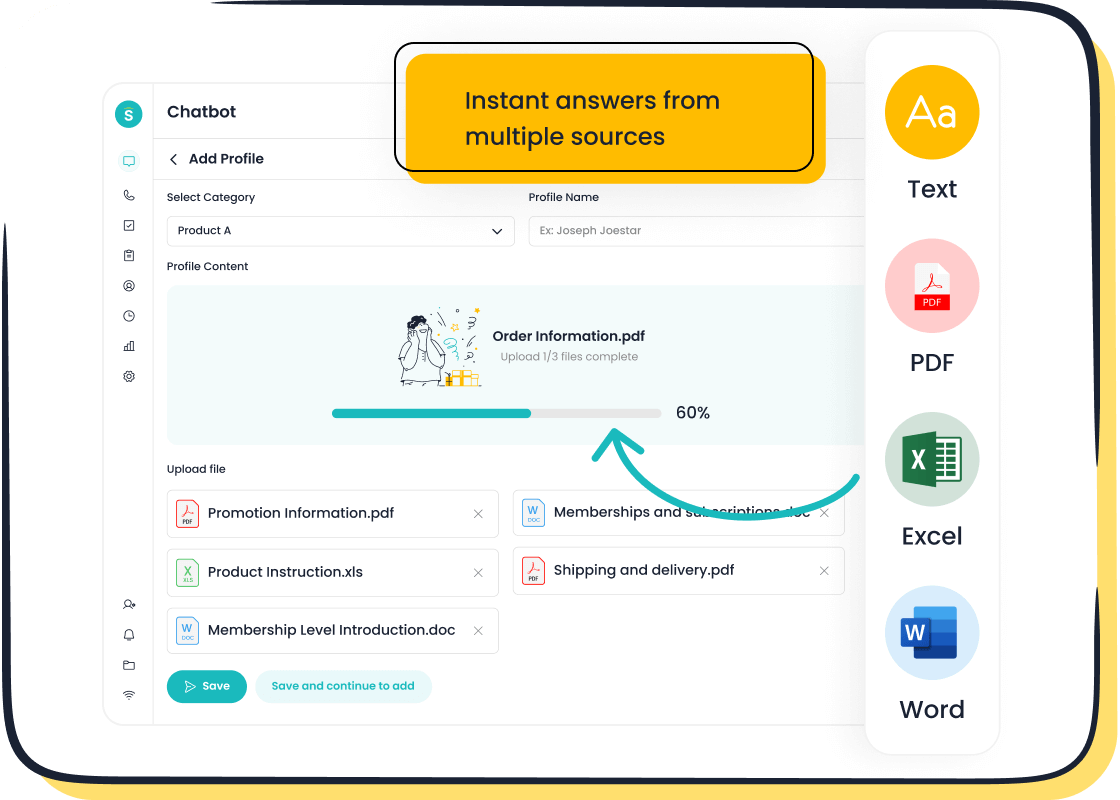

A chatbot for finance is more than just a virtual assistant—it’s your go-to tool for simplifying financial tasks. Whether you’re checking your account balance, transferring funds, or applying for a loan, these AI-powered chatbots handle it all. They’re designed to interact with you in real-time, offering quick and accurate responses.

Did you know that 54% of customers prefer using chatbots for payment transactions? That’s because they’re fast, reliable, and available 24/7. By 2026, over 110.9 million users are expected to interact with banking chatbots, highlighting their growing importance in the financial world.

