Expert Advice on Selecting Chatbots for Financial Services

Chatbots are revolutionizing the finance industry in ways that seemed unimaginable just a few years ago. The adoption of chatbot in finance industry has surged, with interactions increasing by an astounding 3150% between 2019 and 2023. Financial institutions have successfully saved 862 million hours by automating tasks, leading to $7.3 billion in operational cost reductions. However, selecting the right chatbot goes beyond just technology. Expert guidance is essential to identify solutions that elevate customer service while addressing the unique demands of the finance sector. For example, Sobot’s chatbot solutions showcase how AI can drive efficiency and enhance customer satisfaction within financial institutions.

Understanding Chatbots in the Finance Industry

What Are Finance Chatbots?

Finance chatbots are digital assistants designed to simulate human conversations and perform specific tasks within the financial sector. These AI-powered virtual assistants can handle customer inquiries, provide financial advice, and automate routine processes. Some chatbots rely on rule-based systems, using decision trees or keyword databases to deliver limited responses. Others use advanced AI technologies, such as machine learning, to engage in natural and dynamic conversations.

In the banking industry, chatbots focus on tasks like account management, transaction tracking, and fraud detection. They are tailored to meet the unique demands of financial institutions, ensuring secure and efficient interactions. By 2025, organizations using chatbots are expected to save $80 billion in customer service costs, highlighting their growing importance in the finance industry.

Key Features of Banking Chatbots

Banking chatbots come equipped with features that enhance customer service and operational efficiency. Here are some of the most notable ones:

| Feature | Description |

|---|---|

| Automation | Automates processes like FAQs and customer service, improving efficiency. |

| Customer Engagement | Interacts with customers on their preferred channels, boosting engagement. |

| Operational Efficiency | Reduces costs and minimizes errors, freeing agents for complex tasks. |

| Cost Savings | Saves banks billions by automating customer interactions and reducing agent dependency. |

These features make banking chatbots indispensable tools for financial institutions aiming to streamline operations and improve customer satisfaction.

Common Applications of Finance AI Chatbots

Finance AI chatbots are transforming how financial institutions operate. They are widely used in the following areas:

- Customer Service: AI chatbots provide 24/7 support, handling tasks like balance inquiries and troubleshooting.

- Expense Tracking: They simplify budgeting by categorizing expenses and tracking spending habits.

- Personalized Financial Advice: Chatbots analyze transaction history to offer tailored recommendations.

- Lead Generation: They assist in onboarding by gathering client information and guiding new customers.

- Fraud Prevention: AI-powered chatbots monitor account activity in real-time to detect suspicious behavior.

- Operational Efficiency: They automate customer interactions, reducing costs and speeding up processes.

These applications demonstrate the versatility of finance chatbots in addressing both customer needs and operational challenges. With advanced data analysis and multi-language support, they also enhance accessibility and customer experience.

Benefits of Chatbots for Financial Institutions

Enhancing Customer Service with Finance Chatbots

Finance chatbots are transforming customer service in the banking industry by offering instant, accurate, and round-the-clock support. These AI chatbots can handle up to 80% of routine customer inquiries, such as balance checks, transactional support, and account updates. This allows your human agents to focus on more complex issues, improving overall efficiency. Additionally, approximately 65% of customers prefer using chatbots for quick financial answers, showcasing their role in enhancing customer experience.

By automating repetitive tasks, finance chatbots reduce wait times and provide personalized financial advice based on customer data. For example, they can analyze spending habits to offer tailored budgeting tips. This level of digital customer service not only boosts satisfaction but also builds trust. With chatbots in banking, you can deliver seamless and efficient interactions, ensuring your customers feel valued.

Improving Security and Fraud Prevention

AI chatbots play a critical role in fraud detection and security enhancement. They monitor transactions in real-time, flagging unusual activities to prevent potential losses. These virtual assistants also use predictive threat modeling to identify fraud patterns before they occur. For instance, they analyze historical data to forecast risks and recommend preventive measures.

| Aspect | Description |

|---|---|

| Real-Time Detection | Monitors transactions and flags unusual activities immediately. |

| Predictive Threat Modeling | Analyzes historical data to forecast fraud patterns. |

| Dynamic Learning | Adapts to new fraud techniques through continuous learning. |

| Enhanced Identity Verification | Utilizes biometric and multi-factor authentication for stronger security. |

| Anomaly Detection | Identifies deviations from normal behavior to detect fraud. |

| Automated Investigation Support | Generates reports and highlights suspicious patterns for streamlined investigations. |

These capabilities ensure your financial institution stays ahead of evolving threats, safeguarding both your operations and your customers.

