Top Finance AI Chatbots to Consider for Banking in 2025

Imagine a future where managing your finances feels effortless. Finance AI chatbots are making that a reality, revolutionizing banking and personal finance. These intelligent tools are transforming how you interact with financial institutions. By 2025, AI could save the global banking sector up to $340 billion annually and boost U.S. operating profits by the same amount. With the finance AI chatbot market growing at a staggering 30.6% annually, choosing the right solution, like Sobot's chatbot, could redefine efficiency and personalization in your financial journey.

What Are Finance AI Chatbots?

Definition and Overview

Finance AI chatbots are intelligent digital assistants designed to help you manage your money and interact with financial institutions. These chatbots use conversational AI to understand your questions and provide accurate answers. They can assist with tasks like checking your account balance, tracking expenses, or even offering personalized financial advice. Think of them as your 24/7 financial tools, always ready to simplify your banking experience.

The global chatbot market in the financial services sector is growing rapidly. It’s expected to jump from $890 million in 2022 to a whopping $6,170 million by 2030. This growth shows how essential finance chatbots are becoming in the world of banking and personal finance.

How They Work in Banking and Personal Finance

These chatbots rely on AI technology to process your requests. When you type or speak a question, the chatbot uses natural language processing to understand your intent. Then, it pulls data from its knowledge base or connects with your bank’s systems to provide the right information. For example, if you ask about recent transactions, the chatbot retrieves your account details and displays them instantly.

Banking chatbots also use machine learning to improve over time. The more you interact with them, the better they get at understanding your preferences. They can even predict your needs, like reminding you to pay bills or suggesting ways to save money. This makes them powerful financial tools for decision-making.

Why They Are Essential in 2025

By 2025, finance AI chatbots will be indispensable. They save you time by automating routine tasks like transferring money or setting up alerts. They also enhance security by detecting unusual activity and sending real-time alerts. For banks, these chatbots reduce costs and improve customer satisfaction. With the finance AI chatbot market growing at a 27.4% annual rate, their role in financial services will only expand.

In a world where speed and personalization matter, AI finance chatbots are your go-to solution. They combine efficiency with convenience, making them a must-have for both individuals and businesses.

Benefits of Using Finance AI Chatbots in Banking

Enhanced Customer Support and Engagement

Imagine having a customer support advisor who never sleeps and always knows the right answer. That’s what finance AI chatbots bring to the table. These banking chatbots are transforming how you interact with financial institutions by offering instant, accurate, and friendly support. For example, Erica, Bank of America’s virtual assistant, helps customers with budgeting, bill payments, and even investment opportunities. This level of engagement not only saves you time but also makes managing your finances less stressful.

Banks that have integrated conversational AI into their systems report impressive results. A leading financial institution saw a 45% reduction in customer service costs and a 35% increase in customer satisfaction scores. These chatbots don’t just answer questions—they create meaningful interactions that keep you coming back.

24/7 Availability and Faster Response Times

You don’t have to wait for business hours to get help anymore. AI finance chatbots are available around the clock, ensuring you get the support you need when you need it. Whether it’s 2 a.m. or during a holiday, these chatbots respond in under five seconds, compared to the average human agent wait time of over two minutes.