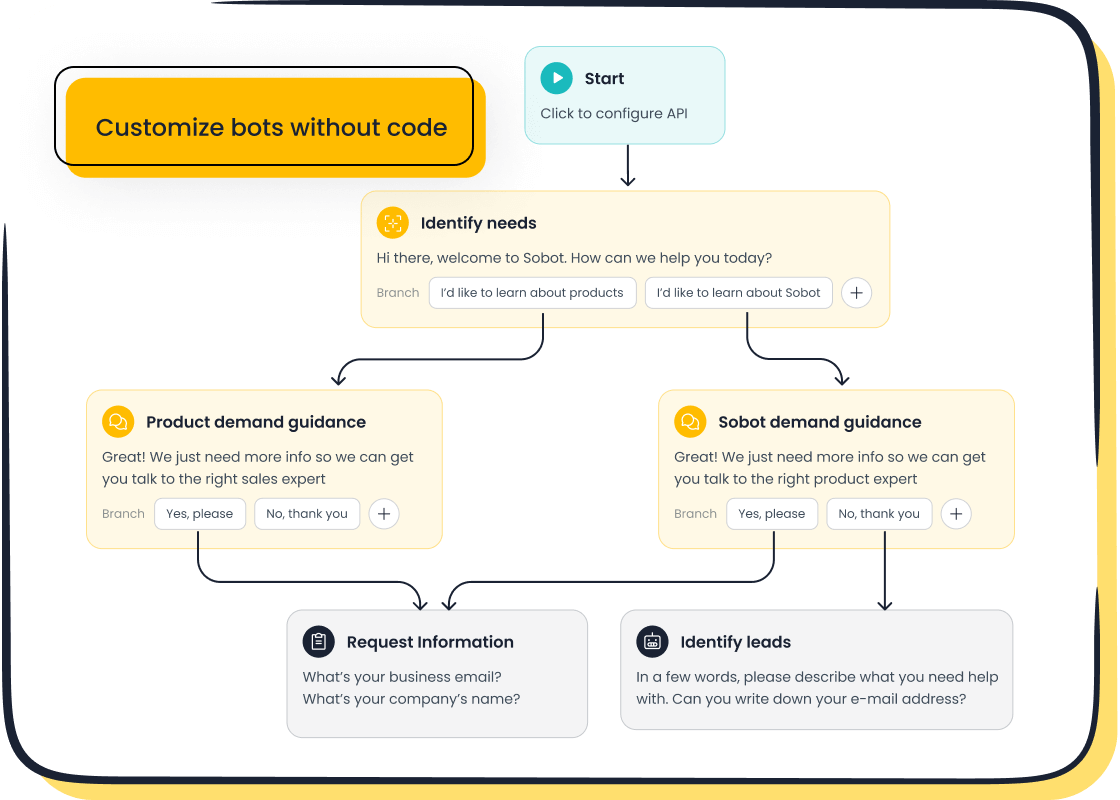

Sobot’s chatbot takes this a step further. It’s multilingual, operates round the clock, and doesn’t require coding to set up. Whether you’re a small business or a global bank, it’s tailored to meet your needs.

AI in Financial Services: A Game-Changer

AI in financial services has completely transformed how banks and institutions operate. With conversational AI, you get personalized advice, faster resolutions, and enhanced security. For example, Bank of America’s virtual assistant, Erica, handles millions of interactions, making banking more efficient.

AI chatbots also excel at fraud detection. They analyze behavior patterns to flag suspicious activities, keeping your finances secure. Plus, they generate valuable insights from customer interactions, helping banks optimize their services.

Sobot’s AI chatbots are a perfect example of this innovation. They automate routine tasks, freeing up human agents to focus on complex issues. This not only improves productivity but also enhances your overall experience.

