Enhancing Banking with Chatbot Solutions in 2025

Chatbots are revolutionizing the way banks engage with customers, delivering services that are faster, smarter, and more accessible. By 2025, the adoption of chatbot solutions for banks is projected to soar, with over 987 million users worldwide depending on these tools for seamless financial assistance. The global market for AI chatbots is anticipated to reach $9.6 billion, fueled by their ability to transform customer service. Sobot’s chatbot solution for banks stands out by providing multilingual support and 24/7 availability, ensuring personalized assistance at any time. With 80% of banks reporting enhanced client service through chatbots, these solutions are becoming essential for the future of modern banking.

Understanding Chatbots in Banking

What Are Chatbots in Banking?

Chatbots in banking are AI-powered virtual assistants designed to interact with customers and automate routine tasks. These digital tools help you perform actions like checking account balances, transferring funds, or even applying for loans. By using natural language processing (NLP), chatbots understand your queries and provide accurate responses in real time.

In 2022, approximately 37% of the U.S. population interacted with a bank's chatbot, and this number is expected to grow. Financial chatbots are becoming essential for digital banking, offering quick and efficient solutions to common customer needs. However, they are not just limited to answering basic questions. They also assist with personalized marketing, fraud detection, and compliance, making them a valuable asset for banks aiming to enhance operational efficiency.

Core Functionalities of AI Banking Chatbots

AI banking chatbots are equipped with advanced features to streamline your banking experience. Here are some of their core functionalities:

- Lower Costs and Smarter Operations: Chatbots handle repetitive tasks, reducing the workload on human agents.

- Improved Efficiency: They expedite routine processes, allowing banks to manage more customer interactions.

- Personalized Banking Experiences: By analyzing your data, chatbots offer tailored advice, similar to a personal financial advisor.

- 24/7 Support: Financial chatbots provide round-the-clock assistance, ensuring you get help whenever you need it.

- Effortless Transaction Management: From checking balances to transferring funds, chatbots make transactions seamless.

For example, Sobot’s AI chatbot enhances efficiency by autonomously solving regular queries, improving productivity by 70%. It also operates 24/7, saving up to 50% on additional agent costs. These features make banking chatbots indispensable for modern financial services.

Technologies Powering Chatbot Solutions for Banks

The technologies behind banking chatbots are constantly evolving to meet your needs. Key advancements include:

| Title | Description |

|---|---|

| The Current and Future State of Generative AI for Banking | Explores how generative AI enhances digital banking experiences. |

| KAI: Continuous Learning | Highlights how continuous learning improves conversational banking. |

| Frost & Sullivan: Banks Win When They Use Virtual Assistants | Discusses the competitive advantages of conversational banking solutions. |

These technologies enable chatbots to learn from interactions, adapt to new scenarios, and provide more accurate responses. Sobot’s chatbot, for instance, uses a knowledge base built from articles, PDFs, and other sources to deliver instant replies. Its multilingual capabilities and omnichannel support ensure seamless communication across platforms like WhatsApp and SMS.

By leveraging these technologies, financial chatbots are transforming conversational banking, making it more intuitive and efficient for you.

Top Use Cases for Chatbots in Banking

Transforming Customer Service and Support

Chatbots in banking have revolutionized customer service by providing instant, accurate, and personalized support. You no longer need to wait in long queues or navigate complex phone menus. With banking chatbots, you can get answers to your questions in seconds, whether it’s about account balances, transaction history, or branch locations. These AI-powered assistants are available 24/7, ensuring you receive help whenever you need it.

For example, Bank of America’s virtual assistant, Erica, offers personalized financial advice, helping customers make informed decisions. Similarly, Sobot’s chatbot solution for banks enhances customer service by automating routine queries and providing multilingual support. This not only improves efficiency but also reduces operational costs by up to 50%.

The impact of chatbots on customer service is evident in the numbers. According to industry data:

| Industry | Company | Chatbot Functionality | Impact on Customer Service Transformation |

|---|---|---|---|

| Banking | Bank of America | Virtual financial assistant providing personalized advice on budgeting and investments | Enhanced customer engagement and informed financial decisions, fostering stronger customer relationships. |

| Music Streaming | Spotify | Resolving customer issues related to playlists and subscriptions | Enhanced user satisfaction and loyalty through effective support services. |

| Airlines | Delta Airlines | Flight information, check-in, and baggage updates | Improved operational efficiency and overall travel experience for passengers. |

These examples show how chatbots can transform customer interactions across industries, especially in digital banking. By adopting a chatbot solution for banks, you can enjoy faster resolutions and a more seamless experience.