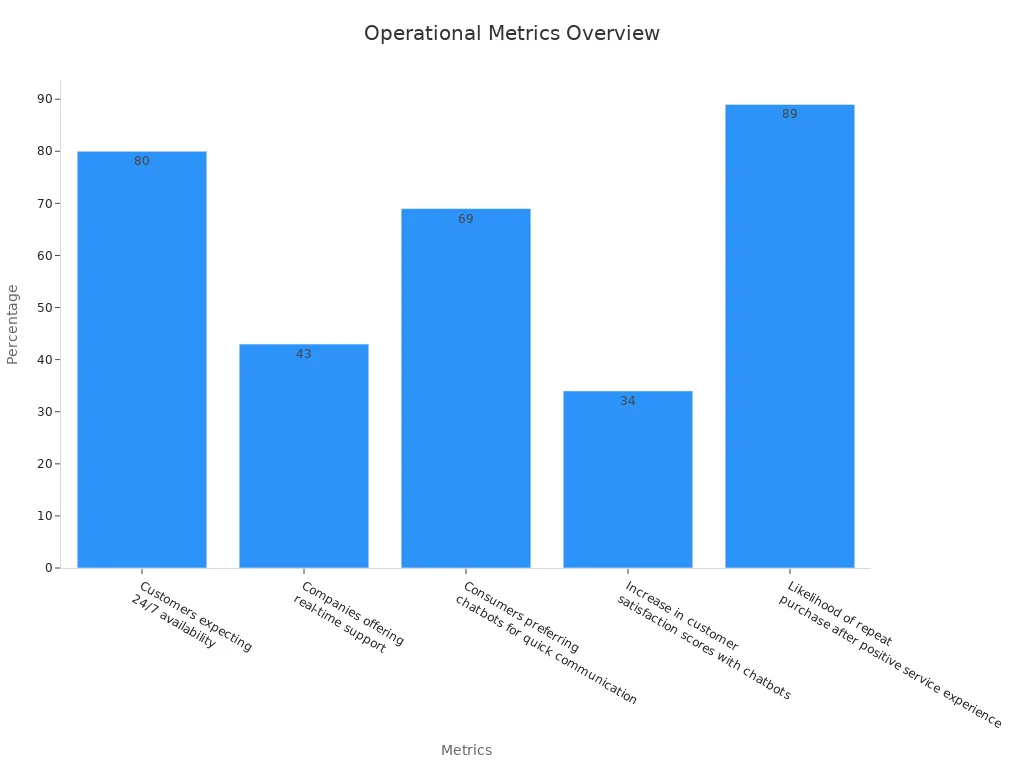

Here’s a quick look at why this matters:

| Metric/Statistic | Value |

|---|---|

| Customers expecting 24/7 availability | 80% |

| Companies offering real-time support | 43% |

| Average response time for chatbots | Under 5 sec |

| Increase in customer satisfaction scores | 34% |

This speed and availability make chatbots indispensable for personal finance management, especially during high-stress situations like fraud alerts or urgent transactions.

Personalized Financial Advice and Insights

Wouldn’t it be great if your financial tools could offer advice tailored just for you? Finance chatbots analyze your spending habits, income, and goals to provide personalized financial advice. They can suggest ways to save, recommend investment opportunities, or even alert you to upcoming bills. This level of personalized insights helps you make smarter decisions and improves your overall financial health.

Studies show that chatbots offering personalized financial advice significantly enhance decision-making. They don’t just provide information—they guide you toward better choices, making them invaluable for personal finance management.

Cost Savings for Banks and Financial Institutions

Finance chatbots aren’t just helpful for you—they’re a game-changer for banks too. By automating customer service tasks, banks save up to 40% on operational costs. Juniper Research estimates that chatbot implementation in the banking sector will save $7.3 billion globally. These savings allow financial institutions to invest in better services and technology, ultimately benefiting you as a customer.

Additionally, fintech companies have collectively saved 826 million hours of customer interaction time through chatbots. This efficiency doesn’t just cut costs; it also ensures you get faster, more reliable service.

Top Finance AI Chatbots for 2025

Erica by Bank of America: Personalized Banking Support

Erica, Bank of America’s AI-powered chatbot, is a trailblazer in personalized financial ecosystems. With over 2 billion interactions and 42 million users, Erica has proven its ability to simplify personal banking. It offers proactive insights tailored to your spending habits, helping you manage your finances with ease. Whether you need help budgeting, paying bills, or tracking financial transactions, Erica is always ready to assist.

What makes Erica stand out is its user-friendly interface and conversational AI capabilities. It doesn’t just answer questions—it anticipates your needs. For instance, it might alert you about unusual charges or suggest ways to save money. With 90% of users reporting a positive experience, Erica is setting a high standard for banking chatbots.

Eno by Capital One: Simplifying Financial Management

Eno by Capital One is another standout in the world of AI finance chatbots. This GenAI assistant simplifies financial management by monitoring your accounts for unique charges and providing real-time banking services. It even safeguards your financial information with virtual card numbers for online transactions.