Why Financial Institutions Rely on Chatbots

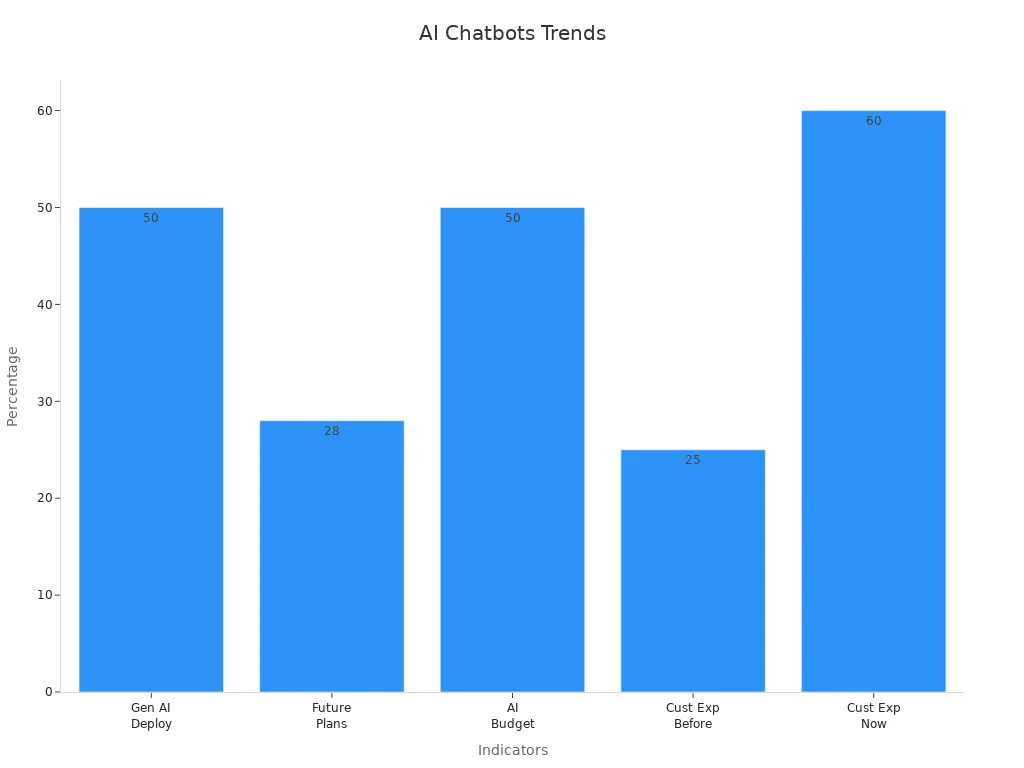

Financial institutions rely on chatbots because they’re efficient, cost-effective, and customer-friendly. Imagine resolving 95% of customer interactions without human intervention—that’s the power of AI in banking. By 2025, 75% of large banks will fully integrate AI strategies, showing their trust in this technology.

Chatbots also save money. Banks can save $0.50 to $0.70 per interaction, which adds up to $8 billion annually. They improve first-call resolution rates by 20%, ensuring your issues are resolved quickly.

Sobot’s chatbot is a trusted partner for many financial institutions. It reduces costs by up to 50% and boosts productivity by 70%. With features like proactive messaging and real-time assistance, it’s no wonder why banks are embracing this technology.

Benefits of Financial Customer Service Chatbots

Automating Processes to Improve Efficiency

Financial customer service chatbots excel at automating processes, making your banking experience faster and smoother. These chatbots handle routine tasks like balance inquiries, fund transfers, and even fraud detection. By automating processes, they reduce the workload on human agents, allowing them to focus on more complex issues.

For example, AI chatbots can manage thousands of customer inquiries simultaneously, ensuring no one waits in line. This automation leads to improved efficiency and faster resolutions. Imagine asking a chatbot for finance about your loan status and getting an instant update—no delays, no hassle.

Here’s how financial customer service chatbots improve efficiency:

- Real-time responses: Chatbots provide instant answers, reducing wait times.

- Seamless integration with banking systems: They access real-time data for accurate information.

- Cost savings: Automation lowers operational costs by reducing the need for large customer service teams.

Enhancing Customer Experience with Personalization

Personalization is key to an enhanced customer experience, and chatbots deliver it effortlessly. Using conversational AI, these bots analyze your preferences and provide tailored solutions. Whether it’s recommending a savings plan or offering personalized responses to your queries, they make you feel valued.

Did you know that personalized chatbots can increase customer satisfaction and loyalty? By understanding your needs, they create trust and improve customer engagement. For instance, Sobot’s chatbot uses AI to analyze your activities and offer customized financial advice. This not only meets your expectations but also strengthens your relationship with your bank.

| Evidence Description | Impact on Customer Experience |

|---|---|

| AI-driven personalization optimizes interactions. | Builds trust and loyalty, reducing customer turnover. |

| Predictive analytics forecasts customer needs. | Enables proactive service and tailored advice. |

| Personalized chatbots enhance data accuracy. | Improves decision-making and customer satisfaction. |

Reducing Costs Through 24/7 Support

One of the biggest advantages of financial customer service chatbots is their 24/7 availability. Unlike human agents, chatbots never sleep. They’re always ready to assist you, whether it’s midnight or a holiday. This constant availability not only improves customer satisfaction but also cuts costs.