Streamlining Operations and Reducing Costs

Finance chatbots significantly streamline operations by automating routine processes and reducing the workload on your staff. On average, they lower costs by $0.70 per customer interaction compared to traditional phone support. Banks with mature chatbot implementations have reported a 35% decrease in call center volume, allowing them to allocate resources more effectively.

The return on investment (ROI) for AI chatbots is impressive, with most financial institutions achieving a 250% ROI within 18 months of implementation. By automating tasks like transactional support and customer inquiries, chatbots in banking not only cut expenses but also enhance operational efficiency. This makes them an indispensable tool for financial management in today’s competitive landscape.

💡 Tip: Implementing finance chatbots can help your institution achieve cost savings while enhancing customer experience and operational efficiency.

Boosting Customer Engagement and Satisfaction

Chatbots have become essential tools for improving customer engagement and satisfaction in financial services. By offering instant responses and personalized interactions, they create a seamless digital customer service experience that meets modern expectations. You can use chatbots to engage customers across multiple channels, ensuring they receive consistent support wherever they interact with your institution.

Metrics That Reflect Engagement and Satisfaction

Understanding how chatbots impact customer experience requires tracking key metrics. These metrics provide insights into user behavior and satisfaction levels:

| Metric | Description |

|---|---|

| Session Duration | Average time users spend interacting with the chatbot. |

| Interactions per Session | Number of message exchanges in a single session. |

| Completion Rate | Percentage of conversations successfully resolved. |

| Active Users | Count of unique users interacting with the chatbot monthly. |

These metrics highlight how chatbots keep users engaged while ensuring their needs are met efficiently.

How Chatbots Enhance Customer Experience

Chatbots improve customer experience by delivering tailored solutions based on user data. For example, sentiment analysis helps refine conversation flows, ensuring responses match the tone and intent of the user. Post-conversation surveys measure CSAT scores, allowing you to identify trends and address problem areas. Additionally, chatbots achieve high resolution rates by accurately completing interactions, which boosts customer satisfaction.

💡 Tip: Use tools like Net Promoter Score (NPS) surveys to gauge how likely customers are to recommend your chatbot service. This feedback helps you refine your chatbot’s performance and improve engagement.

Practical Benefits for Financial Institutions

Chatbots not only enhance engagement but also streamline customer service operations. They handle repetitive tasks, freeing agents to focus on complex issues. This improves efficiency while maintaining high satisfaction levels. Customers appreciate the convenience of instant support, which builds trust and loyalty over time. By integrating chatbots into your financial services, you can create a more engaging and satisfying experience for your users.

How to Choose the Right Chatbot for Your Financial Institution

Defining Your Institution’s Needs

Before selecting a chatbot, you must clearly define your institution’s requirements. Start by identifying the specific tasks your finance chatbots will handle. For example, will they assist with account balance inquiries, bill payments, or fraud detection? Determine the percentage of customer interactions that can be automated and calculate the average handling time for these tasks. This helps you estimate the workload and efficiency improvements.

Next, assess the quality and availability of your data. High-quality data is essential for training ai chatbots to deliver accurate responses. Address any gaps or biases in your data to ensure fair and reliable outcomes. Additionally, evaluate your institution’s security needs. Safeguarding customer information during chatbot interactions is critical in the banking industry. Implementing robust data protection measures will help you maintain trust and compliance.

| Specific Needs | Description |

|---|---|

| Assess Data Availability | Ensure sufficient, relevant, and high-quality data for chatbot training. |

| Ensure Data Security | Protect customer information during interactions. |

| Address Data Gaps | Plan for additional data collection to enhance chatbot performance. |

| Address Data Biases | Mitigate biases to ensure fair and accurate AI outcomes. |

💡 Tip: Clearly defining your needs ensures that your chatbot aligns with your institution’s goals and customer expectations.