Eno’s ability to handle inquiries and alert you to unusual activities makes it an invaluable personal banking assistant. It’s designed to enhance decision-making by offering real-time insights into your financial health. If you’re looking for a chatbot that combines security with convenience, Eno is a top choice.

Eva by HDFC Bank: Revolutionizing Rural Banking

Eva, HDFC Bank’s AI chatbot, is making waves in rural banking. It’s designed to bridge the gap between urban and rural financial services, offering support in multiple languages. Eva provides instant answers to queries about loans, savings, and other financial tools, making banking accessible to everyone.

This chatbot excels in delivering real-time insights and personalized support, even in areas with limited internet connectivity. By automating routine tasks, Eva not only saves time but also empowers users to make informed financial decisions. It’s a game-changer for rural communities.

KAI by Kasisto: AI-Powered Financial Assistance

KAI by Kasisto is a leader in AI chatbot platforms, specifically tailored for the financial industry. Banks like DBS and Westpac have integrated KAI to enhance customer support and financial advisory services. Its generative AI capabilities ensure accurate and contextually relevant responses, making it a reliable tool for real-time banking services.

KAI’s customization options allow financial institutions to create solutions that meet their unique needs. It’s also transparent about its training methodologies, ensuring trust and security. With proven technology and a focus on user experience, KAI is redefining what a financial assistant can do.