For example, Klarna’s AI chatbot managed 2.3 million chats in its first month, reducing chat times from 11 minutes to just 2. This efficiency saved the company millions in operational expenses. Similarly, Sobot’s chatbot operates round the clock, handling queries without the need for additional agents. It reduces costs by up to 50% while boosting productivity by 70%.

With chatbots, you get:

- Automated user support: Thousands of interactions handled simultaneously.

- Lower staffing costs: Fewer agents needed for routine tasks.

- Improved customer engagement: Faster responses lead to happier customers.

Financial institutions that adopt chatbots not only save money but also enhance customer service. It’s a win-win for everyone.

Boosting Productivity with AI-Powered Tools

Imagine having a tool that makes your workday easier and more productive. That’s exactly what financial customer service chatbots do. These AI-powered tools streamline your daily tasks, giving you more time to focus on what really matters. Whether you’re managing customer inquiries or analyzing data, chatbots help you get things done faster and more efficiently.

One of the biggest advantages of using a chatbot is its ability to handle repetitive processes. Tasks like answering FAQs, updating account details, or even processing payments become effortless. You don’t have to worry about delays or errors because automation ensures everything runs smoothly. For example, Sobot’s chatbot can manage thousands of interactions at once, reducing your workload and improving accuracy.

But it doesn’t stop there. Financial customer service chatbots also empower your team. By taking over routine tasks, they free up your agents to focus on more complex issues. This not only boosts productivity but also improves job satisfaction. Your team can spend their time solving problems that require a human touch, while the chatbot handles the rest.

Here’s how these tools make a difference:

- Real-time assistance: Chatbots provide instant support, so you’re never left waiting.

- Data-driven insights: They analyze customer interactions to offer actionable recommendations.

- Seamless integration: Chatbots work with your existing systems, making implementation a breeze.

With automation at the core, these tools transform how you work. They save time, reduce errors, and make your processes more efficient. If you’re looking to enhance productivity, financial customer service chatbots are the way to go.

Use Cases of Chatbots in Finance

Fraud Detection and Prevention

Keeping your finances secure is a top priority, and chatbots play a vital role in fraud detection and prevention. These AI-powered tools monitor transactions in real-time, flagging anything suspicious. For instance, if unusual activity occurs on your account, the chatbot alerts you immediately and verifies your identity. This quick action reduces the risk of fraudulent claims and keeps your money safe.

Chatbots also analyze user behavior to detect inconsistencies. Imagine a sudden large withdrawal from your account—behavior analysis helps the chatbot recognize this as unusual and take preventive measures. They even authenticate documents and cross-check policyholder histories to ensure everything is legitimate.

| Functionality | Impact on Fraud Detection |

|---|---|

| Real-time fraud screening | Reduces the risk of fraudulent claims |

| Identity verification | Validates policyholder identity |

| Behavior analysis | Flags inconsistencies in user behavior |

| Document authentication | Ensures authenticity of submitted documents |

Sobot’s chatbot enhances fraud prevention by combining real-time monitoring with advanced AI modeling. It not only detects fraud but also prepares for future risks, ensuring your financial safety.

Personalized Financial Advice

Managing your finances can feel overwhelming, but chatbots simplify it by offering personalized financial advice. These tools analyze your income, expenses, and savings patterns to provide tailored recommendations. For example, if you’re saving for a down payment, the chatbot might suggest increasing your monthly savings to reach your goal faster.

Chatbots also help with budgeting. They review your spending habits and offer tips to cut unnecessary expenses. Need investment advice? They explain complex financial products in simple terms, helping you make informed decisions.

- Chatbots provide guidance based on your unique financial situation.

- They suggest savings strategies and monitor your progress.

- They even recommend investments aligned with your goals.

Sobot’s chatbot takes personalization to the next level. It uses AI to deliver custom advice, making financial planning accessible and stress-free. Whether you’re saving for a vacation or planning for retirement, it’s like having a financial advisor in your pocket.