Evaluating Scalability and Flexibility

Scalability and flexibility are vital when choosing finance chatbots. Your chatbot should grow with your institution, handling increasing customer interactions without compromising performance. Look for digital solutions that support omnichannel deployment, allowing customers to interact seamlessly across platforms like WhatsApp, email, and SMS.

Flexibility is equally important. A customizable chatbot can adapt to your institution’s unique requirements. For instance, you may need to integrate it with fraud detection systems, CRMs, or compliance tools. Advanced ai chatbots also offer natural language processing (NLP) capabilities, enabling them to understand and respond to customer queries more effectively.

Key benchmarks for scalability and flexibility include:

- Integration Capabilities: Ensure compatibility with essential tools like market data platforms.

- Performance Metrics: Monitor response accuracy, fraud detection rates, and customer satisfaction scores.

- Omnichannel Support: Deploy the chatbot across multiple platforms for a seamless experience.

💡 Note: A scalable and flexible chatbot ensures long-term value and adaptability in the dynamic banking industry.

Ensuring Compliance with Financial Regulations

Compliance is non-negotiable in the finance industry. Your chatbot must adhere to regulations like GDPR and PCI DSS to protect customer data and avoid penalties. For example, GDPR requires that users can access, correct, or delete their personal information. Non-compliance can lead to hefty fines and damage your institution’s reputation.

| Compliance Standard | Description |

|---|---|

| PCI DSS | Ensures secure handling of payment data. |

| GDPR | Regulates data protection and privacy for individuals. |

Strong authentication mechanisms, such as multi-factor authentication and role-based access, are essential for secure operations. Additionally, ai chatbots should include advanced encryption to safeguard sensitive information. By prioritizing compliance, you not only protect your customers but also strengthen their trust in your services.

💡 Tip: Regularly review your chatbot’s compliance with evolving regulations to maintain operational integrity.

Integration with Existing Systems

Integrating a chatbot with your existing financial systems is essential for seamless operations. A well-integrated chatbot can access customer data, process transactions, and provide real-time assistance without disrupting your workflows. To achieve this, you need a solution that supports compatibility with your current tools, such as CRMs, fraud detection systems, and payment gateways.

Successful integrations demonstrate the potential of chatbots in financial services. For example:

| Institution | Chatbot Name | Key Features |

|---|---|---|

| Bank of America | Erica | Automates banking functions, provides personalized financial recommendations, detects fraud in real-time. |

| HSBC | N/A | Uses AI to enhance anti-money laundering efforts by analyzing transactions for suspicious activities. |

- Bank of America: Erica assists with banking queries and fraud detection by analyzing transaction patterns.

- HSBC: Integrated an AI system to improve anti-money laundering efforts by detecting unusual transaction patterns.

When selecting a chatbot, prioritize solutions that offer robust APIs for integration. This ensures your chatbot can communicate with other systems effectively. Additionally, look for platforms that support omnichannel deployment, allowing customers to interact across multiple channels like WhatsApp, email, and SMS. A well-integrated chatbot not only enhances efficiency but also strengthens customer trust by delivering consistent and secure experiences.

💡 Tip: Choose a chatbot that aligns with your institution’s existing infrastructure to maximize its potential and minimize disruptions.

User Experience and Multilingual Support

A chatbot’s success depends heavily on its user experience and multilingual capabilities. Customers expect intuitive interfaces and support in their preferred language. To meet these expectations, focus on the following benchmarks:

- Comprehensive Localization: Ensure all communication is accurately translated and culturally sensitive.

- User-Centric Design: Adapt interfaces for readability and varying text lengths.

- Multilingual Customer Support: Provide assistance in multiple languages across various channels.

- Real-Time Language Switching: Allow users to switch languages seamlessly during interactions.

- NLP in Multiple Languages: Enable the chatbot to understand and respond in diverse languages.

A study by Common Sense Advisory revealed that 74% of consumers are more likely to make repeat purchases if post-sale support is available in their language.

Chatbots like Sobot’s AI-powered solution excel in these areas. They offer multilingual support, real-time language switching, and adaptive learning to improve responses over time. By prioritizing user experience and language accessibility, you can enhance customer satisfaction and engagement.

💡 Note: Regularly gather user feedback to address language-specific issues and refine the chatbot’s performance.