Enhancing Fraud Detection and Prevention

Fraud detection is a critical area where banking chatbots excel. These AI-driven tools analyze large volumes of data to identify suspicious patterns and alert you to potential threats. For instance, if an unusual transaction occurs on your account, the chatbot can notify you immediately and guide you through the steps to secure your account. This proactive approach enhances fraud prevention and keeps your finances safe.

AI-powered fraud detection systems have proven their effectiveness. They can process data faster and more accurately than traditional methods, reducing the risk of human error. A study highlights how these systems establish relationships between various factors to predict fraudulent activities. This capability makes banking chatbots indispensable for modern fraud prevention strategies.

Sobot’s chatbot solution for banks integrates seamlessly with fraud detection systems, offering real-time alerts and guidance. By leveraging this technology, you can protect your assets while enjoying the convenience of digital banking.

Simplifying Financial Management for Customers

Managing your finances can feel overwhelming, but banking chatbots simplify the process. These virtual assistants act like personal financial advisors, helping you track expenses, set budgets, and even plan for future goals. With just a few taps, you can gain insights into your spending habits and make smarter financial decisions.

For example, Tinkoff Bank uses chatbots to automate customer interactions, saving its service department 720 hours per month. This efficiency allows the bank to focus on providing personalized financial advice. Similarly, Sobot’s chatbot solution for banks uses advanced AI to analyze your financial data and offer tailored recommendations. This not only improves your financial literacy but also helps you achieve your goals faster.

The cost-effectiveness of banking chatbots also benefits you. While a transaction at a physical branch costs around $4, mobile banking powered by chatbots reduces this to just $0.019. This significant cost reduction makes digital banking more accessible and affordable for everyone.

By adopting a chatbot solution for banks, you can take control of your finances with ease. Whether you’re saving for a vacation or planning for retirement, these tools provide the guidance you need to succeed.

Improving Operational Efficiency in Banking

Operational efficiency is a cornerstone of modern banking, and chatbots are playing a pivotal role in achieving it. By automating repetitive tasks, chatbots allow banks to allocate resources more effectively. For instance, they handle routine customer inquiries, such as balance checks or transaction histories, freeing up human agents to focus on complex issues. This shift not only reduces costs but also enhances service quality.

Banks measure operational efficiency through various metrics. These include response accuracy, latency, and containment rate. The table below highlights key metrics improved by chatbot integration:

| Metric | Description |

|---|---|

| Latency | Measures the response time between customer input and the chatbot’s reply. |

| First call resolution rate | Percentage of customer inquiries resolved on the first interaction. |

| Cost per message | Tracks the cost of processing messages. |

| Containment rate | Frequency of queries resolved without human escalation. |

| Fallback rate | Rate at which the chatbot fails to respond satisfactorily. |

| Response accuracy | Ensures the chatbot delivers correct and reliable responses. |

| Average handling time | Time taken by the chatbot to resolve queries. |

Research shows that banks can enhance productivity by up to 30% by integrating generative AI into workflows. This improvement stems from the ability of chatbots to streamline processes like customer onboarding and personalized financial advice. For example, Sobot’s AI chatbot operates 24/7, autonomously resolving queries and reducing service costs by up to 50%. Its multilingual capabilities ensure seamless communication, making it a valuable tool for banks aiming to improve efficiency.

Moreover, chatbots contribute to faster transaction processing. They provide instant responses, reducing the average handling time for customer queries. This speed not only enhances customer satisfaction but also allows banks to manage higher volumes of interactions without compromising quality. By adopting chatbot solutions, you can experience improved efficiency and a smoother banking experience.

Supporting Loan Applications and Approvals

Applying for a loan often involves lengthy processes and multiple steps. Chatbots simplify this by automating key aspects of the loan application and approval process. They synchronize data with CRM systems, ensuring real-time updates on application statuses. This transparency keeps you informed at every stage, reducing the need for follow-ups.