Streamlining Loan Applications

Applying for a loan can be a tedious process, but chatbots make it quick and hassle-free. They guide you through each step, from filling out forms to submitting documents. Need an update on your application? The chatbot provides real-time status updates, so you’re never left wondering.

A study by Juniper Research found that chatbots could save financial institutions over $7.3 billion annually by 2025. This efficiency translates to faster processing times and higher approval rates for you.

Here’s how chatbots streamline loan applications:

- They answer your questions instantly, reducing delays.

- They ensure all required documents are submitted correctly.

- They automate repetitive processes, speeding up approvals.

Sobot’s chatbot excels in this area. It simplifies the loan application process, ensuring you get the support you need without the usual stress. Whether you’re applying for a personal loan or a mortgage, it’s designed to make the experience seamless.

Real-Time Account Management

Managing your finances shouldn’t feel like a chore. With real-time account management powered by chatbots, you can access your financial information instantly, anytime you need it. Whether you’re checking your balance, reviewing transactions, or monitoring unusual activity, chatbots make it effortless.

Imagine receiving a proactive notification about a large transaction on your account. Instead of waiting for a bank representative, the chatbot alerts you immediately and helps you verify the action. This level of responsiveness keeps your finances secure and gives you peace of mind.

Here’s how chatbots enable real-time account management:

| Feature Description | Benefit to You |

|---|---|

| 24/7 availability, letting you interact at your convenience. | No more waiting for business hours to manage your account. |

| Proactive notifications about important updates like transaction alerts. | Stay informed about your financial activities instantly. |

| Retrieval of account balances and transaction details in real time. | Get accurate information whenever you need it. |

| Monitoring financial actions and notifying you of anomalies instantly. | Protect your account from fraud and unauthorized access. |

| Quick access to balances and transaction reviews without delays. | Save time and avoid frustration. |

Sobot’s chatbot takes this experience to the next level. It uses real-time data analysis to provide instant updates and actionable insights. Whether you’re tracking expenses or verifying transactions, it’s designed to make account management seamless and secure.

Handling Customer Queries with Sobot Chatbot

Let’s face it—waiting on hold to resolve a banking issue is frustrating. Sobot’s chatbot eliminates that hassle by handling customer queries with speed and accuracy. Whether you’re asking about loan terms or troubleshooting a payment issue, the chatbot delivers answers in seconds.

You’ll love how it simplifies interactions. Over 95% of customers report satisfaction with its performance. It’s not just fast; it’s smart. The chatbot provides over 80% correct answers, ensuring you get reliable information every time.

Here’s what makes Sobot’s chatbot stand out:

| Aspect | How It Benefits You |

|---|---|

| Customer Experience | Enjoy quick resolutions and a smooth interaction. |

| Data Security | Feel confident knowing your information is protected with ISO and GDPR compliance. |

| Effectiveness | Get accurate answers to your queries, saving time and effort. |

| Personalized Service | Receive tailored support that builds trust and strengthens your relationship with your bank. |

Sobot’s chatbot doesn’t just answer questions—it anticipates your needs. It uses AI to personalize responses, making you feel valued. Whether you’re a VIP customer or someone with a simple query, the chatbot ensures every interaction is meaningful.

Emerging Trends in AI Chatbots for Finance

Predictive Analytics for Proactive Support

Imagine a chatbot that knows what you need before you even ask. Predictive analytics makes this possible by analyzing your behavior and offering proactive support. For example, if you frequently check your account balance before payday, the chatbot might remind you about upcoming bills or suggest saving tips. This kind of personalized assistance not only saves time but also helps you make smarter financial decisions.

Studies show that AI-powered chatbots improve decision-making and engagement. In one experiment, proactive chatbot outreach increased financial aid acceptance by 4% and course enrollment by 3% among first-generation students. These numbers highlight how predictive analytics can transform customer interactions in finance.

Banks and financial institutions are already leveraging this trend. By using conversational AI, they can anticipate your needs and provide tailored solutions. Whether it’s reminding you about a loan payment or flagging unusual activity, predictive analytics ensures you stay ahead of your financial goals.