Custom vs. Off-the-Shelf Chatbot Solutions

Overview of Custom Chatbot Solutions

Custom chatbot solutions are tailored to meet the specific needs of your financial institution. These chatbots are built from the ground up, offering full flexibility and control over features, design, and integrations. They can adapt to your unique workflows, ensuring seamless compatibility with existing systems like fraud detection tools or CRMs. For example, many financial institutions prioritize API investments, with adoption rates increasing from 35% in 2019 to 47% in 2021. This shift reflects the growing demand for custom solutions that align with industry-specific requirements.

Custom chatbots also deliver significant operational benefits. Businesses using custom APIs report a 25-35% boost in efficiency within the first year. However, these advantages come with higher upfront costs and longer development cycles. Despite these challenges, custom solutions remain a popular choice for institutions seeking scalability and long-term value.

Overview of Off-the-Shelf Chatbot Solutions

Off-the-shelf chatbot solutions are pre-built platforms designed for quick deployment. These chatbots come with standard features like customer support automation, multilingual capabilities, and basic integrations. They are ideal for financial institutions looking to implement a chatbot without extensive development resources. For instance, off-the-shelf solutions can handle up to 80% of customer inquiries, significantly reducing operational costs.

These solutions are managed by the provider, which simplifies maintenance and updates. While they offer lower initial costs, their flexibility is limited to pre-built features. This makes them suitable for institutions with straightforward needs but less effective for those requiring advanced customization.

Pros and Cons of Custom Chatbots

Custom chatbots offer unparalleled flexibility and scalability. They can integrate seamlessly with your banking systems, providing tailored solutions for tasks like fraud detection and personalized financial advice. Additionally, they enhance customer service by reducing response times and minimizing errors. For example, chatbots save up to 4 minutes per inquiry, contributing to a 30% reduction in customer service costs.

However, custom solutions require significant investment. Development costs are 4-5 times higher than off-the-shelf options, and implementation takes longer. Maintenance also demands in-house expertise, which can increase operational complexity. Despite these drawbacks, custom chatbots are a worthwhile investment for institutions aiming to deliver exceptional customer experiences and achieve long-term efficiency.

💡 Tip: Evaluate your institution’s goals and resources before deciding between custom and off-the-shelf solutions. This ensures you choose the option that best aligns with your needs.

Pros and Cons of Off-the-Shelf Chatbots

Off-the-shelf chatbot solutions offer a quick and cost-effective way to implement AI-powered customer service. These pre-built platforms are ideal for financial institutions seeking immediate deployment without extensive development resources. However, they come with their own set of advantages and limitations.

Advantages:

- Ease of Deployment: Off-the-shelf chatbots are ready to use, requiring minimal setup time.

- Cost-Effectiveness: They are more affordable than custom solutions, making them suitable for smaller institutions.

- Maintenance Included: Providers handle updates and technical support, reducing your operational burden.

- Basic Features: These chatbots often include essential functionalities like multilingual support and basic automation.

Limitations:

- Limited Customization: Pre-built solutions may not fully align with your institution's unique needs.

- Scalability Challenges: They might struggle to handle large-scale operations or complex workflows.

- Restricted Functionality: Advanced features like fraud detection or personalized financial advice may be unavailable.

| Chatbot Solution | Pros | Cons |

|---|---|---|

| Intercom | Highly customizable chat flows, strong integration options, powerful analytics | High pricing for small businesses; limited flexibility for specific use cases |

| Zendesk Answer Bot | Smooth integration with Zendesk, ideal for existing users, multilingual support | Limited functionality beyond basic questions; constrained customizability |

| Drift | Built for lead generation, CRM integration for B2B sales | Primarily marketing-focused; may lack customer service functionality |

| Freshdesk Messaging | User-friendly, affordable, integrates with Freshdesk, some automation | Less advanced NLP; may not meet large-scale operation needs |

| Tidio | Affordable, good for e-commerce, easy for beginners | Limited advanced AI capabilities; may not scale for larger enterprises |

💡 Tip: Evaluate the scalability and functionality of off-the-shelf solutions to ensure they meet your long-term goals.