Chatbots also provide personalized interactions by referencing your historical data. For example, they can suggest loan options tailored to your financial profile, making the process more user-friendly. Additionally, they offer self-service options, allowing you to check loan balances or request payment schedules directly. These features save time and enhance your overall experience.

Sobot’s chatbot solution excels in this area. It integrates seamlessly with banking systems, automating workflows and ensuring accurate data handling. By leveraging AI, it delivers real-time insights and personalized recommendations, streamlining the loan process. This efficiency not only benefits you but also helps banks reduce operational costs.

The impact of chatbots on loan processing is significant. They eliminate manual errors, speed up approvals, and improve customer satisfaction. With these tools, you can navigate the complexities of loan applications with ease, enjoying a faster and more transparent process.

Key Benefits of AI Banking Chatbots

Cost Reduction and Resource Optimization

Banking chatbots significantly reduce costs while optimizing resources. They handle repetitive tasks like answering FAQs or processing simple transactions, freeing up human agents to focus on complex issues. This efficiency leads to substantial savings for financial institutions. For instance, traditional banks can cut costs by 22% by 2030 through AI technology. Additionally, operational cost savings from chatbots in banking reached $7.3 billion globally by 2023, a sharp increase from $209 million in 2019.

The impact of chatbots on resource optimization is equally impressive. Klarna’s AI chatbot managed 2.3 million conversations in its first month, completing the workload of 700 full-time agents. This reduced resolution times from 11 minutes to under 2 minutes, showcasing how chatbots improve productivity. Sobot’s banking chatbot enhances efficiency by autonomously solving regular queries, improving productivity by 70%. It also saves up to 50% on agent costs, making it a cost-effective solution for digital banking.

| Cost Category | Average Savings | Impact |

|---|---|---|

| Support Costs | 30% reduction | Automates routine inquiries effectively |

| Labor Hours | 2.5 billion | Frees up significant time across industries |

| Agent Productivity | 50% increase | Boosts efficiency on a large scale |

By adopting banking chatbots, you can enjoy faster services while banks benefit from reduced operational expenses.

24/7 Availability for Seamless Customer Support

One of the most valued features of banking chatbots is their 24/7 availability. Unlike traditional customer support, chatbots provide instant answers at any time of the day. This ensures that you can resolve issues or access services without waiting for business hours. Approximately 64% of internet users consider round-the-clock service a key feature of chatbots. Moreover, 29% of bot interactions occur outside regular store hours, highlighting their importance in providing uninterrupted support.

