Chatbots in Finance: Real-Time Support Explained

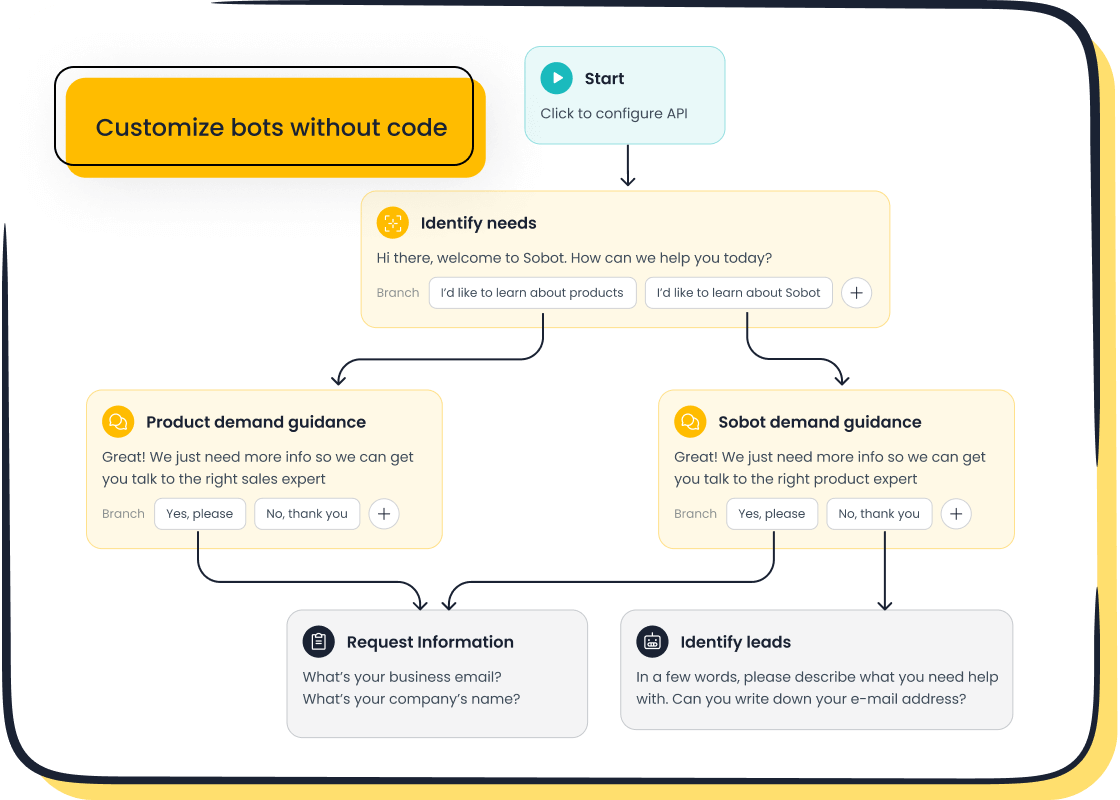

Chatbots in finance are transforming how you interact with financial services. These AI-driven tools handle tasks like answering queries, managing accounts, and even providing financial advice. They ensure real-time support, giving you instant solutions without delays. In 2022, approximately 37% of the U.S. population used a bank's chatbot, a figure expected to rise as more institutions embrace this cost-effective technology. By automating routine processes, chatbots enhance interactions and boost satisfaction. Companies like Sobot lead this innovation, offering customizable solutions that streamline your experience while ensuring efficiency and security.