Choosing Between Custom and Off-the-Shelf Solutions

Selecting between custom and off-the-shelf chatbots depends on your institution’s specific needs, resources, and long-term objectives. A structured decision-making framework can simplify this process.

| Factor | Description | Example |

|---|---|---|

| Compliance | Ensure that your chosen solution complies with relevant data privacy regulations. | Custom solutions can be designed to meet specific regulatory requirements like GDPR or HIPAA. |

| Long-Term Maintenance | Consider the resources needed for maintaining the solution. | Off-the-shelf solutions often include maintenance, while custom solutions require dedicated resources. |

| Scalability | Plan for future scalability requirements and how each solution handles scaling. | Ensure the solution can handle increased data and user loads over time. |

| Weighing Tradeoffs | Consider the tradeoffs discussed (customization, cost, reliability, etc.). | Balance the need for customization against the ease of use and lower costs of off-the-shelf solutions. |

| Use Cases and Examples | Refer to examples to understand how similar decisions have been implemented successfully. | Review case studies of companies that have implemented both types of solutions. |

Custom solutions provide unmatched flexibility and scalability, making them ideal for institutions with complex workflows. On the other hand, off-the-shelf chatbots excel in affordability and ease of use, making them suitable for straightforward applications. For example, banking chatbots often benefit from custom solutions due to their need for advanced features like fraud detection and compliance with strict regulations.

💡 Note: Assess your institution’s goals, budget, and operational complexity to make an informed decision.

Practical Steps to Implement a Chatbot in Financial Services

Planning and Setting Goals

Successful implementation begins with clear planning and goal-setting. You should divide the process into three phases: Crawl, Walk, and Run. In the Crawl phase, focus on immediate business needs by deploying finance chatbots for basic tasks like FAQs and account inquiries. During the Walk phase, refine AI capabilities using collected data to expand functionalities, such as fraud detection or personalized financial advice. Finally, in the Run phase, fully integrate ai chatbots into operations, ensuring continuous learning and feedback loops.

Set objectives tied to strategic goals. For example, aim to reduce customer service response times by 50% or increase customer satisfaction scores by 20%. Use straightforward KPIs to measure success, such as session completion rates or error reduction percentages. AI can assist in goal-setting by analyzing financial situations and mapping out realistic steps to achieve impactful results. This structured approach ensures your finance chatbots align with your institution’s long-term vision.

| Phase | Objective |

|---|---|

| Crawl | Establish a project foundation and address immediate business needs. Start with basic tasks. |

| Walk | Incrementally enhance AI capabilities based on collected data. Refine and expand functionalities. |

| Run | Fully integrate AI into operations and scale. Ensure continuous learning and feedback loops. |

💡 Tip: Include both short- and long-term results in your KPIs to track progress effectively.