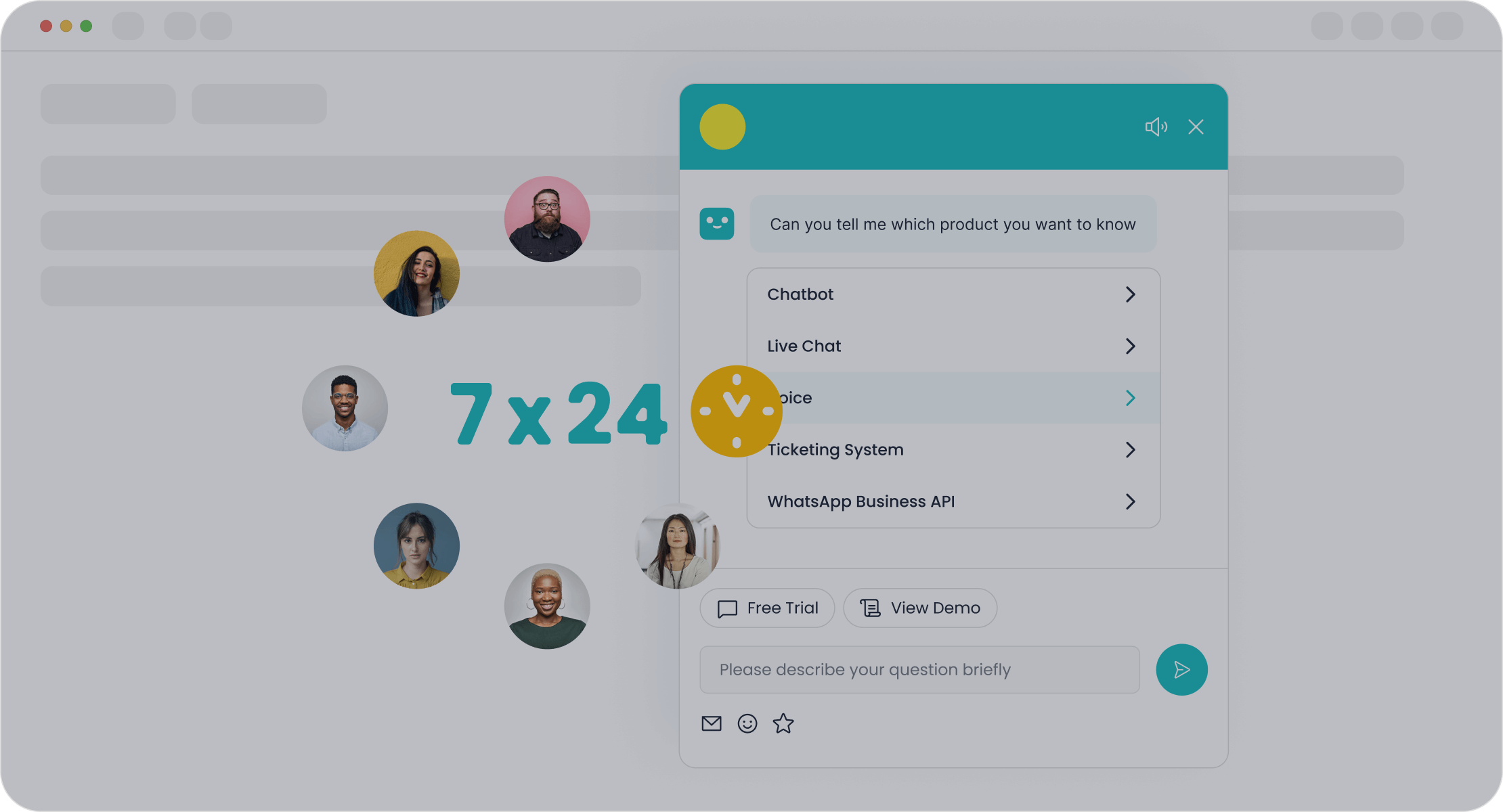

AI chatbots enhance the customer experience by addressing multiple inquiries simultaneously. This eliminates long wait times and ensures quick resolutions. For example, Sobot’s chatbot operates 24/7, offering self-service capabilities across platforms like WhatsApp and SMS. Its multilingual support ensures that you can communicate in your preferred language, making it a reliable tool for improved customer support.

With 24x7 digital support, banking chatbots ensure that your needs are met promptly, enhancing your overall satisfaction with digital banking services.

Delivering Personalized Banking Experiences

Banking chatbots excel at delivering personalized banking experiences. They analyze your financial data to offer tailored advice, helping you make informed decisions. For example, chatbots can recommend savings plans based on your spending habits or alert you to upcoming bill payments. This level of personalization boosts customer engagement and retention.

Chatbots also simplify the banking process by providing real-time assistance in a conversational manner. They collect valuable data to understand your preferences, enabling banks to improve their services. Sobot’s chatbot uses advanced AI to deliver hyper-personalized solutions. It offers proactive support and smart self-service capabilities, ensuring that you receive personalized digital assistance whenever needed.

By integrating chatbots into their systems, banks can enhance operational efficiency and revenue. For you, this means a more intuitive and satisfying banking experience. Personalized experiences like these make digital banking more accessible and enjoyable.

Scalability to Meet Growing Customer Demands

Scalability is a critical factor for banks as they strive to meet the growing demands of their customers. Banking chatbots excel in this area by handling large volumes of interactions without compromising service quality. These AI-powered tools can manage thousands of conversations simultaneously, ensuring that every customer receives timely and accurate assistance.

For instance, N26, a leading mobile bank, implemented an AI assistant to scale its customer service operations. This chatbot automated complex conversations and successfully handled 20% of customer service requests. By doing so, N26 efficiently served its expanding customer base without increasing the size of its call center teams. This example demonstrates how chatbots enable banks to grow their operations while maintaining cost efficiency.

