The Importance of Chatbots for Personal Finance in 2025

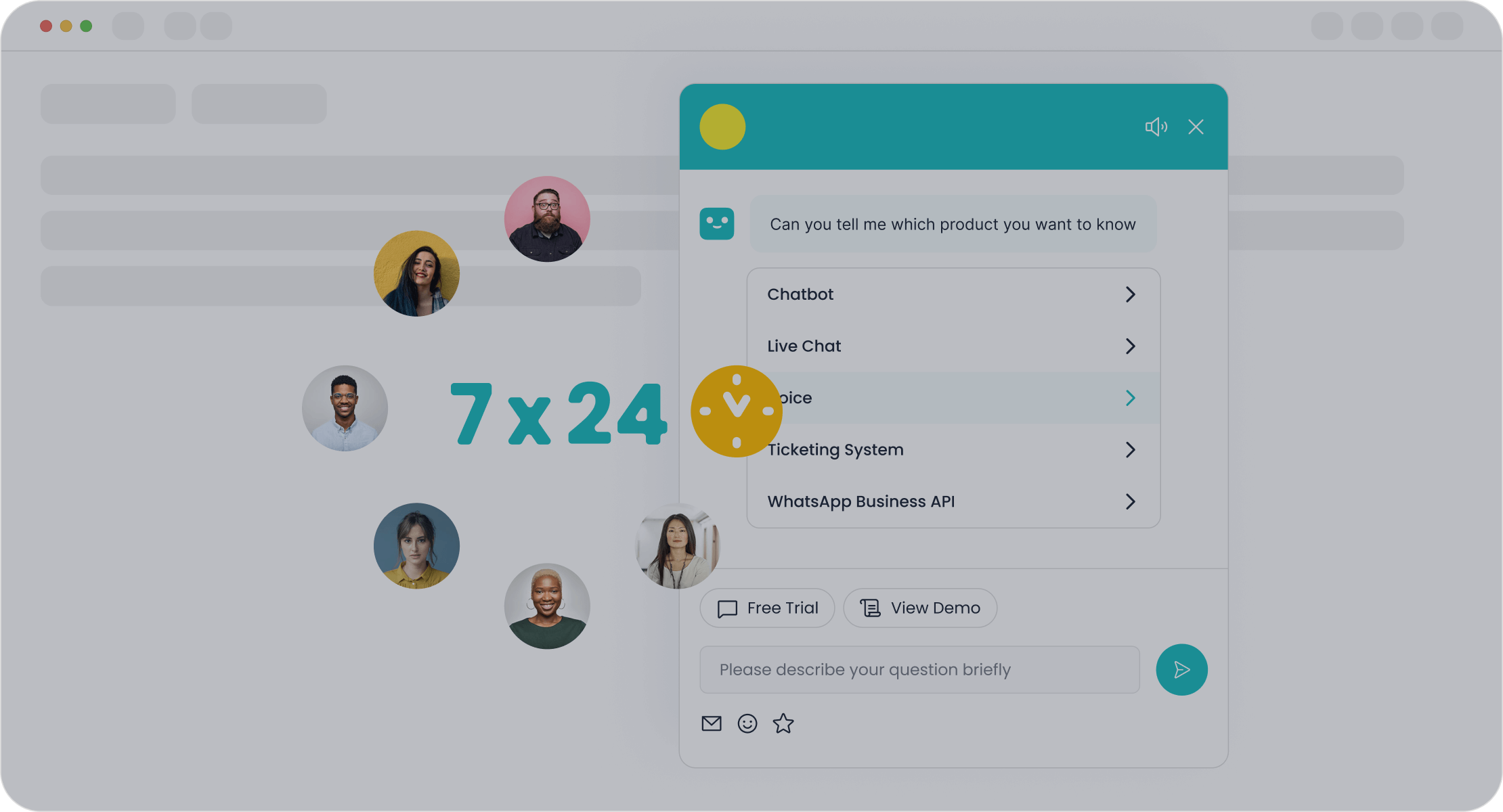

Imagine having a financial assistant available 24/7, always ready to guide you. AI chatbots for finance are making this a reality. With over 43% of Americans already using chatbots for issue resolution, their role in personal finance management is growing fast. Tools like Sobot's Chatbot streamline budgeting and improve accuracy, helping you achieve financial goals with ease.