Key Functionalities of Chatbots in Finance

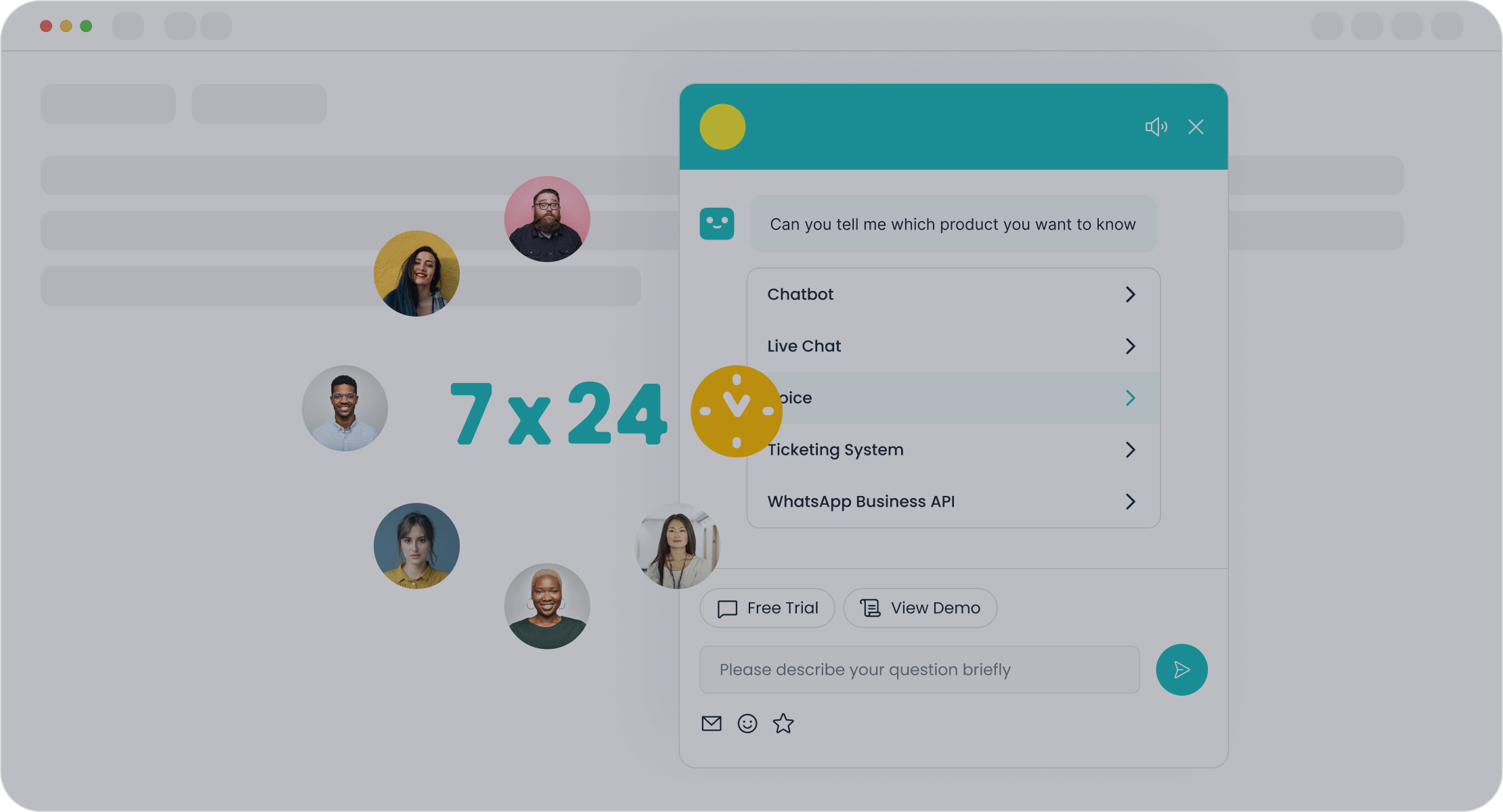

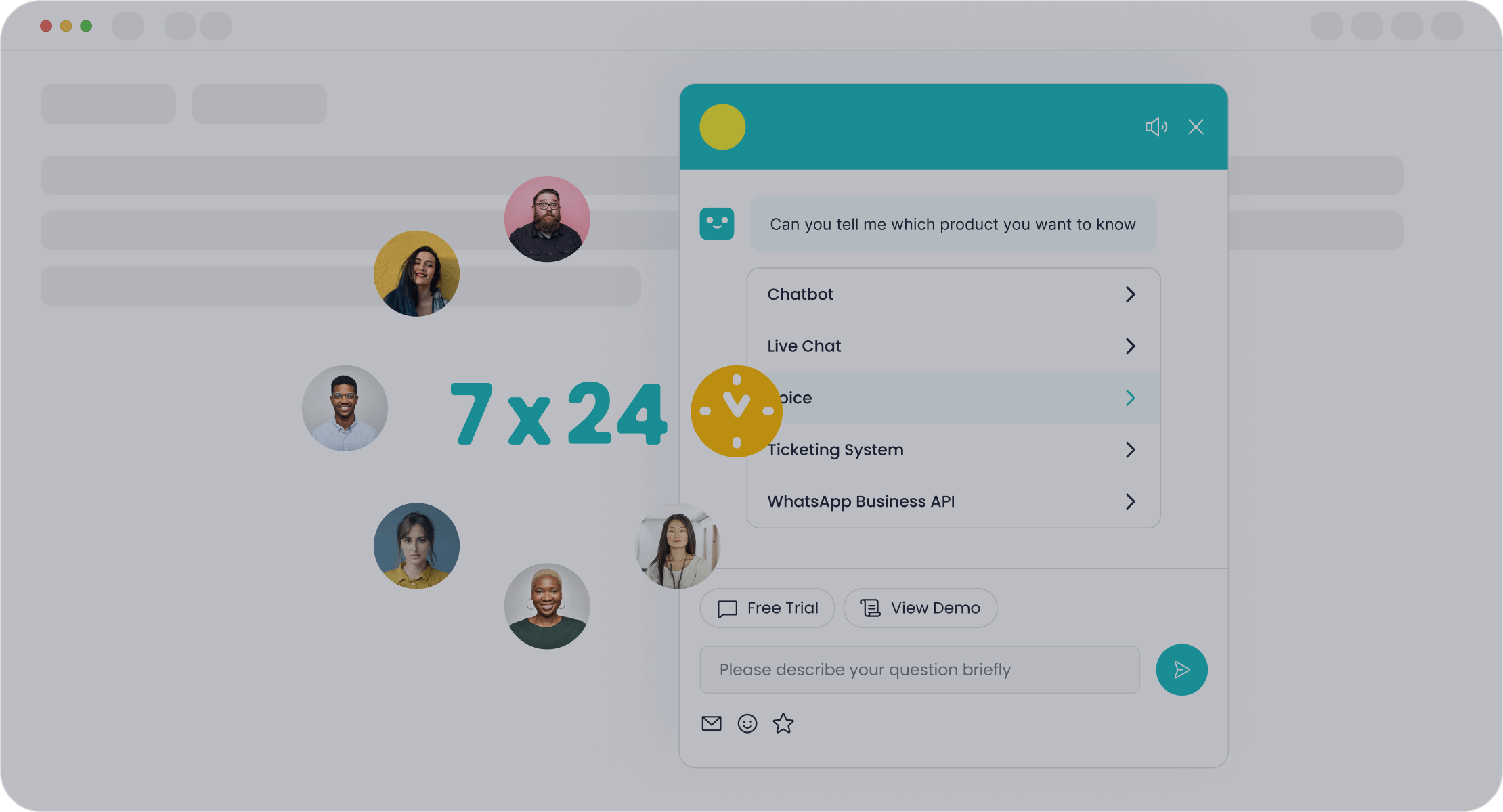

Automating Customer Support with 24/7 Availability

Chatbots in finance have revolutionized customer support by offering round-the-clock assistance. You no longer need to wait for business hours to resolve your queries. These AI-powered tools handle routine questions, such as account balances or transaction statuses, instantly. This ensures you receive timely responses, enhancing your overall experience.

A significant advantage of 24/7 availability is its popularity among users. According to recent data, 64% of consumers find this feature the most helpful aspect of a chatbot. Additionally, 36% of customer service experts rank it as the top benefit of AI in customer support.

| Statistic | Value |

|---|---|

| 64% of consumers find 24/7 availability to be the most helpful feature of a chatbot. | 64% |

| 36% of customer service experts consider 24/7 availability the top benefit of AI. | 36% |