Voice Integration in Financial Chatbots

Talking to a chatbot feels more natural than typing, doesn’t it? Voice integration is making this a reality in financial services. You can now ask your chatbot to check your balance, set up a budget, or even explain credit terms—all through voice commands.

Users love this feature because it’s convenient and judgment-free. You can discuss your financial situation without feeling awkward. Plus, voice-enabled chatbots offer personalized support, making you feel understood and valued.

These chatbots also monitor your activity and engage with you at the right moment. For instance, if you’re about to miss a payment, the chatbot might remind you and guide you through the process. This proactive approach enhances your overall experience and builds trust.

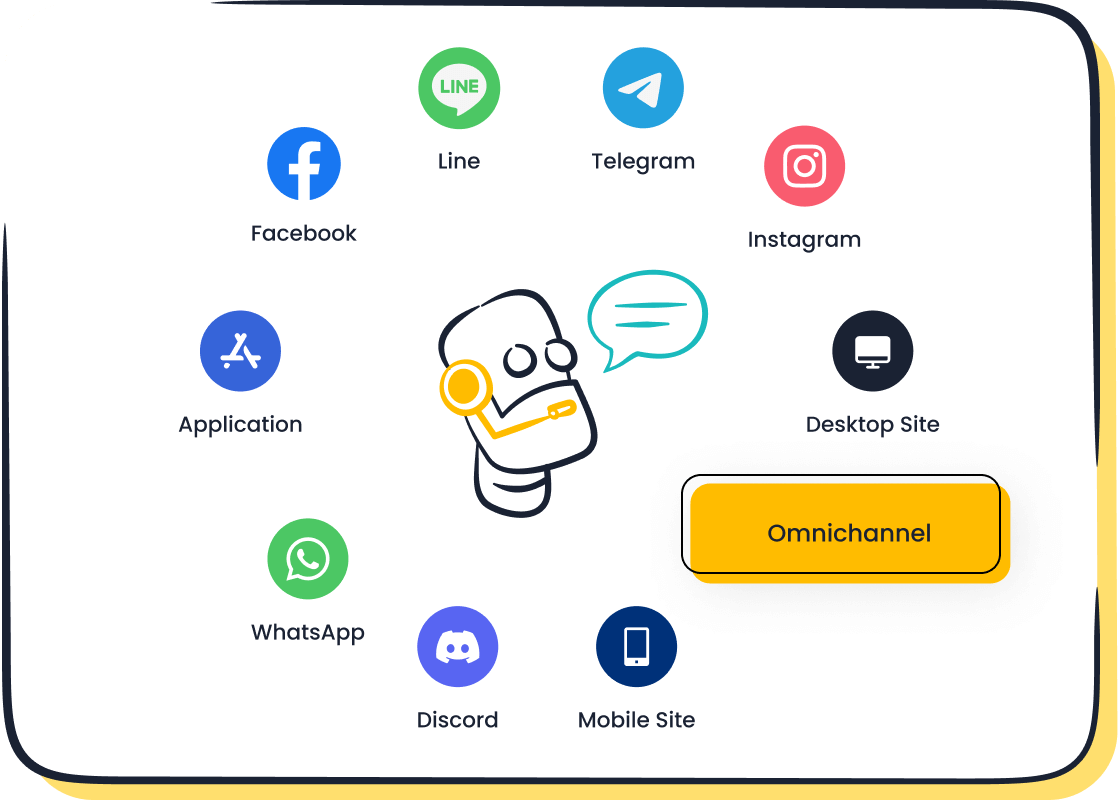

Multilingual Capabilities for Global Reach

Language should never be a barrier when managing your finances. That’s why multilingual chatbots are a game-changer. They let you interact in your preferred language, making financial services more accessible and inclusive.

Over 70% of global consumers prefer using their native language for customer support. Multilingual chatbots meet this demand, improving satisfaction and loyalty. They also reduce operational costs by handling inquiries in multiple languages, freeing up human agents for complex tasks.

For businesses, this feature drives sales growth and expands market reach. By addressing language barriers, financial institutions can connect with more customers and create new revenue opportunities. Whether you’re in New York or Tokyo, a multilingual chatbot ensures you get the support you need.