Revolutionizing Personal Finance with AI Chatbots

Data-Driven Financial Decision-Making

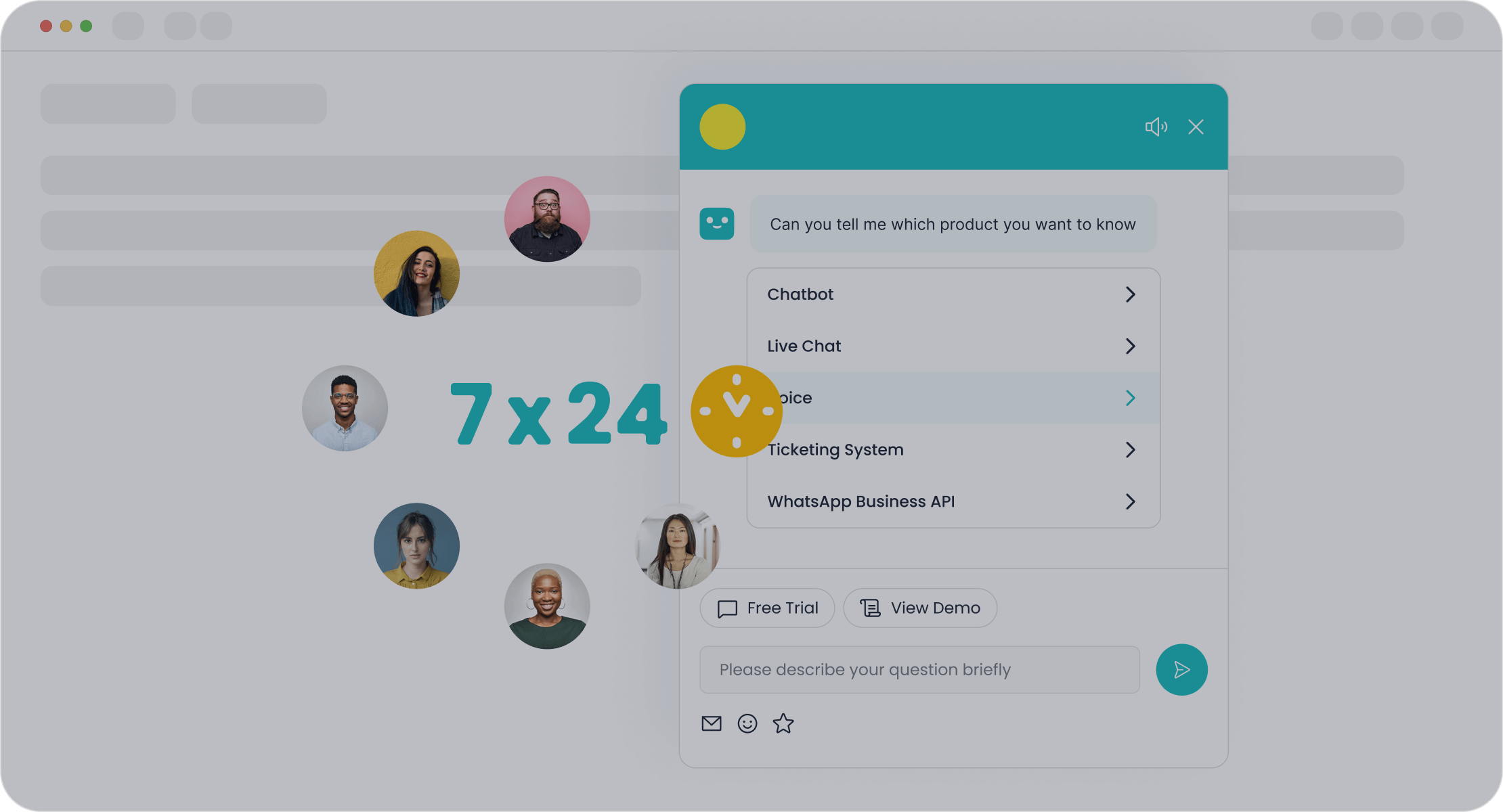

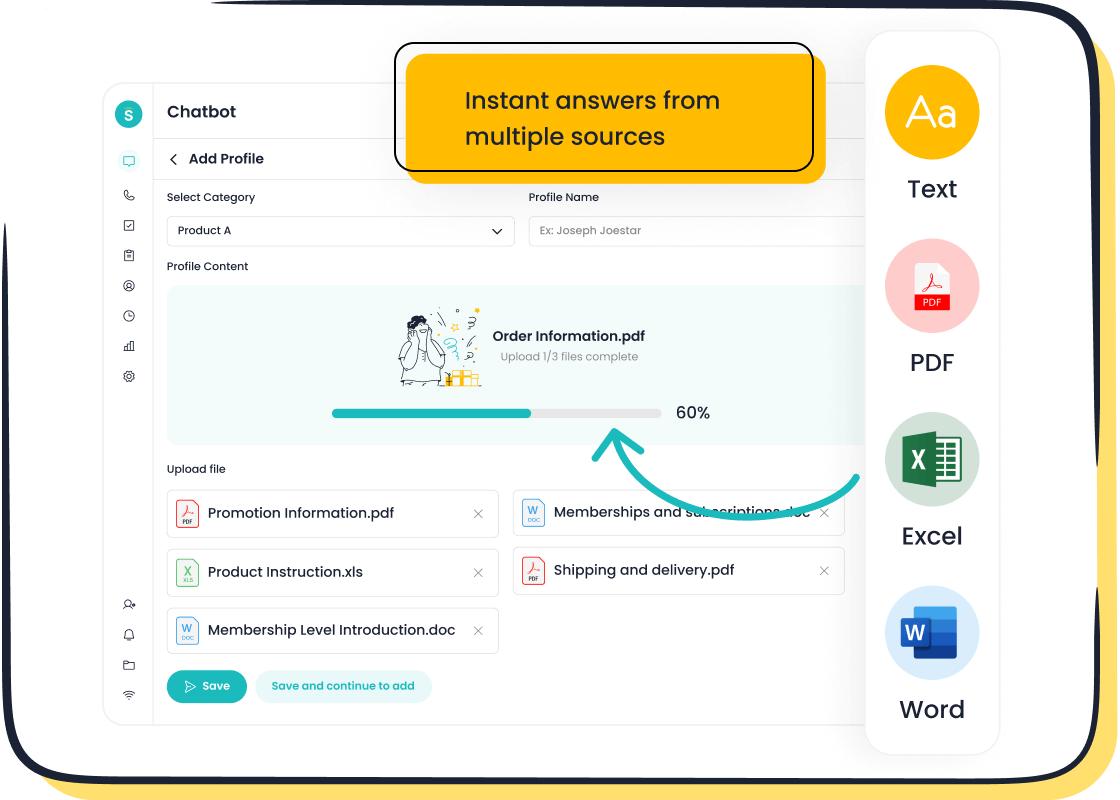

Imagine having a tool that helps you make smarter financial choices every day. AI chatbots for finance are transforming how you approach financial decision-making. These chatbots analyze your spending habits, categorize expenses, and even offer reminders to keep you on track. For example, Sobot's AI Chatbot uses advanced data analytics to provide personalized financial advice tailored to your goals.

Data-driven decision-making (DDDM) isn’t just a buzzword—it’s proven to work. Banks that adopted DDDM saw a 10.5% boost in output, with an additional 4.43% improvement when paired with data analytics investments. This means you can rely on chatbots to guide your financial planning with precision.

| Feature | Description |

|---|---|

| Instant Advice | Get tailored financial guidance anytime, without waiting. |

| Spending Analysis | Understand your spending patterns and stay on track with reminders. |

| Natural Language Processing | Chatbots respond conversationally, making financial advice feel personal. |

Predictive Insights for Smarter Spending

Wouldn’t it be great to know how your spending today impacts your financial health tomorrow? AI chatbots excel at predictive analytics, helping you make smarter spending decisions. They forecast trends based on your habits, ensuring you avoid overspending and save more effectively.

Take this example: A leading bank used predictive analytics to reduce loan defaults by 20% in just one year. This same technology powers chatbots like Sobot’s, enabling you to plan ahead and improve your financial performance. Companies using predictive insights report up to 20% greater forecast accuracy, which translates to better savings and smarter investments.

| Metric Type | Key Measures | Target Accuracy |

|---|---|---|

| Statistical Accuracy | MAE, MAPE | MAPE < 10% |

| Financial Performance | Revenue Growth Rate, Profit Margins | Improvement > 15% |

| Operational Efficiency | Cash Flow Accuracy, Inventory Turnover | Variance < 5% |

Risk Assessment and Mitigation in Real-Time

Managing financial risks can feel overwhelming, but AI chatbots simplify this process. They process real-time data to identify potential risks and offer solutions instantly. For example, Sobot’s chatbot integrates predictive insights to safeguard your financial decisions, ensuring you stay ahead of potential pitfalls.

Some companies, like SoFi, use AI-driven platforms to enhance fraud prevention strategies. Their chatbot handles inquiries efficiently while analyzing data to improve fraud detection rates. With tools like these, you can trust chatbots to protect your financial health and provide peace of mind.