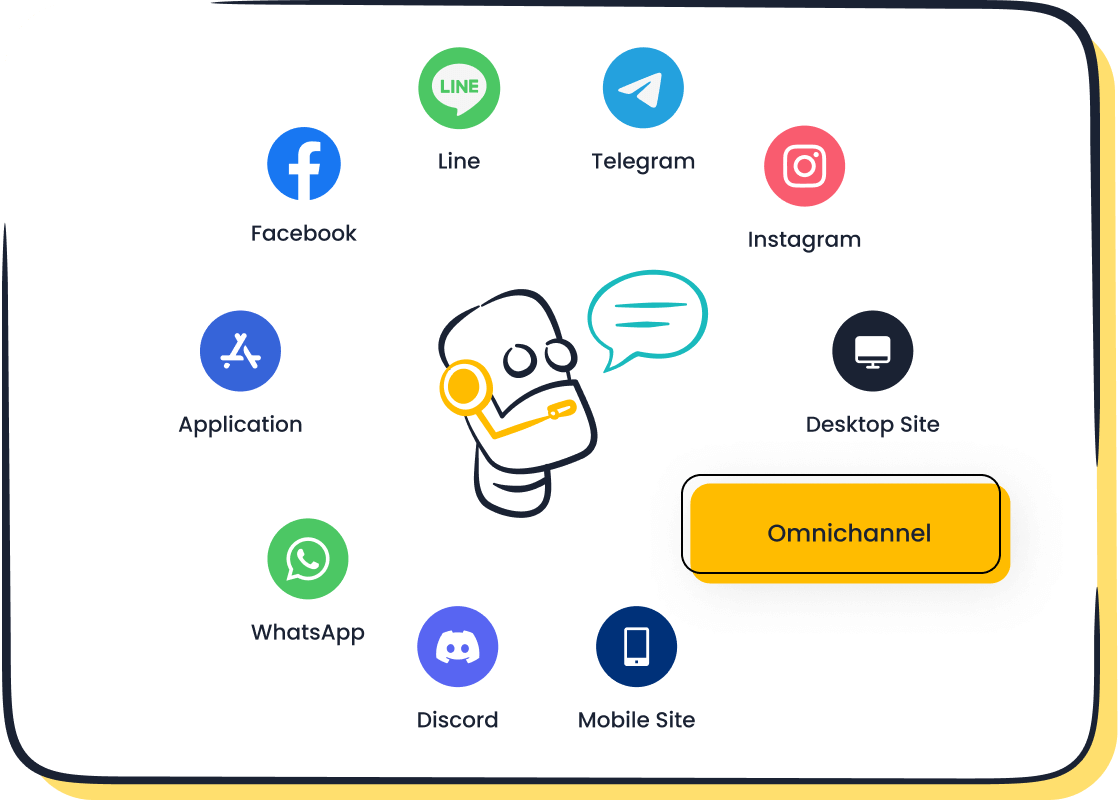

Sobot’s AI chatbot takes this a step further. It operates across multiple channels, including WhatsApp and SMS, ensuring you can access support wherever you are. Its multilingual capabilities also make it easier for users worldwide to interact seamlessly.

Providing Personalized Financial Advice

Finance AI chatbots excel at delivering personalized financial advice tailored to your unique needs. By analyzing your spending habits and financial goals, they offer insights that help you make smarter decisions. For instance, a chatbot might suggest saving plans based on your monthly expenses or recommend investment opportunities suited to your risk tolerance.

Personalization is key here. Chatbots use advanced algorithms to understand your preferences and provide advice that feels tailored just for you. This not only improves your financial literacy but also builds trust in the services you use. Sobot’s chatbot leverages AI to deliver such personalized experiences, ensuring you receive relevant and actionable financial advice.

Streamlining Transactions and Payment Processing

Chatbots simplify transactions, making processes like money transfers and bill payments faster and more efficient. They automate routine tasks, reducing the time you spend on manual inputs. For example, you can ask a chatbot to pay your utility bills or transfer funds, and it will complete the task instantly.

The efficiency of chatbots in streamlining transactions is backed by impressive metrics:

- AI automates repetitive tasks, cutting processing time.

- Predictive analytics optimize payment systems during peak times.

- Real-time fraud detection ensures secure transactions.

- Automated compliance checks meet regulatory standards.

Sobot’s chatbot enhances these processes with features like real-time fraud monitoring and detailed transaction analysis. It also integrates with financial APIs, ensuring seamless operations across platforms. This makes managing your finances not only easier but also safer.

Enhancing Fraud Detection and Security Alerts

Fraud detection is a critical aspect of financial services, and finance AI chatbots are transforming how you stay protected. These chatbots monitor transactions in real time, identifying unusual patterns that may indicate fraud. For example, if a transaction occurs from an unfamiliar location, the chatbot can flag it immediately and notify you. This proactive approach minimizes risks and ensures your financial security.

The effectiveness of chatbots in fraud detection is supported by impressive statistics:

| Statistic Description | Value |

|---|---|

| Improvement in detection accuracy | 40% |

| Reduction in phishing attacks by Citibank | 70% |

| PayPal's fraud rate compared to industry | 0.17% vs 1.86% |

| Reduction in false positives by Mastercard | 85% |

| Projected financial fraud losses by 2026 | $43 billion |

Sobot’s AI chatbot enhances fraud detection by integrating advanced algorithms and real-time monitoring. It not only identifies potential threats but also sends instant security alerts to keep you informed. With its multilingual capabilities, you can receive these alerts in your preferred language, ensuring clarity and prompt action. By leveraging finance AI chatbots like Sobot’s, you gain a reliable partner in safeguarding your finances.

Simplifying Account Management and Updates

Managing your account has never been easier, thanks to finance AI chatbots. These tools automate repetitive tasks, such as checking balances or updating personal details, saving you time and effort. You can perform these actions directly through your mobile device, making account management more convenient.

Here are some ways chatbots simplify account management:

- Automating routine tasks like balance inquiries reduces the workload for agents.

- Speeding up banking processes improves efficiency and satisfaction.

- Providing real-time updates on balances and transactions enhances your experience.

- Allowing easy account management via mobile ensures accessibility.

By 2025, organizations using chatbots are expected to save $80 billion in customer service costs. Sobot’s chatbot takes this a step further by offering omnichannel support, enabling you to manage your account across platforms like WhatsApp and SMS. Its intuitive interface ensures you can make updates without technical expertise. With Sobot, you can enjoy seamless account management and timely updates, all while reducing service costs.

Technologies Powering Finance AI Chatbots

Natural Language Processing (NLP) for Understanding Queries

Natural Language Processing (NLP) is the backbone of conversational AI. It enables chatbots to understand and respond to your queries in a conversational manner. By analyzing the structure and meaning of your words, NLP ensures that ai-powered assistants can provide accurate and relevant answers. For example, when you ask about your account balance or recent transactions, the chatbot interprets your request and delivers the information instantly.