Sobot’s chatbot solution offers similar scalability benefits. Its omnichannel support allows you to interact with your bank across platforms like WhatsApp and SMS. The chatbot operates 24/7, ensuring uninterrupted service even during peak times. Additionally, its multilingual capabilities make it accessible to a diverse customer base, further enhancing its scalability.

By adopting scalable chatbot solutions, banks can not only meet but exceed customer expectations. These tools ensure that as customer demands grow, service quality remains consistent, fostering trust and satisfaction.

Boosting Customer Engagement and Retention

Customer engagement is essential for building long-term relationships in banking. Chatbots play a pivotal role in enhancing this engagement by offering personalized and proactive interactions. They analyze your behavior, preferences, and financial needs to provide tailored advice, making your banking experience more relevant and enjoyable.

AI-driven analytics empower chatbots to understand your unique requirements. For example, they can identify patterns in your spending habits and suggest ways to save money. These insights not only improve your financial literacy but also make you feel valued as a customer. Machine learning algorithms further enhance retention by predicting when you might consider switching banks. This allows banks to implement targeted strategies to keep you engaged.

Sobot’s chatbot solution excels in boosting customer engagement. It uses smart self-service features and proactive messaging to address your needs in real time. Whether you’re looking for financial advice or need help with a transaction, the chatbot ensures a seamless experience. This level of personalization strengthens your loyalty and encourages you to continue using the bank’s services.

By integrating chatbots into their systems, banks can create meaningful connections with their customers. These tools not only enhance engagement but also reduce churn, ensuring that you remain a satisfied and loyal customer.

Real-World Examples of Chatbot Solutions for Banks

Case Study: Sobot's Chatbot Enhancing Customer Service

Sobot's chatbot has transformed customer service for financial institutions by automating routine interactions and providing instant support. For example, Opay, a leading financial service platform, implemented Sobot's omnichannel solution to manage customer inquiries across multiple channels. This integration streamlined operations, reducing costs by 20% and increasing customer satisfaction from 60% to 90%.

The chatbot's multilingual capabilities allowed Opay to serve a diverse customer base effectively. Additionally, its 24/7 availability ensured that customers received assistance anytime, improving response times and reducing the workload on human agents. By leveraging Sobot's chatbot, Opay achieved a 17% increase in conversion rates, demonstrating the value of AI-powered solutions in enhancing customer engagement.

Case Study: Fraud Prevention with AI Chatbots

Fraud prevention is a critical area where chatbots excel. These AI-driven tools analyze transaction patterns to detect anomalies and alert users to potential threats. For instance, a leading bank integrated Sobot's chatbot into its fraud detection system. The chatbot provided real-time alerts for suspicious activities, enabling customers to secure their accounts immediately.

This proactive approach significantly reduced fraud-related losses and improved customer trust. The chatbot's ability to process vast amounts of data quickly ensured accurate detection of fraudulent activities. By adopting such solutions, banks can enhance security while maintaining a seamless user experience.

Case Study: Financial Planning Assistance via Chatbots

Chatbots have also revolutionized financial planning by offering personalized advice based on user data. For example, Sobot's chatbot analyzes spending habits to recommend savings plans or investment opportunities. This feature helps users make informed financial decisions effortlessly.