Tip: Real-time risk assessment isn’t just about avoiding losses—it’s about building confidence in your financial planning.

Personalized Financial Management with Sobot Chatbot

Tailored Budgeting and Savings Plans

Managing your finances can feel overwhelming, but Sobot’s AI chatbot makes it simple. By analyzing your historical spending data, it creates personalized budgets tailored to your goals. Imagine having a tool that predicts future expenses based on past trends, helping you plan ahead with confidence. Tools like Tends and Life Planner already use similar AI algorithms to optimize savings. Sobot takes it further by offering personalized financial advice that aligns with your unique needs.

You’ll also love how the chatbot simplifies financial planning. It automates tasks like tracking bills and suggesting spending adjustments. Apps like Wally and Rocket Money have shown how AI can help users save more effectively. With Sobot, you get a smarter, more efficient way to manage your money and achieve savings optimization.

Automated Expense Categorization for Better Tracking

Tracking expenses manually is a hassle. Sobot’s automated expense categorization eliminates this burden by organizing your spending into clear categories. This feature improves accuracy and saves time, making personal financial management easier than ever.

For instance, companies like Swiss Sports Co. achieved a 472% efficiency improvement by automating expense tracking. ARAG streamlined processes and improved compliance with nearly 100% automation. Sobot’s chatbot brings this level of precision to your personal finances, ensuring you stay on top of your financial health.

Real-Time Budgeting and Expense Tracking

Staying updated on your finances is crucial. Sobot’s chatbot offers real-time budgeting and expense tracking, giving you instant insights into your financial health. Whether you’re saving for a vacation or managing monthly bills, this feature keeps you informed and in control.

With AI chatbots like Sobot, you can make smarter financial decisions and improve your financial planning. It’s like having a personal assistant dedicated to your financial well-being, available 24/7.

Streamlining Financial Operations with Chatbots for Finance

Simplifying Debt Management

Managing debt can feel like a heavy burden, but chatbots for finance make it easier. They help you organize repayment schedules, send reminders, and even suggest strategies to pay off loans faster. With tools like Sobot’s AI chatbot, you can track your debts in real-time and avoid missing deadlines.

Imagine having a virtual assistant that not only keeps you informed but also helps you prioritize which debts to tackle first. This automation of debt management ensures you stay on top of your financial obligations without the stress of manual tracking. By simplifying the process, chatbots give you more time to focus on saving and achieving your financial goals.

Automating Routine Financial Tasks

Routine financial tasks, like paying bills or tracking expenses, can be time-consuming. AI chatbots take over these repetitive jobs, saving you time and reducing errors. For example, automation reduces reporting errors by 90% and speeds up processes by 85 times. With Sobot’s chatbot, you can automate tasks like categorizing expenses or setting up recurring payments, ensuring accuracy and efficiency.

Manual data entry often leads to mistakes, but automation ensures consistent and reliable results. By modernizing financial processes, chatbots not only save you time but also build trust in your financial planning. This level of precision helps you focus on what truly matters—growing your savings and planning for the future.

Fraud Detection and Prevention

Fraud can disrupt your financial stability, but AI chatbots provide a strong line of defense. They monitor transactions in real-time, flag suspicious activities, and send immediate alerts for verification. For instance, Sobot’s chatbot analyzes transaction patterns to detect potential fraud and notifies you instantly.

This quick response can prevent significant financial losses. Chatbots also tailor their interactions based on your transaction history, adding a personalized layer of protection. By minimizing wait times and offering real-time support, they ensure your financial safety while enhancing your overall experience.

Tip: Always review alerts from your chatbot promptly to stay ahead of potential risks.

Enhancing Security and Trust in Personal Finance Management

Advanced Encryption and Data Privacy Standards

Your financial data deserves the highest level of protection, and advanced encryption ensures just that. AI chatbots for finance use cutting-edge encryption methods to safeguard sensitive information, preventing unauthorized access and reducing the risk of data breaches. This isn’t just about keeping your data safe—it’s about maintaining your trust and confidence in the tools you rely on for financial planning.

Companies that prioritize data security and encryption often see significant benefits. For example:

- A robust encryption framework protects trade secrets and ensures compliance with regulations.

- Regular audits and employee training foster a culture of privacy.

- Improved privacy scores lead to higher consumer trust levels.

Sobot’s AI chatbot integrates these practices seamlessly, ensuring your financial insights remain secure while you focus on saving and achieving your goals.

Building Confidence Through Transparency

Transparency builds trust, especially when it comes to managing your finances. Chatbots for finance, like Sobot’s, prioritize clear communication, ensuring you always know how your data is being used. This openness fosters confidence and loyalty, making you feel more secure in your financial decisions.

