The financial services sector contends with special challenges in keeping track of customer requests and internal workings. When dealing with a large volume of requests for support, addressing complicated compliance challenges, or attempting to manage delayed times for responses, financial institutions regularly underscore the difficulties they face in delivering prompt and useful service.

As restrictions grow tighter and customer desires increase, the need for effective solutions is increasingly relevant. The ticketing system is a technology that is increasingly being adopted to remedy these challenges. To become important tools for financial institutions, ticketing systems like those from Sobot have increasingly centralized customer support, automated routine processes, and guaranteed compliance.

This article looks into how ticketing systems might improve efficiency and adherence to regulations in the financial sector, giving special attention to the features of Sobot's personalized solution.

What is a Ticketing System in Finance?

A ticketing system represents a software solution for tracking, categorizing, and managing customer or internal issues by inventing tickets from them. These tickets embody particular problems or demands that flow from their introduction to their resolution. Ticketing systems are capable of managing diverse communication methods, comprising email, phone, social media, and inquiries made in person.

For addressing both external and internal issues, the finance sector finds these systems to be essential. Financial firms use them to manage customer support inquiries related to account inconsistencies and loan requests, while also simplifying their internal processes including IT and compliance tasks. As an example, employees can tackle internal compliance questions and IT support needs using ticketing systems, which helps preserve smooth operational function in the institution.

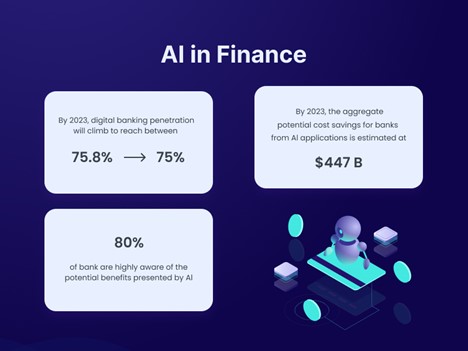

Nearly half (46%) of financial institutions utilizing artificial intelligence have reported enhanced customer experiences. (NVIDIA)

How Ticketing Systems Streamline Financial Services

Centralized Query Management

A ticketing system in finance provides a key benefit by enabling the central management of queries. Financial institutions manage many kinds of requests each day, such as applications for loans, account disputes, and transaction errors. The management of these inquiries over many platforms can quickly go out of control, contributing to perplexity and lags.

Consolidating all these requests on a single platform creates a centralized point for interaction thanks to the ticketing system. Using this method not only simplifies the workflow for customer service representatives but also confirms that no ticket goes unnoticed. For instance, a customer who brings up a query about a transaction error via social media can have their request managed and solved by the system that handles both in-person and email requests.

Automation of Repetitive Tasks

Ticketing systems play a crucial role in automating routine tasks in the finance sector, especially when handling immediate issues like payment disputes or account inquiries. They help automate processes such as sorting, categorizing, and prioritizing tickets, which significantly reduces response times and enhances customer satisfaction. For example, automating common queries like account balance checks or password recovery frees up agents to focus on more complex issues, ensuring quicker resolutions.

When integrated with chatbots, the automation process is further streamlined. Chatbots handle repetitive customer interactions, like answering frequently asked questions or guiding users through simple processes, before passing more complicated cases to the ticketing system. This integration not only ensures fast, accurate responses but also optimizes workflow, reducing the need for human intervention in basic tasks.

Agent turnover can cost businesses more than $12,000 per employee, making it crucial to equip helpdesk teams with AI ticketing systems that help them work smarter, not harder.

Compliance and Documentation

Financial institutions deal with a vital challenge to ensure compliance, which entails strict adherence to rules such as the GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard). An orderly ticketing system confirms compliance with regulations by delivering auditable data regarding all customer interactions.

As an example, should a disagreement surface around a financial transaction, the system can provide a complete account of the exchange, ensuring that all supporting documentation is accessible. In fields such as banking and insurance, such conditions are notably important, since a single oversight in compliance may lead to serious outcomes.

Sobot's Success in Finance: Case Studies of Palmpay & Opay

1. PalmPay: Reducing Resolution Times and Enhancing Service Quality

Challenge:

PalmPay, Africa's top fintech app, faced challenges in handling large volumes of customer queries. Simple issues overwhelmed the support team, while urgent problems often went unresolved promptly.

Solution:

Sobot's omnichannel ticketing system consolidated all customer interactions in one place, allowing agents to deliver faster, personalized responses. The introduction of intelligent chatbots reduced the workload by automating routine tasks.