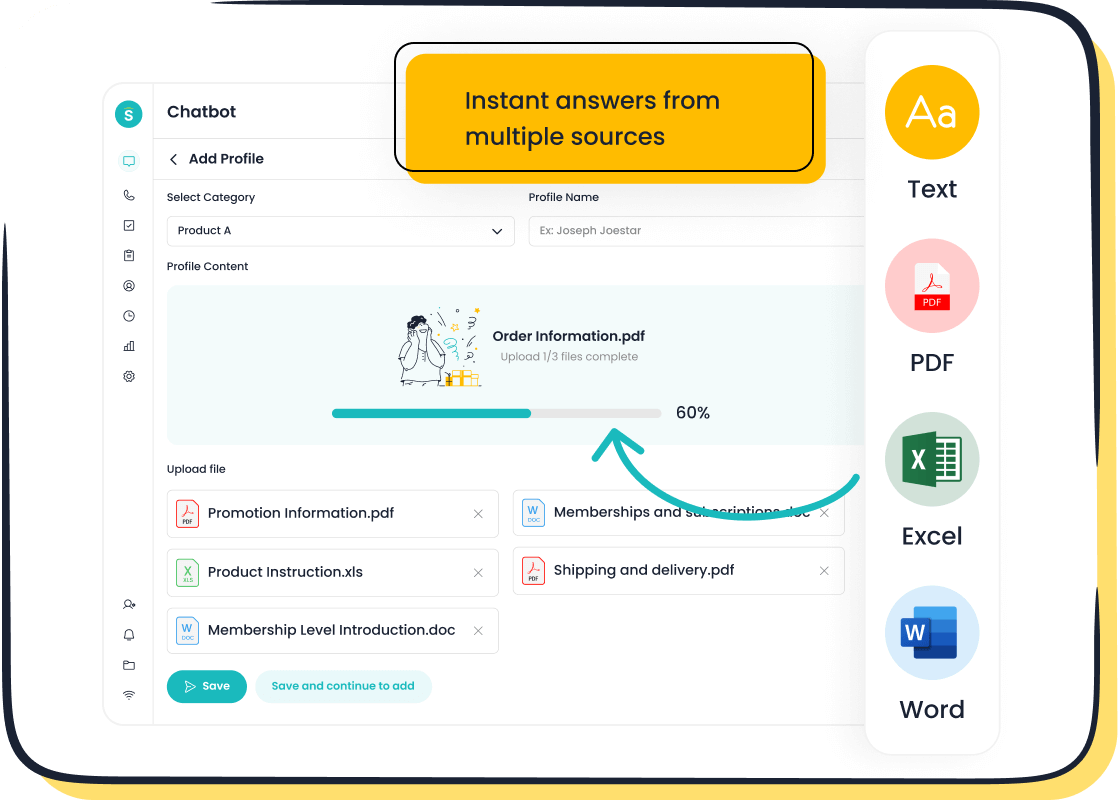

Studies show that large language models (LLMs) enhance customer support by enabling real-time interactions. They also provide timely financial insights, which are crucial for addressing your needs. In the finance sector, NLP-powered chatbots handle everyday banking inquiries, reducing costs and improving efficiency. Sobot’s chatbot leverages NLP to deliver seamless conversational experiences, ensuring you receive precise answers to your questions.

Artificial Intelligence (AI) and Machine Learning (ML) for Real-Time Insights

AI and ML play a vital role in making finance chatbots smarter. These technologies analyze vast amounts of data to provide real-time insights. For instance, they can predict your spending patterns or detect anomalies in your transactions. This helps you make informed decisions while ensuring your financial security.

AI-driven automation speeds up decision-making by automating data aggregation and model updates. It also enhances forecasting accuracy by incorporating real-time variables. Additionally, AI eliminates human error, saving operational costs and improving efficiency. Sobot’s ai-powered assistants use these technologies to process large datasets in seconds, ensuring you receive timely and accurate financial advice.

Integration with Financial APIs for Seamless Operations

Financial APIs connect chatbots with banking systems, enabling smooth operations. These integrations allow chatbots to access your account details, process payments, and provide real-time updates. For example, when you request a fund transfer, the chatbot communicates with the bank’s system to complete the transaction instantly.

Integrating financial data into a unified platform reduces errors and eliminates data silos. This improves decision-making and speeds up processing. APIs also support scalable integration across platforms, enhancing your digital banking experience. Sobot’s chatbot integrates seamlessly with financial APIs, ensuring you enjoy the convenience of fast and secure transactions.

Data Analytics for Predictive Financial Assistance

Data analytics plays a crucial role in providing predictive financial assistance. By analyzing large volumes of data, it helps you make smarter financial decisions. Predictive analytics identifies patterns in your spending, saving, and payment behaviors. This allows financial institutions to forecast cash flows, manage risks, and offer proactive solutions tailored to your needs.

For example, advanced algorithms can predict when you might face a cash shortfall. They can also identify potential credit risks, helping you avoid payment defaults. These insights enable you to plan better and stay ahead of financial challenges. Here are some ways data analytics enhances financial assistance:

- It forecasts cash flows, ensuring you have enough funds for future expenses.