Studies back this up. The Edelman Trust Barometer found that trustworthy brands are more likely to succeed. Similarly, Salesforce reported that 80% of customers prefer engaging with transparent companies. When you know your chatbot operates with integrity, you can focus on saving and planning without second-guessing its reliability.

AI-Powered Fraud Prevention Measures

Fraud can derail your financial planning, but AI-powered tools are here to help. Chatbots equipped with fraud detection systems monitor transactions in real-time, flagging suspicious activities and notifying you instantly. This proactive approach minimizes risks and keeps your finances safe.

Here’s how these systems work:

- Real-time Monitoring: Identifies irregularities early, reducing manual intervention.

- Customizable Fraud Scoring: Tailors detection settings to your needs for better accuracy.

- Collaboration with Institutions: Shares data to uncover fraud patterns and improve prevention.

Sobot’s chatbot excels in these areas, offering a fraud detection ROI that maximizes efficiency while keeping your savings secure. With 97% accuracy and 80% precision, you can trust it to protect your financial health.

Future Trends in AI Chatbots for Finance

Integration with Emerging Financial Tools

AI chatbots are becoming the backbone of modern financial ecosystems. By 2025, they’re expected to save organizations $80 billion in customer service costs. These tools don’t just answer questions—they integrate seamlessly with emerging financial platforms to enhance your experience. Imagine connecting your chatbot to investment management and robo-advising tools. It could analyze your portfolio, suggest adjustments, and even automate transactions.

Chatbots like Sobot’s are already leading this transformation. They unify multiple financial tools, from budgeting apps to savings platforms, into one easy-to-use interface. This integration speeds up routine banking processes and improves operational efficiency by up to 40%. You’ll enjoy faster responses, better insights, and a smoother financial journey.

| Metric | Value |

|---|---|

| AI market size in finance (2023) | $38.36 billion |

| Projected AI market size by 2030 | $190.33 billion |

| Compound annual growth rate (CAGR) | 30.6% |

| Annual contribution to global banking sector | $200 billion to $340 billion |

| Estimated increase in U.S. banking profits | $340 billion |

Voice-Activated and Multilingual Chatbots

Voice-activated chatbots are changing how you interact with your finances. Instead of typing, you can simply ask your chatbot to check your balance or set a savings goal. This hands-free convenience is perfect for busy lifestyles. Plus, multilingual capabilities ensure that everyone, regardless of language, can access these tools.

Sobot’s chatbot excels in this area. It supports multiple languages and integrates with platforms like WhatsApp, making it accessible to users worldwide. Whether you’re in the U.S. or abroad, you’ll get the same high-quality support. With 76% of customers preferring self-service options, voice-activated and multilingual chatbots are the future of AI in personal finance.

Predictive AI for Proactive Financial Management

Predictive analytics for strategic planning is a game-changer. Instead of reacting to financial issues, you can prevent them. For example, an AI-powered system helped a financial institution reduce fraud losses by 40% in one year. It analyzed transaction data in real-time, identifying suspicious patterns before they caused harm.

Sobot’s chatbot uses similar predictive models to help you save and plan better. It forecasts expenses, identifies saving opportunities, and even alerts you to potential risks. This proactive approach ensures you stay ahead of financial challenges, giving you peace of mind and a stronger financial future.

AI chatbots are transforming personal finance. By 2024, they’ll handle 70% of customer-bank interactions and resolve 80% of routine inquiries. Tools like Sobot’s Chatbot make managing money easier, safer, and more personalized. You’ll save time, reduce stress, and reach your goals faster. Embrace this technology—it’s your key to smarter financial management.

FAQ

What makes AI chatbots essential for personal finance in 2025?

AI chatbots simplify financial management by automating tasks, offering real-time insights, and enhancing security. Tools like Sobot’s Chatbot save time and improve accuracy, making them indispensable.

Can Sobot’s Chatbot really help me save money?

Yes! Sobot’s Chatbot automates expense tracking, suggests savings strategies, and reduces service costs by up to 50%. It’s like having a personal financial assistant available 24/7.

How secure is my financial data with AI chatbots?

AI chatbots, including Sobot’s, use advanced encryption and privacy standards. They monitor transactions in real-time, ensuring your financial data stays safe and protected from fraud.

See Also

Enhancing Customer Satisfaction Through E-commerce Chatbots

Best 10 Websites Implementing Chatbots This Year

Leading 10 Chatbots for Websites in 2024