Selecting the Right Vendor: Why Sobot Chatbot Stands Out

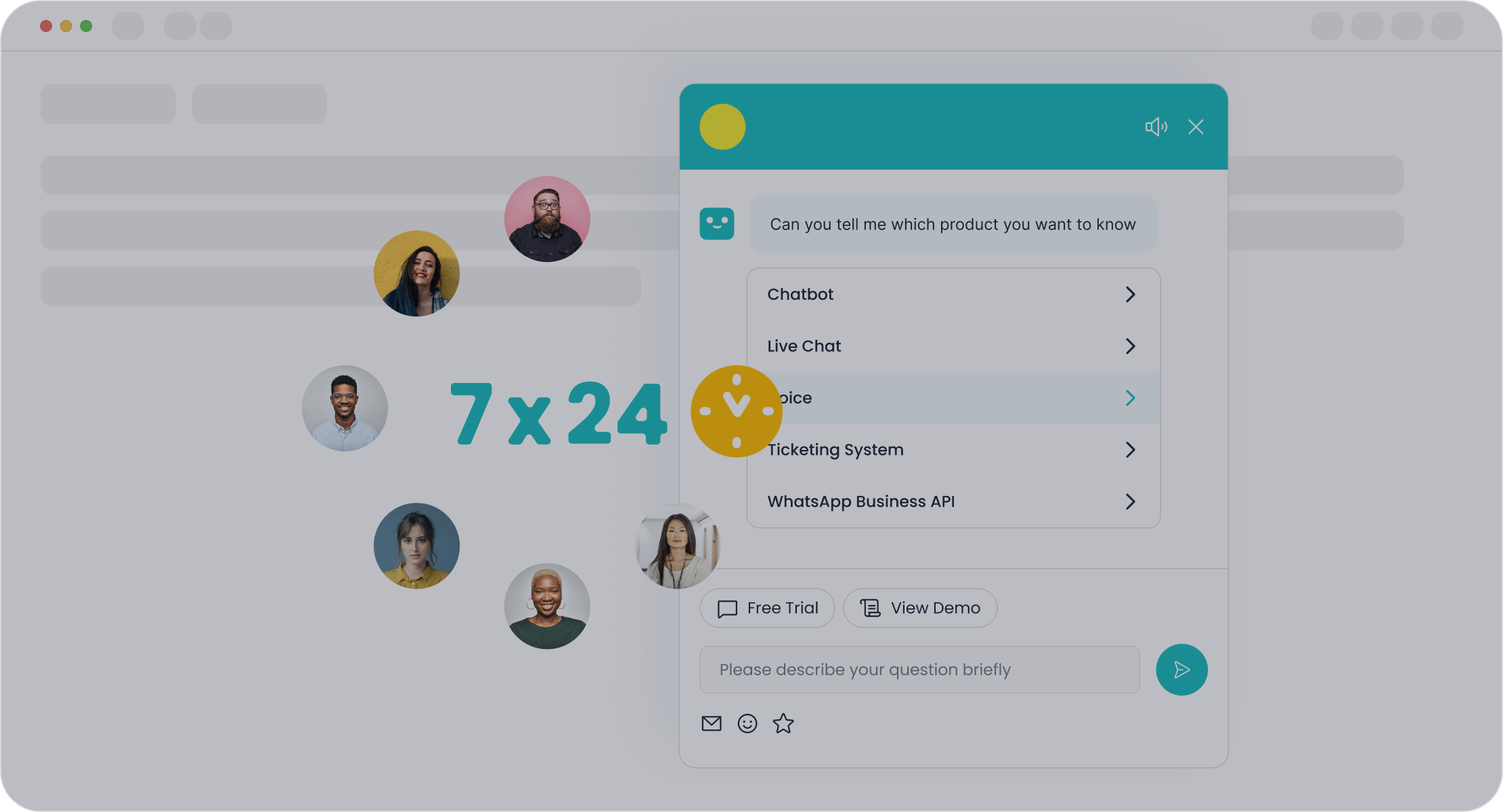

Choosing the right vendor is critical for implementing chatbots in banking. Sobot Chatbot stands out due to its exceptional performance metrics and customer satisfaction rates. Over 80% of answers provided by Sobot’s AI platform are correct, and its CSAT score reaches an impressive 97%. Additionally, Sobot’s solutions resolve 85% of customer issues autonomously, reducing inbound discussion volume by 20% over two years.

Sobot emphasizes efficiency and security, making it ideal for financial institutions. Its AI chatbots operate 24/7, ensuring seamless customer service while safeguarding sensitive data through advanced encryption and authentication measures. The platform’s multilingual capabilities and omnichannel support allow you to engage customers across various channels, such as WhatsApp and SMS, without compromising quality.

💡 Note: Sobot’s chatbot solutions have achieved a 96%+ positive feedback rate, demonstrating their reliability and effectiveness in the finance industry.

Designing and Testing the Chatbot

Designing and testing your chatbot ensures it meets user expectations and operational goals. Start by creating a conversational flow with clear messages and short text blocks. Use a natural tone to enhance user experience. Implement fallback mechanisms to prevent errors and confirm user actions before execution. Allow users to switch to live consultants easily when needed.

Testing protocols should focus on key performance indicators (KPIs) like reliability of information, accuracy of advice, and engagement levels. For example, measure whether the chatbot provides correct and unbiased financial insights or if conversations lead to desired outcomes, such as loan applications or account upgrades. Regularly seek user feedback to refine the chatbot’s performance and address any shortcomings.

| KPI Type | Description |

|---|---|

| Reliability of information | Ensures the chatbot provides correct, unbiased, and trustworthy information. |

| Accuracy of advice | Evaluates the correctness of the advice given, especially in expert advisory systems. |

| Engagement levels | Tracks user interactions and requests for further advice. |

| Conversion rates | Measures whether conversations lead to desired outcomes, such as sales leads. |

💡 Tip: Ensure the chatbot is visually identified as a bot to manage user expectations effectively.