- It identifies payment patterns, helping you optimize your budget.

- It predicts the timing of payments, improving cash flow management.

Sobot’s AI chatbot leverages data analytics to deliver these benefits seamlessly. It uses real-time data to provide personalized financial advice, ensuring you receive accurate and timely insights. For instance, the chatbot can analyze your transaction history to recommend savings plans or alert you about upcoming bills. This proactive approach not only simplifies financial management but also boosts your confidence in handling your finances.

By 2026, the global financial analytics market is expected to reach $19.8 billion, highlighting its growing importance. With tools like Sobot’s chatbot, you can harness the power of predictive analytics to make informed decisions and achieve your financial goals. Explore how data-driven insights can transform your financial journey by visiting Sobot’s Chatbot.

Benefits of Chatbots in Financial Services

Enhancing Customer Experience with Real-Time Support

Chatbots have transformed how you interact with financial services by offering real-time support. They respond instantly to your queries, ensuring you never have to wait for assistance. This immediacy improves your overall customer experience, making financial interactions smoother and more satisfying. For example, when you need to check your account balance or inquire about a transaction, a chatbot provides the information in seconds.

Real-time support also enhances customer engagement. By addressing your concerns promptly, chatbots build trust and loyalty. Sobot’s AI-driven customer support takes this further by offering personalized interactions across multiple channels. Its multilingual capabilities ensure you receive high-quality customer support in your preferred language, creating a seamless experience.

Reducing Operational Costs and Increasing Efficiency

Finance chatbots significantly reduce operational costs while improving efficiency. They automate repetitive tasks like answering FAQs and processing transactions, freeing up human agents to focus on complex issues. This automation not only saves time but also cuts expenses.

- A leading bank reduced customer service costs by 45% after implementing AI chatbots.

- The same bank saw a 50% improvement in response times.

- AI-driven RegTech solutions have lowered compliance costs by up to 30%.

Sobot’s chatbot enhances operational efficiency by integrating with financial APIs and automating workflows. It processes large volumes of data in real time, ensuring accurate and timely responses. This efficiency translates into better customer satisfaction and streamlined operations.

Providing 24/7 Customer Support Across Channels

In today’s on-demand world, 24/7 customer support is essential. Chatbots ensure you can access assistance anytime, whether it’s late at night or during weekends. This availability minimizes disruptions and boosts your confidence in financial services. Starling Bank emphasizes that round-the-clock support is vital for meeting customer needs at any time.

| Benefit | Description |

|---|---|

| Minimized Disruptions | Support continues uninterrupted, ensuring customers always feel supported. |

| 24/7 Availability | Assistance is accessible during evenings, weekends, or holidays. |

Sobot’s chatbot excels in providing 24/7 customer support across channels like WhatsApp and SMS. Its omnichannel capabilities ensure you can reach out through your preferred platform, enhancing your experience and engagement. This constant availability strengthens customer satisfaction and loyalty.

Strengthening Security and Fraud Prevention Measures

Finance AI chatbots play a crucial role in enhancing security and preventing fraud. These intelligent tools monitor transactions in real time, identifying unusual patterns that could indicate fraudulent activity. For example, if a transaction occurs from an unfamiliar location, the chatbot can flag it immediately and notify you. This proactive approach ensures your financial safety and minimizes risks.

AI-powered systems excel at fraud detection due to their ability to analyze vast amounts of data with precision. They continuously learn and adapt to new fraud tactics, keeping your accounts secure. Here are some key benefits of using chatbots in finance for fraud prevention:

- Improved accuracy in fraud detection reduces false positives, enhancing your experience.

- AI analyzes thousands of transactions per second, ensuring legitimate purchases are not declined.

- Early fraud detection prevents costly breaches and chargebacks, saving financial institutions millions.

- Anti-money laundering solutions powered by AI improve detection accuracy by up to 90%.

Sobot’s AI chatbot takes these capabilities further by integrating advanced algorithms and real-time monitoring. It not only detects potential threats but also sends instant alerts in your preferred language. This ensures you stay informed and can act quickly to secure your finances.

Automating fraud detection processes also leads to significant cost savings for organizations. By reducing manual intervention, financial institutions can allocate resources more effectively. With tools like Sobot’s chatbot, you gain a reliable partner in safeguarding your financial transactions while enjoying seamless and secure real-time support.

By leveraging finance AI chatbots, you can trust that your financial data remains protected. These tools provide peace of mind, allowing you to focus on achieving your financial goals without worrying about security threats.

Real-World Applications of Chatbots in Finance

Sobot Chatbot: Transforming Customer Support in Finance

Sobot’s chatbot is revolutionizing customer support in finance by providing seamless, real-time interactions. It handles routine queries like balance checks, transaction statuses, and account updates, allowing you to get instant answers without waiting. This efficiency not only saves time but also enhances your overall experience.