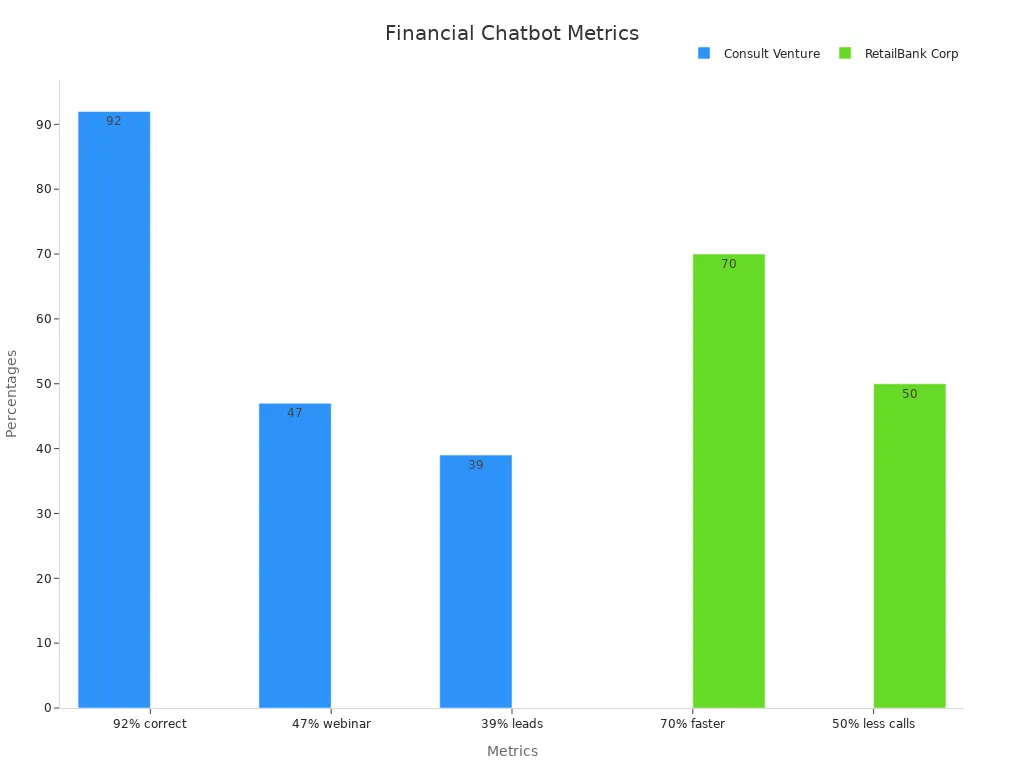

The impact of chatbots in financial planning is evident in metrics from case studies. For instance:

| Case Study | Key Metrics | Benefits |

|---|---|---|

| Consult Venture Partners | 92% of queries answered correctly | Enhanced customer engagement and lead generation |

| 47% of queries led to webinar registrations | Increased user interaction and interest in services | |

| 39% of inquiries converted into leads | Improved conversion rates and business opportunities | |

| RetailBank Corp | 70% reduction in average response times | Faster customer service response |

| 50% decrease in calls needing human agents | More efficient use of human resources | |

| Improved customer satisfaction ratings | Enhanced overall customer experience |

These real-world examples of banking chatbots highlight their ability to simplify financial planning, improve efficiency, and boost customer satisfaction.

Best Practices for Implementing Chatbots in Banking

Ensuring Security and Data Privacy

Security and data privacy are critical when implementing chatbots in banking. You trust banks with sensitive information, so they must protect it at all costs. Chatbots should follow strict technical standards to ensure your data remains secure. For example, data encryption transforms readable information into an unreadable format, safeguarding it from unauthorized access. Secure transmission protocols like HTTPS and SSH create safe channels for data exchange. Access controls further enhance security by limiting who can view or modify sensitive information.

Regulations like GDPR and CCPA also play a vital role. These laws give you control over your personal data, ensuring transparency in how it is used. Banks must comply with these standards to maintain your trust. Sobot’s chatbot solutions prioritize security by integrating these protocols, offering you peace of mind while interacting with your bank.

| Technical Standard/Protocol | Description |

|---|---|

| Data Encryption | Transforms readable data into an unintelligible format to protect sensitive information. |

| Secure Transmission Protocols | Establishes secure channels for data to travel, such as HTTPS, SSH, and SFTP. |

| Access Controls | Manages permissions for data access, ensuring only authorized users can view sensitive information. |

| GDPR | Regulation that mandates transparency and user control over personal data. |

| CCPA | California law that requires explicit consent for data processing and grants users rights over their information. |

Seamless Integration with Banking Systems

For chatbots to function effectively, they must integrate seamlessly with existing banking systems. This ensures they can access the data and tools needed to provide accurate and timely assistance. For example, integration with core banking systems allows chatbots to retrieve account balances or transaction histories instantly. Connecting with CRM systems enables personalized responses by referencing your financial profile.