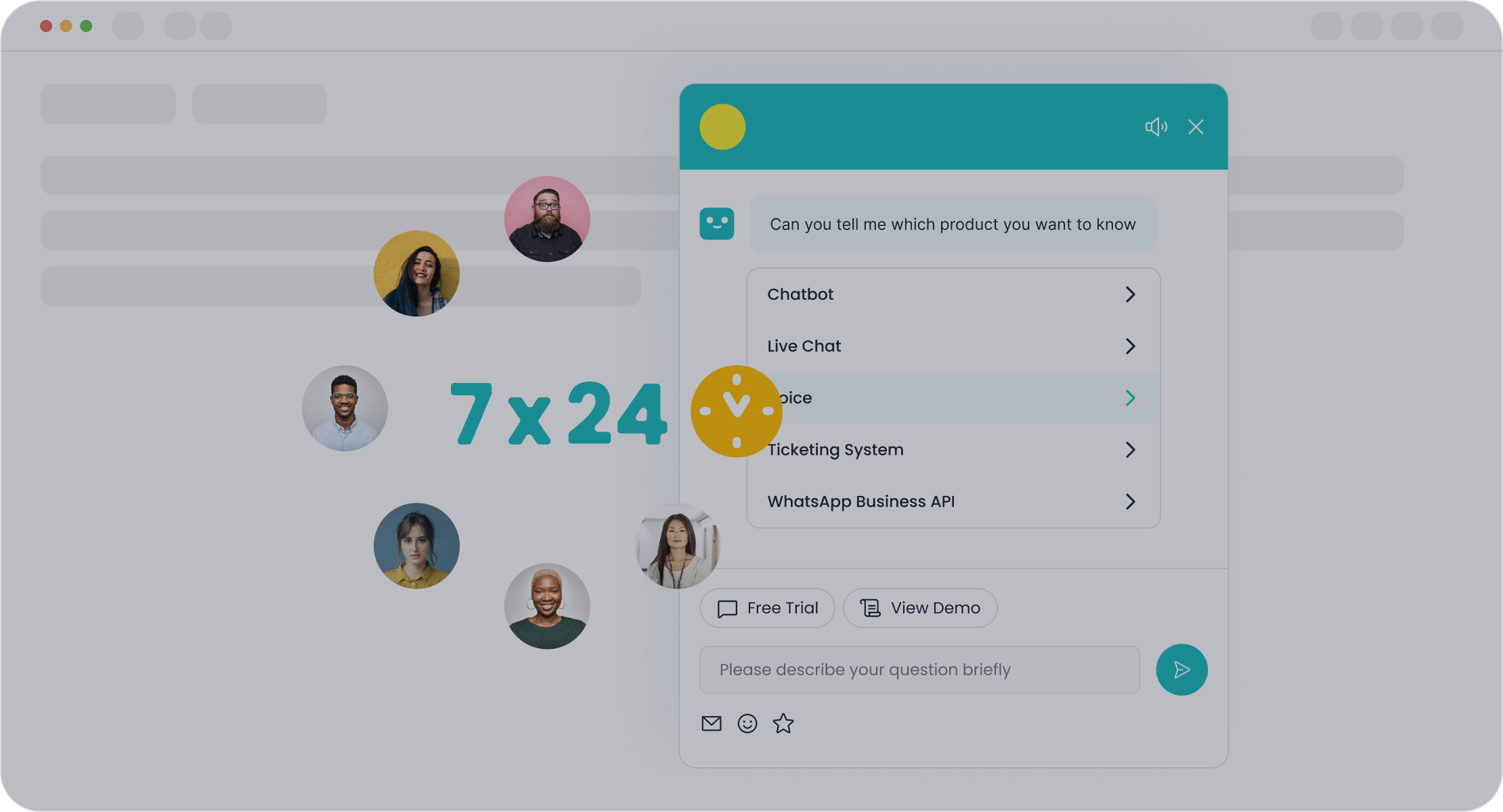

Sobot Chatbot: Enhancing Customer Interactions with AI

The Sobot Chatbot is a versatile solution designed to improve customer interactions across various industries, including financial services. It operates 24/7, autonomously handling up to 80% of inquiries and reducing resolution times by 50%. This efficiency not only saves costs but also enhances user experience.

Sobot’s multilingual capabilities and omnichannel support make it a standout choice for businesses aiming to streamline their operations. Its no-coding-required setup and customizable features allow you to tailor it to your needs. By integrating advanced conversational AI, Sobot helps you deliver faster, more personalized service, boosting customer satisfaction and loyalty.

Use Cases of Finance AI Chatbots

Streamlining Customer Support in Banking

Imagine needing help with your bank account at midnight. Instead of waiting for business hours, a chatbot can instantly assist you. Banking chatbots streamline customer support by providing 24/7 service, answering common questions, and resolving issues quickly. For example, Bank of America's Erica has handled over 50 million client requests, proving its effectiveness in customer support. These chatbots also reduce costs for banks, saving up to $340 billion annually through automation and efficiency.

Here’s how major banks are using chatbots to enhance customer support:

| Bank Name | Chatbot Name | Use Cases |

|---|---|---|

| Capital One | Eno | Provides tips on money-saving strategies, account security, and spending tracking. |

| JPMorgan Chase | N/A | Offers real-time sales notifications, credit card benefit reminders, and contextual recommendations. |

| Wells Fargo | Fargo | Allows sending funds, checking account information, and accessing FICO scores and spending summaries. |

These examples show how conversational AI is transforming banking experiences.

Assisting with Personal Finance Management

Managing your money can feel overwhelming, but chatbots make it easier. They analyze your spending habits, track expenses, and even offer personalized budgeting assistance. For instance, Sarah used an AI-powered budgeting app to set savings goals and improve her financial health. These tools act like personal financial advisors, guiding you toward smarter decisions.

Chatbots also excel in predictive financial forecasting. They use your financial data to predict future expenses and suggest ways to save. Whether you're planning a vacation or saving for college, these chatbots help you stay on track.

Fraud Detection and Security Alerts

Security is a top priority in banking, and chatbots play a crucial role in fraud detection. They monitor transactions in real time, identify suspicious activities, and send instant alerts. For example, chatbots use natural language understanding to detect fraudulent behavior and notify agents immediately. They also analyze patterns of fraud to improve their detection capabilities over time.

| Chatbot Functionality | Contribution to Fraud Detection |

|---|---|

| Conversation Recording | Helps in identifying suspicious activities |

| Natural Language Understanding (NLU) | Detects fraudulent behavior and alerts agents |

| Data Extraction | Identifies patterns of fraud for training updates |

With these features, chatbots ensure your financial data stays secure.

Automating Routine Banking Transactions

Chatbots simplify routine tasks like transferring money, paying bills, and checking account balances. They save you time and reduce the workload for bank employees. According to Gartner, chatbots could save banks up to $80 billion in customer service costs by 2025. They also improve workflow automation, allowing human teams to focus on complex issues.