The chatbot’s multilingual capabilities ensure that users from diverse backgrounds can interact effortlessly. Its omnichannel support allows you to access assistance through platforms like WhatsApp and SMS, making it highly convenient. Additionally, Sobot’s chatbot uses advanced AI to analyze your financial data and provide personalized advice, helping you make informed decisions.

For example, Opay, a financial service platform, implemented Sobot’s chatbot to manage customer inquiries across multiple channels. This integration led to a 90% customer satisfaction rate and reduced operational costs by 20%. These results highlight how Sobot’s chatbot can transform customer support in finance.

Bank-Specific Chatbots for Account Management

Bank-specific chatbots simplify account management by automating tasks like balance inquiries, fund transfers, and personal detail updates. You can perform these actions directly through your preferred device, making banking more accessible and efficient.

The impact of these chatbots is measurable. Banks using them have reported up to a 30% reduction in costs and a 20% increase in customer satisfaction. Additionally, key performance metrics have shown significant improvements:

| Outcome | Measurement |

|---|---|

| Customer Satisfaction Score | Increased by 26% |

| First-Contact Resolution Rate | Improved by 35% |

| Average Resolution Time | Decreased from 8.5 min to 3.2 min |

These results demonstrate how chatbots enhance interactions and streamline banking processes. Sobot’s chatbot further elevates this experience by integrating with financial APIs, ensuring secure and seamless operations.

Investment Chatbots for Portfolio Insights

Investment chatbots provide valuable insights into your portfolio, helping you make smarter financial decisions. They analyze market trends, assess your risk tolerance, and recommend investment opportunities tailored to your goals. For instance, you can ask a chatbot about the performance of your stocks, and it will deliver real-time updates and suggestions.

These chatbots also improve accessibility by breaking down complex financial data into simple, actionable insights. Sobot’s chatbot excels in this area by leveraging data analytics to offer predictive financial assistance. It can analyze your investment history and suggest strategies to optimize your portfolio. This proactive approach ensures you stay ahead in your financial journey.

Payment Chatbots for Seamless Transactions

Payment chatbots are transforming how you handle financial transactions. These AI-powered tools simplify processes like bill payments, fund transfers, and invoice management. You can complete these tasks quickly and securely without needing to visit a bank or navigate complex systems. By automating routine payment tasks, chatbots save you time and reduce errors.

AI chatbots enhance transaction efficiency in several ways:

- They detect anomalies and provide real-time insights, ensuring secure payments.

- They automate repetitive tasks, making transactions faster and more accurate.

- They handle payment-related inquiries, reducing the workload on human agents.

These advancements are not just convenient—they are cost-effective. AI chatbots are predicted to save the financial sector $7.3 billion by 2023. They also improve your experience by offering engaging interactions and optimizing lead generation.

Sobot’s AI chatbot takes payment processing to the next level. It integrates seamlessly with financial APIs, enabling smooth and secure operations. Whether you need to pay a bill or transfer funds, Sobot’s chatbot completes the task instantly. Its omnichannel support allows you to manage payments through platforms like WhatsApp and SMS, making it accessible wherever you are.

Imagine needing to pay your utility bill late at night. Instead of waiting until morning, you can simply ask the chatbot to process the payment. It handles the request immediately, ensuring your account stays up to date. This level of convenience and efficiency is why payment chatbots are becoming essential in financial services.

By adopting AI chatbots like Sobot’s, you gain a reliable partner for managing transactions. These tools not only save you time but also enhance your confidence in handling financial tasks securely and efficiently. Explore how Sobot’s chatbot can simplify your payments by visiting Sobot’s Chatbot.

Challenges and Considerations for Implementing Chatbots

Addressing Data Privacy and Security Concerns

When deploying chatbots in finance, ensuring data privacy and security is critical. Financial chatbots handle sensitive information like account details and transaction histories, making them attractive targets for cyberattacks. Threats such as malicious input, user profiling, and data breaches can compromise your trust in these systems. To mitigate these risks, businesses must adopt robust strategies like end-to-end encryption and blockchain technology. These measures protect your data and maintain its integrity.

Precautionary analyses are essential before launching a chatbot. Identifying vulnerabilities early helps prevent potential breaches. For example, financial institutions often implement secure authentication methods to safeguard user accounts. Maintaining trust is vital, as a single security lapse can harm a company’s reputation. Sobot’s chatbot prioritizes security by integrating advanced encryption and real-time monitoring, ensuring your data remains safe while you interact seamlessly.

Overcoming Limitations in Complex Query Handling

Chatbots excel at handling routine tasks, but complex financial queries can pose challenges. For instance, questions involving intricate investment strategies or regulatory compliance may require advanced capabilities. To address this, businesses focus on improving chatbot efficiency and user experience. Streamlined responses and reduced resolution times enhance satisfaction, while tools like sentiment analysis help chatbots understand your emotions and needs.