Sobot’s chatbot solutions excel in this area. They integrate with various platforms, including fraud detection systems and compliance tools, ensuring smooth operations. Omni-channel support further enhances this integration, allowing you to interact with your bank through platforms like WhatsApp or SMS without any disruptions.

| Integration Aspect | Description |

|---|---|

| Core Systems | Seamless integration with core banking systems is essential for effective chatbot functionality. |

| CRM Systems | Integration with existing CRM systems allows the chatbot to access comprehensive customer profiles for personalized responses. |

| Tech Stack | Chatbots are designed to integrate seamlessly with existing tech stacks, ensuring compatibility and scalability. |

Aligning Chatbot Features with Customer Needs

To maximize their effectiveness, chatbots must be aligned with customer needs. This means understanding what you value most in a banking experience, whether it’s quick responses, personalized advice, or 24/7 availability. For instance, an airline chatbot designed as a calm travel companion improved user satisfaction by reducing call center loads. Similarly, a fashion retailer’s chatbot styled as a trendy friend increased user engagement and purchase confidence.

Sobot’s chatbots offer features tailored to your preferences. They provide omni-channel support, ensuring you can access services through your preferred platform. Their multilingual capabilities and adaptive learning further enhance the experience, making them a perfect fit for diverse customer bases.

- Examples of customer-aligned chatbots:

- Airline Customer Service Chatbot: Improved satisfaction by acting as a calm, knowledgeable travel companion.

- Fashion Retailer’s Style Advisor Bot: Boosted engagement by offering trendy, friendly advice.

- B2B Software Company’s Technical Assistant: Built trust with a professional tone, reducing the need for human support.

By aligning chatbot features with your needs, banks can deliver a more satisfying and efficient digital experience.

Continuous Monitoring and Optimization

Continuous monitoring and optimization ensure that chatbots in banking deliver consistent and reliable performance. By tracking their interactions, you can identify areas for improvement and enhance their functionality over time. This process involves analyzing metrics like response accuracy, containment rates, and customer satisfaction scores. For example, a bank might notice that its chatbot struggles with complex loan inquiries. By updating its knowledge base, the bank can improve the chatbot's ability to handle such queries.

Regular updates also keep chatbots aligned with evolving customer needs. As banking regulations change or new financial products emerge, chatbots must adapt to provide accurate and relevant information. Sobot’s chatbot solution excels in this area. Its point-and-click interface allows you to update workflows without coding, ensuring quick and seamless optimizations. Additionally, its multilingual capabilities make it easier to cater to diverse customer bases.

AI-driven analytics play a crucial role in optimization. These tools help you understand user behavior and predict future trends. For instance, if customers frequently ask about investment options, you can train the chatbot to offer tailored advice. This proactive approach not only improves customer satisfaction but also boosts engagement.

Continuous monitoring also enhances security. By reviewing chatbot interactions, banks can detect unusual patterns that may indicate fraud or data breaches. Sobot’s chatbot integrates with fraud detection systems, providing real-time alerts and ensuring your financial safety.

Incorporating these practices ensures that chatbots remain effective, scalable, and secure. With regular monitoring and updates, you can maximize the value of your chatbot solution and provide a superior banking experience.

