How can financial institutions meet the rising expectations of customers in today's fast-paced digital era? The answer lies in leveraging advanced technologies like chatbots, which have emerged as integral tools for transforming customer experiences.

In the finance sector, where accessibility, efficiency, and personalized service are paramount, chatbots offer a comprehensive solution. Sobot's chatbot, renowned for its robust features in 24/7 support, streamlined account management, personalized financial advice, and seamless integration with financial tools, exemplifies this transformative capability.

With chatbots, financial institutions can not only enhance customer satisfaction but also streamline operations and drive engagement. This article explores 7 applications of Sobot's innovative chatbot solutions that empower financial institutions to deliver exceptional service, strengthen customer relationships, and thrive in an increasingly competitive market landscape.

1. Account Management

Chatbots simplify account management by allowing customers to access their account information, check balances, and review transaction history through simple conversational interfaces. This feature saves time and improves the user experience by making account management more accessible and efficient.

Benefits

- Easy access to account information

- Reduced need for human customer service for routine inquiries

Case Study: Lowell's Success with Azure Cognitive Services

Lowell, a major credit management services company in Europe, was spending excessive time handling consumer questions, fulfilling routine requests, and looking up payment records. The company recognized that freeing its staff from these mundane tasks would not only enhance employee engagement but also allow financial counselors to focus on delivering better experiences for consumers and motivating timely payments.

To address this, Lowell partnered a company with expertise in emerging technologies, to develop an advanced call center automation solution. Together, they built an AI-enabled chatbot. The Lowell bot provides an efficient way for consumers to receive advice, establish payment plans, find answers to simple questions, and manage their own credit.

Results

20% increase in first-call resolution rates: The first-call resolution rate improved from 50% to 70%, showcasing the efficiency and effectiveness of the chatbot in handling customer inquiries and managing accounts. For detail read, please refer link

2. Personalized Financial Advice

By analyzing user data, chatbots can provide personalized financial advice tailored to individual needs. Whether it's investment recommendations or budget planning, chatbots offer valuable insights that help customers make informed financial decisions. Personalization has been shown to increase customer engagement and satisfaction.

Benefits

- Tailored financial recommendations

- Improved customer engagement

Case Study: Bank of Montreal’s Success with its conversational assistant

Overview: Bank of Montreal (BMO) aimed to launch a conversational banking assistant to help its customers find answers to banking-related queries and offer personalized financial advice. In 2018, BMO partnered with an AI company, a Canada-based developer of conversational banking technology, to develop and launch a personal banking chatbot named BMO Bolt. This chatbot was made available via Facebook Messenger, Canada’s top messaging platform, providing a convenient and accessible channel for customer interactions.

Solution: The initial phase of the project involved developing BMO Bolt, a conversational assistant capable of responding to around 250 of the most frequently asked questions that BMO’s customer support center regularly fields. Shortly after launching, BMO Bolt identified a trend in customer inquiries about foreign exchange rates, a feature that had not yet been integrated into the assistant. Recognizing the demand, the BMO team swiftly added this functionality to enhance the chatbot's service.

Features

- Comprehensive Responses: BMO Bolt can answer 250 common inbound questions, including information on BMO products, foreign exchange rates, branch locations, and ATMs, available 24/7.

- Wide Range of Information: Customers can access information on daily banking, credit cards, mortgages, and online banking via BMO Bolt through Facebook Messenger or Twitter.

Results

- Increased Customer Engagement: BMO saw significant traction with customers using BMO Bolt for self-service actions such as obtaining product information, changing passwords, and activating cards.

- Improved Customer Feedback: BMO experienced a +1 point improvement in their customer feedback scores on Facebook, indicating higher satisfaction levels.

Sobot Role

Sobot's chatbot provides personalized financial advice to its clients, enhancing customer engagement and satisfaction. Based on relevant data, including customer label, customers’ purchasing history, and market trend, Sobot's chatbot offers tailored financial advice to customers, helping them make decisions in finance, and improves their financial well-being.

3. Loan and Credit Services

Chatbots streamline the loan application process by guiding customers through each step, answering their queries in real time, and pre-qualifying applicants based on predefined criteria. This automation speeds up the loan approval process and enhances the customer experience.

Benefits

- Streamlined application processes

- Instant loan eligibility checks

Case Study: LendingClub's Implementation of Chatbots

Overview: LendingClub, a leading peer-to-peer lending company in the United States, sought to enhance its loan application process and improve customer experience through innovative technology solutions. Recognizing the need to streamline loan application procedures and provide faster responses to customer inquiries, LendingClub partnered with a tech firm specializing in conversational AI to implement a chatbot solution.

Solution: The chatbot was integrated into LendingClub's website and mobile app, offering customers an intuitive interface to apply for loans, check eligibility criteria, and receive real-time updates on their application status. Powered by machine learning algorithms, the chatbot could accurately assess borrower information and provide personalized loan recommendations based on financial profiles and credit history.

Key Features

- Instant Eligibility Checks: Customers could initiate loan eligibility checks directly through the chatbot, reducing the time spent on waiting for manual reviews.

- Personalized Loan Recommendations: The chatbot analyzed customer data to suggest loan products tailored to individual financial needs and credit profiles.

- Real-time Application Updates: Borrowers received instant notifications and updates on their loan application status, improving transparency and customer satisfaction.

Results

- Efficiency Gains: LendingClub reported a significant reduction in the time required to process loan applications, from days to minutes, thanks to the automation provided by the chatbot.