Metrics such as resolution rates and customer satisfaction scores measure a chatbot’s effectiveness. High engagement rates and user retention indicate its ability to provide value. For example, a chatbot that resolves 90% of queries quickly and accurately builds trust and encourages continued use. Sobot’s chatbot leverages AI and machine learning to analyze complex queries, delivering personalized and accurate responses that meet your expectations.

Ensuring Integration with Legacy Systems

Integrating chatbots with legacy financial systems can be challenging but essential for seamless operations. Many financial institutions rely on older infrastructures that may not easily support modern AI technologies. Successful integration requires careful planning and robust backend enhancements. For example, Union Financial Services transformed its customer service by integrating AI-powered chatbots, reducing response times by half and increasing satisfaction by 35%.

Generative AI has also proven effective in bridging gaps between traditional systems and modern chatbots. WillowTree’s banking chatbot demonstrated how advanced AI could enhance user interactions while adhering to strict regulations. Sobot’s chatbot integrates effortlessly with existing systems, ensuring smooth operations without disrupting your financial services. This adaptability makes it a reliable solution for modernizing legacy platforms.

Balancing Automation with Human Interaction

Automation in financial services has revolutionized customer interactions, but it cannot replace the human touch entirely. While chatbots handle routine tasks efficiently, you may still prefer human support for complex or emotionally sensitive issues. Striking the right balance between automation and human interaction ensures a seamless and satisfying experience.

Research highlights the importance of this balance. For example, 64% of consumers feel that online experiences often lack the human element. Additionally, 75% of users prefer human assistance when automated tools fail to meet their needs. This preference becomes even more pronounced during high-stakes decisions, with 69% of customers valuing personal advice. These insights emphasize the need for human expertise alongside AI-driven solutions.

| Evidence | Description |

|---|---|

| Importance of Trust | Combining AI with human interaction builds trust in financial services. |

| Role of Human Expertise | Human agents provide meaningful advice, enriching the customer experience. |

| Implementation Strategy | A strategic approach ensures AI complements human insights effectively. |

Imagine you are making a significant financial decision, such as choosing an investment plan. A chatbot can provide data-driven recommendations, but a human advisor can offer nuanced insights based on your unique circumstances. This collaboration enhances your confidence and satisfaction.

Sobot’s AI chatbot exemplifies this balance. It automates repetitive tasks like account inquiries, freeing human agents to focus on complex issues. Its omnichannel capabilities ensure you can switch seamlessly between chatbot and human support across platforms like WhatsApp and SMS. This integration allows you to enjoy the efficiency of automation without losing the personal touch.

By combining the strengths of AI and human expertise, financial institutions can deliver a superior customer experience. This approach not only improves efficiency but also fosters trust and loyalty, ensuring you feel supported at every step of your financial journey.

Finance chatbots have revolutionized how you manage financial tasks, offering real-time support and personalized assistance. These tools operate 24/7, handle thousands of interactions simultaneously, and provide tailored financial advice, enhancing your experience and satisfaction. They also improve operational efficiency by automating routine inquiries and addressing security concerns effectively. Sobot’s chatbot exemplifies these benefits, delivering seamless, secure, and multilingual financial automation. By adopting advanced solutions like Sobot’s, you can streamline operations, boost customer engagement, and achieve greater efficiency in your financial services.

FAQ

What are chatbots, and how do they work in finance?

Chatbots are AI-powered tools that automate customer interactions. In finance, they handle tasks like answering queries, managing accounts, and processing payments. They use technologies like Natural Language Processing (NLP) to understand your questions and provide instant, accurate responses.

Can chatbots help with fraud detection?

Yes, chatbots monitor transactions in real time to identify unusual patterns. For example, they flag suspicious activities like unauthorized access or unexpected location-based transactions. Sobot’s chatbot enhances fraud detection with advanced algorithms and instant alerts, ensuring your financial security.

How do chatbots improve customer service in finance?

Chatbots provide 24/7 support, answer routine questions, and offer personalized advice. They reduce wait times and improve satisfaction. Sobot’s chatbot operates across multiple channels, including WhatsApp and SMS, making customer service accessible and efficient.

Are chatbots secure for handling sensitive financial data?

Chatbots use encryption and secure authentication methods to protect sensitive data. Sobot’s chatbot integrates real-time monitoring and advanced security measures to ensure your information remains safe during interactions.

Can chatbots assist with investment decisions?

Yes, chatbots analyze market trends and your portfolio to provide tailored investment advice. Sobot’s chatbot uses predictive analytics to recommend strategies based on your financial goals, helping you make informed decisions.

See Also

Enhancing Customer Satisfaction Through Effective Chatbot Use

Simple Steps for Integrating Chatbots on Your Website

Excelling in Live Chat for Superior Customer Service