Advanced Security Features for Fraud Prevention

Keeping your finances safe is more important than ever. Chatbots in 2025 are equipped with advanced security features that make fraud prevention smarter and faster. These AI-powered tools monitor transactions in real time, flagging anything suspicious. If unusual activity occurs, the chatbot sends you an instant alert, helping you act quickly to protect your account.

Chatbots also verify identities to ensure only authorized users access sensitive information. For example, they might ask for additional authentication if they detect a login from an unfamiliar location. This extra layer of security keeps your data safe and gives you peace of mind.

Here’s a quick look at how chatbots enhance fraud prevention:

| Feature | Benefit to You |

|---|---|

| AI-based transaction monitoring | Detects fraud early and alerts banks and customers. |

| Real-time alerts | Notifies you immediately about unusual activities. |

| Identity verification | Confirms your identity to prevent unauthorized access. |

Companies like Mastercard are already using AI to fight fraud. Their Decision Intelligence platform analyzes spending patterns in real time, evaluating the likelihood of fraud for every transaction. This kind of innovation ensures your financial safety while making banking more secure.

AI-Driven Insights for Financial Decision-Making

Making smart financial decisions can feel overwhelming, but chatbots simplify the process with AI-driven insights. These tools analyze data to identify patterns and predict outcomes, helping you make informed choices. Whether you’re planning a budget or considering an investment, the chatbot provides recommendations tailored to your needs.

AI tools also automate data preparation, making forecasting more accurate. For example, they use techniques like time series analysis to reveal trends and moving averages to clarify long-term patterns. This helps you understand where your money is going and how to optimize it.

Here’s how AI-driven insights improve decision-making:

- Machine learning models identify patterns and forecast financial outcomes.

- Automated tools enhance accuracy, saving you time and effort.

- Predictive analytics help you respond quickly to market changes.

Businesses are already seeing results. CapitalGains Investments increased annual returns by 20% after adopting an AI platform. Similarly, EquityPlus Investment improved portfolio performance by 35%, thanks to faster market responses. With chatbots offering these insights, you can feel confident about your financial future.

Why Financial Institutions Should Adopt Chatbots in 2025

Staying Ahead in a Digital-First Era

In today’s fast-paced world, staying ahead means embracing digital transformation. Financial institutions that adopt chatbots position themselves as leaders in this digital-first era. These tools don’t just automate tasks—they redefine how you interact with your bank. Imagine getting instant answers to your customer inquiries or managing your account without stepping into a branch. That’s the power of AI in financial services.

Chatbots also supercharge productivity. They handle routine tasks like balance checks or payment reminders, freeing up employees to focus on strategic initiatives. This efficiency improves operations and enhances customer engagement. Plus, with 24/7 availability, chatbots ensure you’re never left waiting.

| Benefit | Description |

|---|---|

| Supercharged Productivity | Chatbots handle routine tasks quickly, allowing employees to focus on strategic initiatives. |

| Optimized Resource Allocation | Automating processes streamlines operations and maximizes efficiency. |

| Gaining a Competitive Edge | Exceptional service through chatbots positions organizations as industry leaders. |

By adopting chatbots, you not only meet today’s demands but also prepare for tomorrow’s challenges.

Meeting Customer Expectations with AI Chatbots

Your customers expect fast, reliable, and personalized service. AI chatbots deliver exactly that. They provide instant responses, reducing wait times and improving customer satisfaction. In fact, financial customer service chatbots can handle over 90% of interactions successfully by 2026.

These bots also offer personalized experiences. They analyze your preferences and provide tailored solutions, whether it’s recommending a savings plan or helping you track expenses. This level of customization builds trust and strengthens customer relationships.

Did you know? A survey found that 86% of customers believe chatbots should offer a live agent option. Sobot’s chatbot does just that, ensuring a seamless transition when human assistance is needed.

With AI chatbots, you’re not just meeting expectations—you’re exceeding them.

Leveraging Data Insights for Growth

Data is the backbone of modern finance. Chatbots don’t just interact with customers; they collect and analyze data to uncover valuable insights. For example, a European bank using an NLP-powered chatbot saw customer satisfaction scores rise by 26% and reduced call center volume by 42%.