For example, Coconut Software found that chatbots act as on-demand assistants, improving service efficiency. Whether you're setting up a recurring payment or checking your transaction history, these bots handle it all seamlessly.

How to Choose the Right Finance AI Chatbot

Key Features to Look For

When choosing a finance AI chatbot, focus on features that make your life easier. Look for a chatbot with a user-friendly interface that doesn’t require coding to set up. Multilingual support is a must if you deal with customers from different regions. Omnichannel capabilities are also essential. They let the chatbot interact across platforms like WhatsApp, SMS, and email, ensuring seamless communication.

Another key feature is conversational AI. This technology allows the chatbot to understand your intent and respond naturally, making interactions feel human-like. Fraud detection capabilities are also critical. A chatbot that monitors transactions and alerts you to suspicious activity can protect your finances. Finally, prioritize chatbots with workflow automation. These tools save time by handling repetitive tasks like ticketing and routine inquiries.

Evaluating Compatibility with Your Needs

Not all banking chatbots fit every system. Before choosing one, ensure it integrates smoothly with your existing platforms. Compatibility with legacy systems can be tricky, so check if the chatbot supports robust APIs for seamless interaction.

Here’s how some institutions have tackled compatibility challenges:

| Institution | Integration Details | Benefits |

|---|---|---|

| Wells Fargo | Integrated AI-powered chatbots for customer inquiries and transactions. | 24/7 support and improved customer satisfaction. |

| Capital One | Utilized AI chatbots to enhance operational efficiency. | More tailored and timely services for clients. |

If your systems are outdated, consider upgrading them to support modern AI chatbot platforms. This ensures you get the most out of your investment.

Assessing Security and Privacy Standards

Security should be your top priority. Finance AI chatbots handle sensitive data, so they must comply with strict privacy laws. Check if the chatbot has clear policies for data retention and sharing. Ethical standards are also crucial. Generative AI tools can be exploited to create deceptive content, so ensure the chatbot follows ethical guidelines.

To stay safe, assess risks like data breaches and biased algorithms. A thorough risk assessment helps you identify vulnerabilities and implement strategies to mitigate them. For example, chatbots must comply with wiretap laws due to their conversational nature. This ensures legal compliance while protecting your data.

Considering Scalability and Future-Proofing

Your chatbot should grow with your business. Scalable AI technology adapts to increasing workloads and complex tasks. Open AI platforms offer flexibility, allowing you to customize the chatbot to meet your unique needs.

The financial sector is transforming rapidly. By the end of 2024, 75% of enterprises will operationalize AI, making future-proof solutions essential. Arya.ai’s scalable infrastructure is a great example. It handles both routine and complex workflows, ensuring your chatbot remains effective as your business evolves.

Investing in a chatbot that integrates seamlessly with modern systems ensures you’re ready for the future. This approach enhances efficiency and keeps your operations ahead of the curve.

Finance AI chatbots are reshaping how you interact with banks and manage your money. They simplify tasks, save time, and offer personalized advice. Choosing the right chatbot ensures you stay ahead in 2025. With the AI market in banking projected to hit $315.50 billion by 2033, their role will only grow.

| Evidence Type | Description |

|---|---|

| Consumer Preference | 73% of consumers prioritize customer experience, driving demand for chatbots. |

| Market Growth | The AI market in banking will grow at 31.83% annually, reaching $315.50 billion by 2033. |

| Profit Increase | AI technologies could boost banking profits by $170 billion by 2028. |

The future of conversational AI in banking looks bright. It’s not just about convenience—it’s about transforming your financial journey.

FAQ

What is conversational AI, and how does it power finance chatbots?

Conversational AI enables chatbots to understand and respond naturally to your queries. It uses advanced technologies like natural language processing to make interactions feel human-like.

Can finance AI chatbots handle multiple languages?

Yes, many finance AI chatbots, like Sobot's, support multiple languages. This feature ensures you can communicate in your preferred language effortlessly.

Are finance AI chatbots secure?

Absolutely! These chatbots follow strict security protocols, including encryption and compliance with privacy laws, to protect your sensitive financial data.

See Also

10 Leading Websites Utilizing Chatbots This Year

10 Most Effective Chatbots for Websites This Year

How to Select the Ideal Chatbot Software