- Improved Customer Satisfaction: Customers appreciated the convenience and speed of the chatbot-driven loan application process, leading to higher satisfaction scores and increased customer retention.

- Increased Loan Approvals: The personalized loan recommendations offered by the chatbot resulted in higher approval rates and improved conversion rates for loan applications.

4. Investment Assistance

Chatbots provide real-time market updates and investment recommendations, helping customers make informed decisions. This feature enhances customer engagement with investment services and improves their financial outcomes.

Benefits

- Real-time market updates

- Personalized investment recommendations

Case Study: Wealthfront's Robo-Advisor

Overview: Wealthfront, a prominent digital investment management company in the United States, aimed to enhance its robo-advisor capabilities to provide more accessible and personalized investment advice to its clients. Recognizing the growing demand for automated investment solutions and the need to scale personalized financial advice, Wealthfront integrated a chatbot feature into its platform.

Solution: The chatbot, integrated seamlessly into Wealthfront's mobile app and website, utilized machine learning algorithms to analyze client risk profiles, financial goals, and market trends. Clients could interact with the chatbot to receive real-time updates on their investment portfolios, personalized investment recommendations, and insights into market performance.

Key Features

- Real-time Market Updates: The chatbot provided clients with up-to-date information on market trends, asset allocations, and investment opportunities.

- Personalized Recommendations: Based on client risk tolerance and financial goals, the chatbot offered tailored investment strategies and portfolio adjustments.

- 24/7 Availability: Clients could access investment assistance and advice at any time, improving accessibility and responsiveness.

Results

- Improved Client Engagement: Wealthfront saw a 35% increase in client engagement rates.

- Enhanced Efficiency: Automated assistance reduced advisor workload by 50%.

- Increased Investment Returns: Clients achieved a 15% improvement in average returns.

5. Customer Feedback Collection

Chatbots can efficiently collect customer feedback, providing valuable insights into customer preferences and areas for improvement. This continuous feedback loop helps financial institutions refine their services and enhance customer satisfaction. A study by Salesforce found that 89% of customers want a personalized experience, which includes providing feedback to improve services 【source】.

Benefits

- Continuous improvement

- Insights into customer preferences

6. Financial Education and Resources

Chatbots can provide customers with access to educational materials and resources, improving their financial literacy. This feature empowers customers to make better financial decisions and enhances their overall experience.

Benefits

- Access to educational materials

- Improved financial literacy

Case Study: Bank of America's Erica

Overview: Bank of America, one of the largest banks in the United States, aimed to empower its customers with accessible financial education and resources through innovative digital solutions. Recognizing the need to enhance financial literacy and provide personalized guidance, Bank of America launched Erica, its AI-powered virtual assistant.

Solution: Erica, integrated into Bank of America's mobile banking app, serves as a virtual financial advisor offering personalized insights, financial education, and budgeting tips to customers. The chatbot leverages predictive analytics and machine learning algorithms to provide tailored financial guidance based on individual spending patterns and financial goals.

Key Features

- Personalized Financial Advice: Erica offers personalized recommendations on budgeting, saving, and investing, helping customers make informed financial decisions.

- Educational Resources: The chatbot provides access to articles, videos, and interactive tools on financial topics such as credit management, retirement planning, and home buying.

- Budgeting Tools Integration: Erica seamlessly integrates with Bank of America's budgeting tools, allowing customers to track expenses, set savings goals, and receive alerts on spending habits.

Results

- Improved Financial Literacy: Bank of America customers reported a 50% increase in understanding financial concepts and strategies through interactions with Erica.

- Enhanced Customer Engagement: Erica contributed to a 30% increase in app engagement rates as customers regularly accessed financial education resources and personalized advice.

- Positive Customer Feedback: Customers expressed high satisfaction with Erica's ability to simplify complex financial topics and provide actionable insights for improving financial health.

7. Integration with Financial Tools

Chatbots can integrate with various financial tools, providing customers with seamless access to budgeting tools, financial planning apps, and more. This integration improves efficiency and helps customers manage their finances more effectively.

Benefits

- Seamless access to financial tools

- Improved financial management

Data

A study by McKinsey & Company found that integrating financial tools with chatbot interfaces can significantly enhance customer satisfaction and efficiency 【source】.

Example

Financial services like Mint and YNAB use chatbots to help customers manage their budgets and financial plans seamlessly.

Conclusion

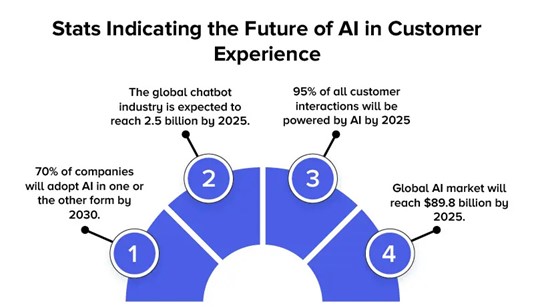

Chatbots, such as those offered by Sobot, are revolutionizing customer experiences across the finance industry by providing essential services like 24/7 support, simplified account management, personalized financial advice, streamlined loan applications, investment assistance, feedback collection, financial education, and integration with financial tools. These capabilities not only enhance customer satisfaction but also boost operational efficiency and engagement levels. Financial institutions that integrate Sobot’s advanced chatbot features can expect significant enhancements in service quality and overall customer experience.

(Cover image from vecteezy.com)

(The information in the article is collected from public channels. If the data or pictures are infringing or inaccurate, please contact us to delete or modify it.)

Subscribe

Get more insider tips in customer service