Here’s how chatbots drive growth:

- They analyze customer behavior to identify new opportunities.

- They provide actionable insights for refining strategies.

- They improve first-contact resolution rates, saving time and money.

Sobot’s chatbot excels in this area. It uses advanced analysis to optimize customer service and boost engagement. By leveraging these insights, you can make smarter decisions and achieve measurable growth.

Adopting chatbots isn’t just about staying competitive—it’s about thriving in a data-driven world.

Building Trust Through Reliable Support

Trust is the foundation of any strong relationship, especially in finance. When you know your bank or financial institution has your back, you feel more confident managing your money. That’s where reliable chatbot support comes in. These AI-powered tools don’t just answer your questions—they create a sense of security by being accurate, consistent, and always available.

Imagine reaching out with customer inquiries about your account balance or a recent transaction. Instead of waiting on hold, you get instant, reliable answers. This kind of dependable service builds trust over time. You start to see the chatbot as more than just a tool—it becomes a trusted partner in your financial journey.

Here’s how reliable chatbot support strengthens trust and loyalty:

| Evidence Description | Supporting Theory | Impact on Customer Loyalty |

|---|---|---|

| Personalized interactions with AI chatbots enhance trust. | Social Presence Theory | Leads to improved customer loyalty. |

| AI chatbot personalization provides unique customer experiences. | Relationship Marketing Theory | Increases customer trust and loyalty. |

| Satisfaction mediates the relationship between trust and loyalty. | N/A | Positive reinforcement leads to loyal behaviors. |

When a chatbot personalizes its responses, it feels like it truly understands your needs. This creates a sense of connection, making you more likely to stay loyal to your financial institution. Plus, consistent and accurate customer service ensures you always get the help you need, reinforcing that trust.

Sobot’s chatbot takes reliability to the next level. It handles customer inquiries with precision, ensuring you always receive accurate and timely support. Whether it’s a simple question or a complex issue, you can count on it to deliver. This level of dependability not only builds trust but also strengthens your relationship with your bank.

Chatbots are revolutionizing financial services, and Sobot's AI Chatbot is leading the charge. By automating tasks, they save time and reduce costs. They also enhance the customer experience with personalized, 24/7 support. In 2025, advancements in AI chatbots have made them smarter, more secure, and incredibly versatile.

If you're looking to stay competitive, adopting a chatbot for finance is a must. It boosts customer service efficiency and builds trust with your users. Sobot's chatbot is designed to help you achieve all this and more. Ready to transform your financial operations? Explore Sobot's solutions today and take your customer experience to the next level.

Learn more about Sobot's Chatbot.

FAQ

What is a chatbot, and how does it work in finance?

A chatbot is an AI-powered tool that interacts with you through text or voice. In finance, it helps with tasks like checking balances, transferring funds, and answering questions. It uses advanced algorithms to understand your needs and provide instant, accurate responses.

Can a chatbot handle sensitive financial information securely?

Yes, modern chatbots are designed with advanced security features. They use encryption and identity verification to protect your data. For example, Sobot’s chatbot complies with GDPR and ISO standards, ensuring your financial information stays safe.

How does a chatbot improve customer service in banking?

A chatbot enhances customer service by providing 24/7 support, instant answers, and personalized assistance. It reduces wait times and resolves most queries without human intervention. This makes your banking experience faster, easier, and more satisfying.

Do I need technical skills to set up a chatbot for my business?

Not at all! Sobot’s chatbot offers a no-coding-required setup. Its point-and-click interface makes it easy for anyone to design and deploy workflows. You can have it up and running in no time.

Why should financial institutions adopt chatbots in 2025?

Chatbots save costs, improve efficiency, and meet customer expectations. They handle routine tasks, provide personalized support, and operate 24/7. By adopting a chatbot, financial institutions can stay competitive and deliver exceptional service.

See Also

Enhancing Customer Satisfaction Through Chatbots in E-commerce

The 10 Most Effective Chatbots for Websites This Year

Leading Websites Utilizing Chatbots in 2024