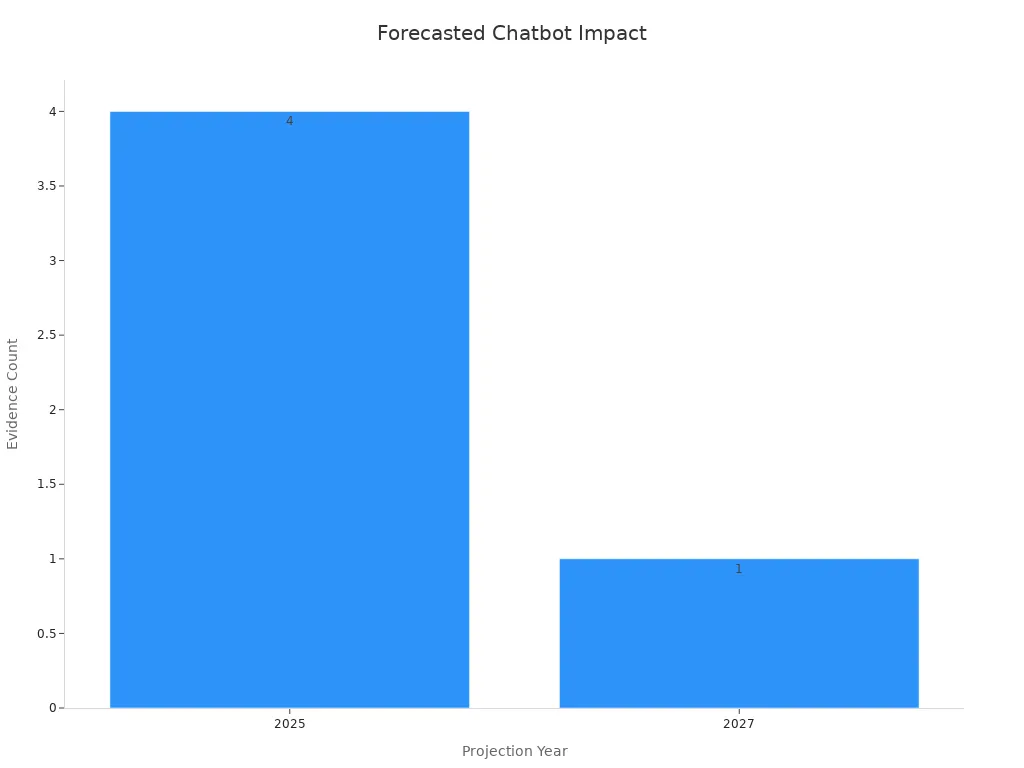

AI-powered chatbots are reshaping the banking landscape, offering unparalleled efficiency and personalized customer experiences. By 2025, chatbots in banking will revolutionize customer service, enabling instant responses and reducing operational costs. For instance, organizations using chatbots are projected to save $80 billion in customer service costs. These tools also enhance operational efficiency by handling thousands of queries simultaneously, ensuring no wait times during peak hours.

Banks adopting innovative solutions like Sobot's chatbot can automate tasks, allowing employees to focus on high-value responsibilities. This shift boosts workforce productivity while delivering tailored services to customers.

| Evidence Description | Projection/Forecast Year | Impact on Banking |

|---|---|---|

| Organizations using chatbots will cut customer service costs by $80 billion. | 2025 | Significant cost reduction in customer service. |

| Chatbots provide personalized advice, enhancing customer experience. | 2025 | Improved customer experience through tailored services. |

| Chatbots can handle thousands of queries simultaneously, ensuring no wait times. | 2025 | Enhanced operational efficiency during peak times. |

| Automating tasks allows employees to focus on high-value responsibilities. | 2025 | Increased workforce productivity and efficiency. |

| By 2027, chatbots will be the primary channel for customer service for many firms. | 2027 | Transformation of customer service channels. |

As you embrace 2025, focusing on innovation, security, and personalization will help you unlock the full potential of banking chatbots. With tools like Sobot's chatbot, you can enjoy seamless financial services while banks achieve greater efficiency and customer satisfaction.

FAQ

What are chatbots, and how do they work in banking?

Chatbots are AI-powered tools that interact with you to answer questions or perform tasks. In banking, they help with account inquiries, fund transfers, and loan applications. They use natural language processing (NLP) to understand your queries and provide accurate, real-time responses.

Are chatbots secure for banking transactions?

Yes, chatbots in banking follow strict security protocols like data encryption and secure transmission. They comply with regulations such as GDPR to protect your sensitive information. For example, Sobot’s chatbot ensures secure interactions while maintaining 24/7 availability for your convenience.

How do chatbots improve customer service in banking?

Chatbots enhance customer service by providing instant, accurate, and personalized support. They handle routine queries, reducing wait times and improving efficiency. For instance, Sobot’s chatbot automates interactions, saving up to 50% on agent costs while ensuring you receive timely assistance.

Can chatbots help with financial planning?

Yes, chatbots act as virtual financial advisors. They analyze your spending habits and recommend savings plans or investment options. For example, Sobot’s chatbot uses AI to offer tailored advice, helping you make smarter financial decisions effortlessly.

Why are chatbots important for modern banking?

Chatbots streamline banking operations by automating repetitive tasks and improving efficiency. They provide 24/7 support, personalized experiences, and fraud detection. With tools like Sobot’s chatbot, banks can reduce costs and enhance customer satisfaction, making them essential for digital banking.

See Also

Enhancing Customer Satisfaction Through Chatbots in E-commerce

Best 10 Websites Utilizing Chatbots This Year

Simple Ways to Integrate Chatbots on Your Website