Results:

• 45% reduction in resolution times

• 92% customer satisfaction (CSAT)

• 20% cost reduction

• Stable call center with fewer dropped calls

2. OPay: Scaling Support and Boosting Productivity

Challenge:

OPay, a one-stop mobile platform for payments and loans in emerging markets, needed an efficient system to manage both customer and internal support operations.

Solution:

Sobot's unified platform brought all communication channels, including WhatsApp, into a single interface. This allowed OPay's agents to manage support requests seamlessly while using automation to handle repetitive tasks, boosting overall efficiency.

Results:

• 17% increase in conversion rates

• Over 20% reduction in operational costs

• 82% read rate on targeted WhatsApp marketing campaigns

• Enhanced agent productivity with faster query resolution

According to Precedence Research, AI-powered automated ticketing systems are driving efficiency in customer support, with the market projected to exceed USD 1,094.52 billion by 2032.

Key Benefits of Ticketing Systems in the Finance Industry

In the rapidly moving world of finance, providing customer support must be personalized to optimize efficiency and maintain compliance. A ticketing system developed specifically for the finance sector deals with the specific hurdles of the industry, including managing delicate financial data and following rigorous regulatory rules. Here we present the most important features that make these solutions a necessity for financial institutions.

Improved Response Time

In finance, each passing minute equates to money. Ticketing systems make it possible to expedite responses to urgent problems, like payment arguments and reports of fraud. To ensure that important issues find quick solutions, financial organizations can automate the process of urgency prioritization in tickets.

Greatly Improved Security & Compliance

Ticketing systems offer comprehensive security functions, like data encryption and role-based permissions, to ensure that financial information is secure. Ensuring compliance with industry guidelines like GDPR and PCI DSS comes standard within the system, which helps financial institutions evade expensive fines.

Insightful Analytics for Strategic Decision-Making

The analytics issued by ticketing systems enable financial organizations to obtain critical insights into service performance and customer problems. These reports can provide insights for strategic choices, comprising improving service quality, recognizing areas for product development, and increasing operational efficiency.

Better Customer Experience

Ultimately, ticketing systems greatly increase the customer experience by delivering current information about their query status. Self-service portals along with automated responses enable customers to maintain engagement in the resolution process, which enhances satisfaction and fuels loyalty.

Top Features of a Finance-Specific Ticketing System

In the rapidly moving world of finance, providing customer support must be personalized in order to optimize efficiency and maintain compliance. A ticketing system developed specifically for the finance sector deals with the specific hurdles of the industry, including managing delicate financial data and following rigorous regulatory rules. Here we present the most important features that make these solutions a necessity for financial institutions.

Omnichannel Support

Financial institutions require the capability to respond to queries from diverse channels. A support system for ticketing that offers omnichannel functionality enables uninterrupted monitoring and resolution of customer issues, regardless of the channel from which the query arose, such as email, phone, or social media.

SLA Management

Finance depends critically on Service Level Agreements (SLAs). A robust ticketing platform ensures that companies stick to their service level agreements, particularly for urgent transactions such as payment processing or the detection of fraud.

Custom Reporting and Data Analytics

Custom reports provide financial institutions with the ability to individualize insights according to their particular needs, such as tracking performance metrics or uncovering trends in customer queries.

Role-based Permissions

In finance, security is of top importance. Ticket systems need to provide permissions based on role so that only permitted individuals can access sensitive financial data.

How to Choose the Right Ticketing System for Financial Institutions

An essential part of selecting a ticketing system in the financial sector involves factors like scalability, compliance with regulations, and automation capabilities. Sobot's ticket framework shines due to its specialized solution created for financial institutions, which guarantees effortless sync with existing CRMs and powerful compliance capabilities.

Conclusion

Sobot is revolutionizing financial customer support. Therefore, ticketing systems are important for raising efficiency and ensuring that regulations are met in the financial sector. These systems encourage financial institutions to provide services that are faster, safer, and more efficient using facilities that include centralized query management, automating redundant tasks, and enforcing adherence to regulations.

The tailored solutions provided by Sobot allow financial institutions to increase their operational scale, while still delivering high levels of customer contentment and regulatory adherence. To lead in the quick-changing financial landscape, think about using Sobot's ticketing system.

(The information in the article is collected from public channels. If the data or pictures are infringing or inaccurate, please contact us to delete or modify it.)

Subscribe

Get more insider tips in customer service