Training the Chatbot with Financial Data

Training your chatbot with financial data is a critical step in ensuring its accuracy and reliability. To start, you need to gather high-quality data from various sources, such as transaction records, customer inquiries, and financial reports. This data forms the foundation of your chatbot’s knowledge base, enabling it to provide precise and relevant responses.

Organize the data into categories like account management, fraud detection, and customer support. This structure helps the chatbot understand different contexts and respond appropriately. Use tools that allow you to upload data in formats like PDFs, Excel sheets, or text snippets. For example, finance chatbots trained with categorized data can handle tasks like balance inquiries or fraud alerts more effectively.

Once the data is uploaded, focus on training the chatbot using machine learning models. These models analyze patterns in the data to improve the chatbot’s decision-making abilities. Regularly update the training data to include new financial products, services, or regulatory changes. This ensures your chatbot stays relevant and continues to meet customer expectations.

Testing is equally important. Simulate real-world scenarios to evaluate how well the chatbot handles complex queries. Monitor its performance and make adjustments to improve accuracy. A well-trained chatbot not only enhances customer satisfaction but also builds trust in your financial institution.

💡 Tip: Use multilingual training data to ensure your chatbot can serve a diverse customer base effectively.

Deployment and Continuous Optimization

Deploying your chatbot is the next step after training. Start by integrating it with your existing systems, such as CRMs or fraud detection tools. Ensure it operates seamlessly across multiple channels, including WhatsApp, email, and SMS. Finance chatbots with omnichannel support provide a consistent experience for customers, regardless of the platform they use.

After deployment, focus on continuous optimization. Regular updates are essential to keep the chatbot accurate and relevant. Add new information about financial products or services as they become available. Monitor user interactions to identify areas for improvement. For instance, if customers frequently ask questions the chatbot cannot answer, update its knowledge base to address those gaps.

Establish clear KPIs to measure the chatbot’s success. These should include metrics like response accuracy, customer satisfaction scores, and cost savings. Tie each KPI to a specific monetary value to demonstrate the chatbot’s financial impact. For example, ai chatbots that reduce call center volume can save your institution significant operational costs.

📊 Key Optimization Strategies:

- Continuously adapt the chatbot to new customer needs.

- Use user feedback to refine conversation flows.

- Monitor KPIs like completion rates and ROI to track performance.

By prioritizing optimization, you ensure your chatbot remains a valuable asset for your financial institution. This approach not only improves efficiency but also enhances the overall customer experience.

Selecting the right chatbot is vital for financial institutions aiming to enhance operations and customer satisfaction. With 1.9 billion people banking online today and this number expected to grow to 2.5 billion by 2024, the demand for efficient digital solutions is clear. Chatbots like Sobot’s AI-powered platform streamline processes, reduce costs, and improve customer engagement. For example, DNB Bank’s chatbot improved convenience by handling routine tasks, while Íslandsbanki automated 50% of chat traffic in just six months. Sobot’s multilingual capabilities and 24/7 availability make it an ideal choice for modern financial services. Explore Sobot’s solutions to transform your customer experience and operational efficiency.

FAQ

What is the main purpose of a finance chatbot?

A finance chatbot automates customer interactions. It answers questions, provides financial advice, and handles routine tasks like balance inquiries. This improves efficiency and saves time for both you and your customers.

How do chatbots ensure data security in financial services?

Chatbots use encryption, multi-factor authentication, and secure APIs to protect sensitive data. They comply with regulations like GDPR and PCI DSS, ensuring your customers' information stays safe.

💡 Tip: Always choose a chatbot provider with strong security measures and compliance certifications.

Can chatbots handle multiple languages?

Yes, advanced chatbots like Sobot’s AI Chatbot support multiple languages. They provide seamless communication by understanding and responding in your customers’ preferred language.

How do chatbots improve customer satisfaction?

Chatbots offer instant responses, 24/7 availability, and personalized interactions. They reduce wait times and provide accurate answers, making your customers feel valued and supported.

Do chatbots require coding knowledge to set up?

No, many chatbots, including Sobot’s, feature no-code interfaces. You can design workflows using simple drag-and-drop tools, making setup easy even without technical expertise.

💡 Note: A no-code chatbot saves time and resources during implementation.

See Also

Essential Tips for Selecting Top Chatbot Solutions

Simple Steps to Integrate Chatbots on Your Website

2024's Leading Chatbots for Enhancing Your Website